please see name of accounts and don't give other names

b.

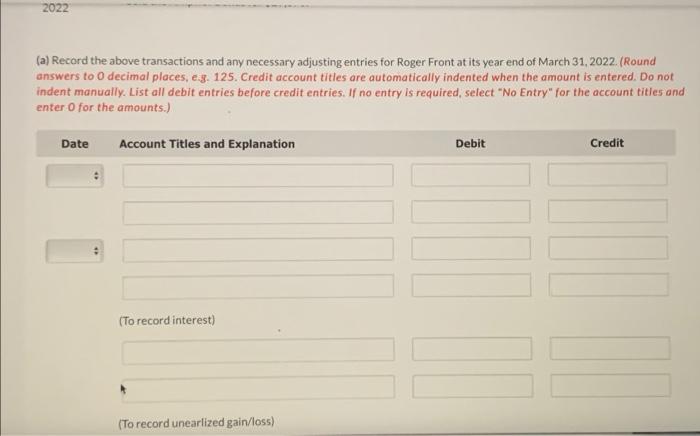

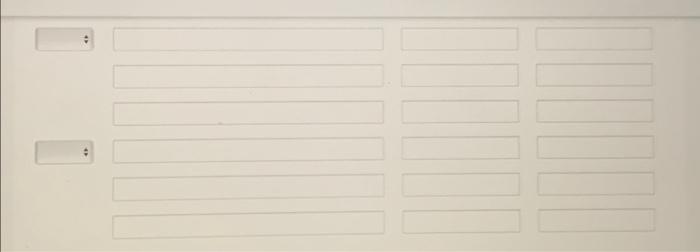

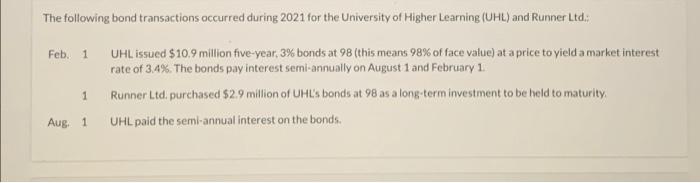

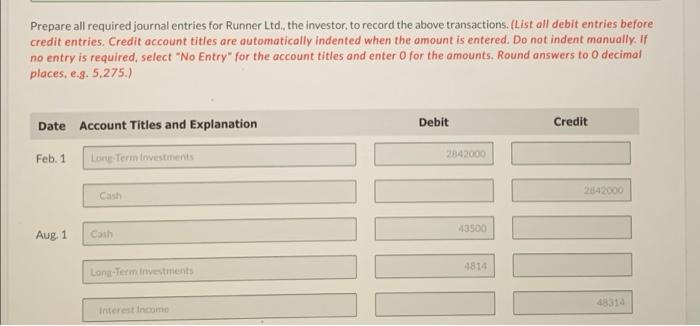

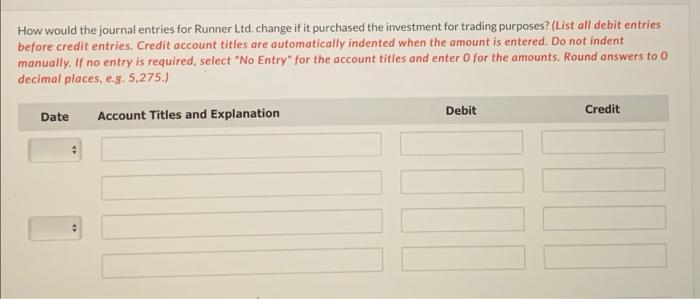

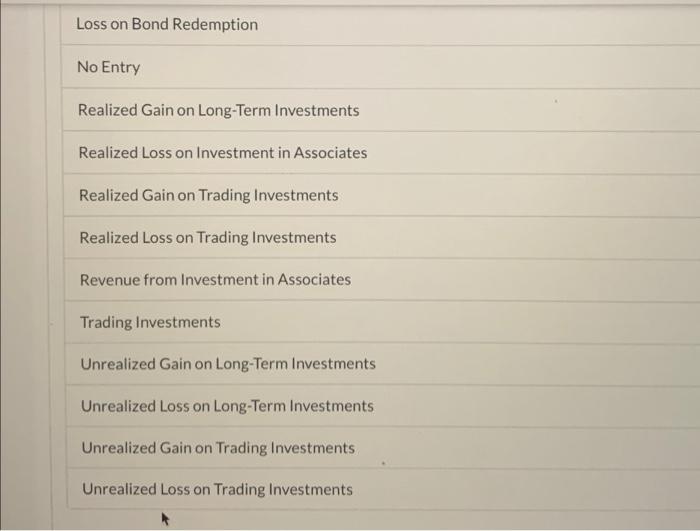

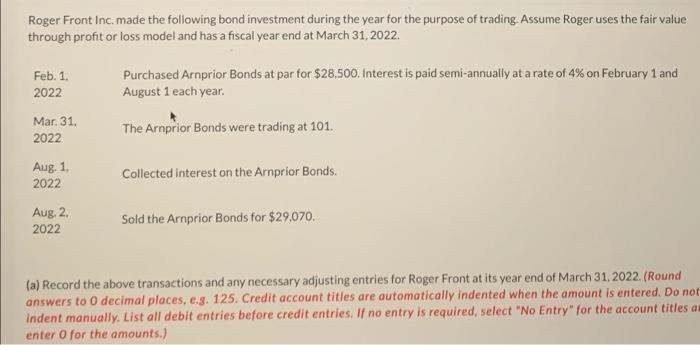

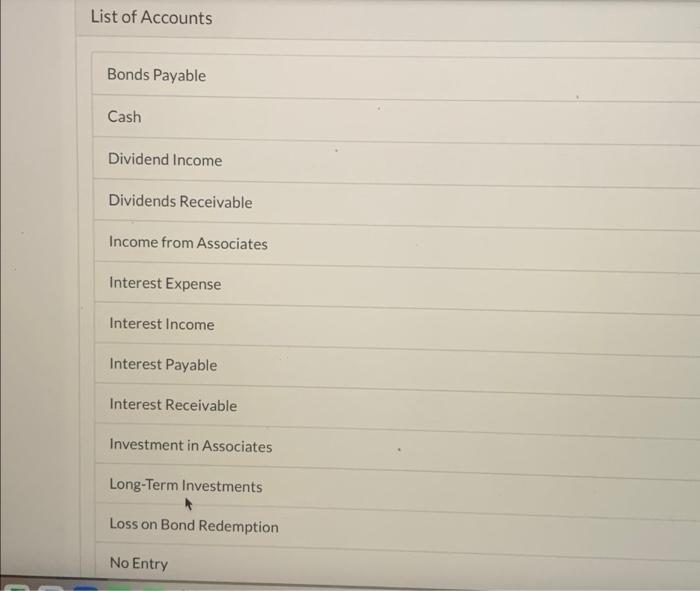

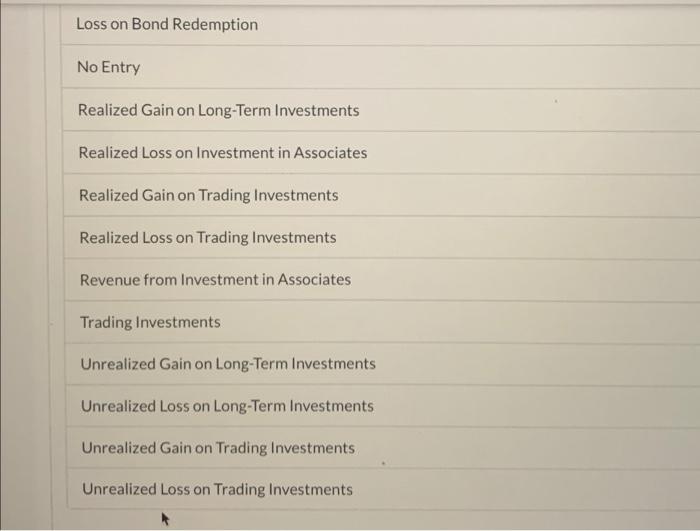

Roger Front Inc. made the following bond investment during the year for the purpose of trading. Assume Roger uses the fair value through profit or loss model and has a fiscal year end at March 31, 2022. Feb. 1 2022 Purchased Arnprior Bonds at par for $28,500. Interest is paid semi-annually at a rate of 4% on February 1 and August 1 each year. Mar. 31. 2022 The Armprior Bonds were trading at 101. Aug. 1. 2022 Collected interest on the Armprior Bonds. Aug, 2. 2022 Sold the Armprior Bonds for $29,070. (a) Record the above transactions and any necessary adjusting entries for Roger Front at its year end of March 31, 2022. (Round answers to 0 decimal places, e.g. 125. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles an enter o for the amounts.) List of Accounts Bonds Payable Cash Dividend Income Dividends Receivable Income from Associates Interest Expense Interest Income Interest Payable Interest Receivable Investment in Associates Long-Term Investments Loss on Bond Redemption No Entry Loss on Bond Redemption No Entry Realized Gain on Long-Term Investments Realized Loss on Investment in Associates Realized Gain on Trading Investments Realized Loss on Trading Investments Revenue from Investment in Associates Trading Investments Unrealized Gain on Long-Term Investments Unrealized Loss on Long-Term Investments Unrealized Gain on Trading Investments Unrealized Loss on Trading Investments 2022 (a) Record the above transactions and any necessary adjusting entries for Roger Front at its year end of March 31, 2022. (Round answers to decimal places, e.g. 125. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit (To record interest) (To record unearlized gain/loss) The following bond transactions occurred during 2021 for the University of Higher Learning (UHL) and Runner Ltd. Feb. 1 UHL issued $10.9 million five-year, 3% bonds at 98 (this means 98% of face value) at a price to yield a market interest rate of 3.4%. The bonds pay interest semi-annually on August 1 and February 1 Runner 1.td purchased $2.9 million of UHL's bonds at 98 as a long-term investment to be held to maturity, UHL paid the semi-annual interest on the bonds 1 Aug 1 Prepare all required journal entries for Runner Ltd., the investor, to record the above transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round answers to o decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Feb. 1 Long Term livestments 2842009 2842000 43900 Aug. 1 Cash 4814 Lorem investments 48314 Interest incomo How would the journal entries for Runner Ltd. change if it purchased the investment for trading purposes? (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to o decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit

please see name of accounts and don't give other names

please see name of accounts and don't give other names