Q2

Q3

Q4

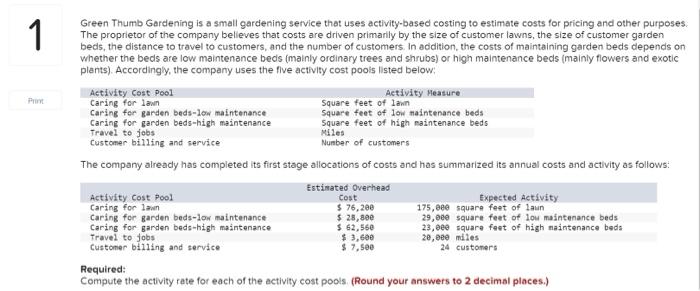

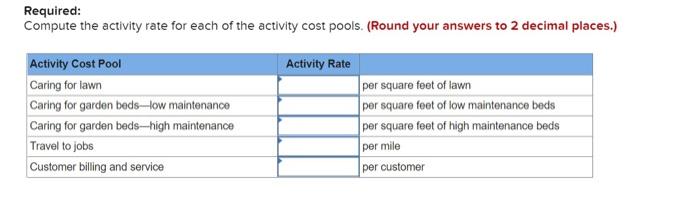

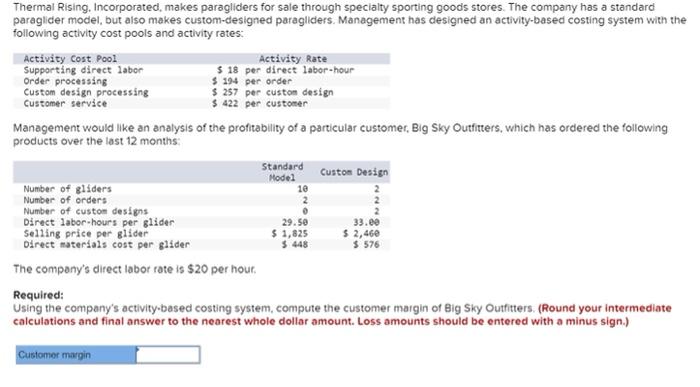

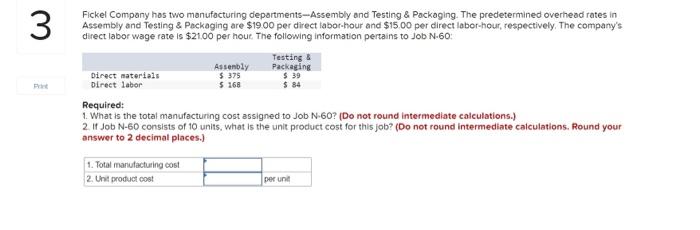

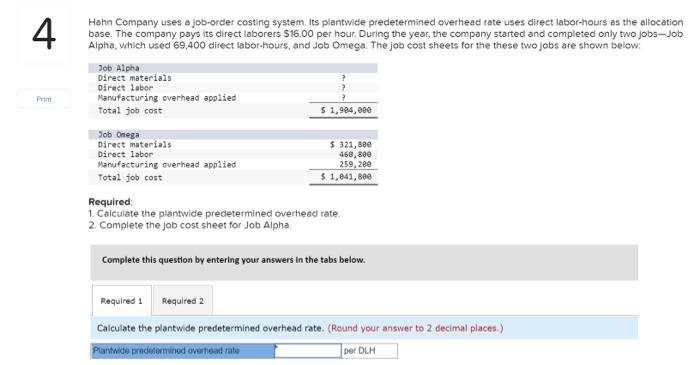

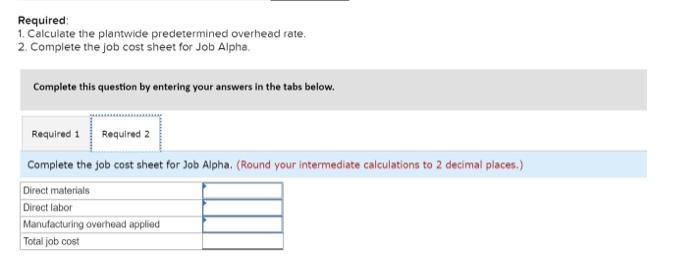

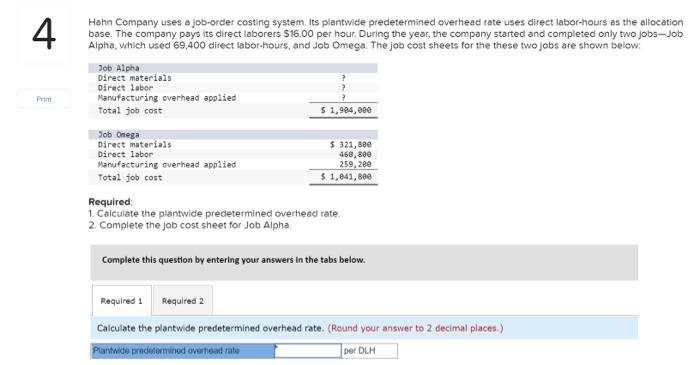

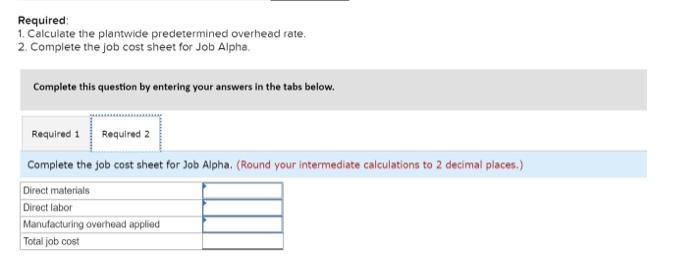

1 Green Thumb Gardening is a small gardening service that uses activity-based costing to estimate costs for pricing and other purposes The proprietor of the company believes that costs are driven primarily by the size of customer lawns, the size of customer garden beds, the distance to travel to customers, and the number of customers. In addition, the costs of maintaining garden beds depends on whether the beds are low maintenance beds (mainly ordinary trees and shrubs) or high maintenance beds (mainly flowers and exotic plants) Accordingly, the company uses the five activity cost pools listed below: Activity Cost Pool Activity Measure Caring for lawn Square feet of lawn Caring for garden beds-low maintenance Square feet of low maintenance beds Caring for garden beds-high maintenance Square feet of high maintenance beds Travel to jobs Miles Customer billing and service Number of customers The company already has completed its first stage allocations of costs and has summarized its annual costs and activity as follows: Pat Activity Cost Pool Caring for lawn Caring for garden beds-low maintenance Caring for garden beds-high maintenance Travel to jobs Customer billing and service Estimated Overhead Cost $ 76,200 $ 28,800 $ 62,560 $ 3,600 $ 7,500 Expected Activity 175,eee square feet of laun 29,000 square feet of low maintenance beds 23,800 square feet of high maintenance beds 20,000 miles 24 customers Required: Compute the activity rate for each of the activity cost pools (Round your answers to 2 decimal places.) Required: Compute the activity rate for each of the activity cost pools. (Round your answers to 2 decimal places.) Activity Rate Activity Cost Pool Caring for lawn Caring for garden beds-low maintenance Caring for garden beds-high maintenance Travel to jobs Customer billing and service per square feet of lawn per square feet of low maintenance beds per square feet of high maintenance beds per mile per customer Thermal Rising. Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Activity Rate Supporting direct labor $ 18 per direct labor-hour Order processing $ 194 per order Custom design processing $ 257 per custon design Customer service $ 422 per customer Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months Standard Model 10 2 Custom Design Number of gliders Number of orders Number of custom designs Direct labor-hours per glider 33.00 Selling price per glider $ 2,460 Direct materials cost per glider $ 576 The company's direct labor rate is $20 per hour. Required: Using the company's activity-based costing system, compute the customer margin of Big Sky Outfitters. (Round your intermediate calculations and final answer to the nearest whole dollar amount. Loss amounts should be entered with a minus sign.) 29.50 $ 1,825 $ 448 Customer margin 3 Fickel Company has two manufacturing departments-Assembly and Testing & Packaging. The predetermined overhead rates in Assembly and Testing & Packaging are $19.00 per direct labor-hour and $15.00 per direct labor-hour, respectively. The company's direct labor wage rate is $21.00 per hour. The following information pertains to Job N-60: Testing Assembly Packaging Direct materials $ 375 Direct labor $ 168 $ 84 Required: 1. What is the total manufacturing cost assigned to Job N-60? (Do not round intermediate calculations.) 2. If Job N-60 consists of 10 units, what is the unit product cost for this job? (Do not round intermediate calculations. Round your answer to 2 decimal places.) $ 39 1. Total manufacturing cost 2. Unit productos per un 4 Hahn Company uses a job-order costing system. Its plantwide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $16.00 per hour. During the year, the company started and completed only two jobs-Job Alpha, which used 69,400 direct labor-hours, and Job Omega The job cost sheets for the these two jobs are shown below: Job Alpha Direct materials Direct labor Manufacturing overhead applied Total job cost $ 1,984,000 Job Onega Direct materials $ 321,800 Direct labor 468,800 Manufacturing overhead applied 259,200 Total job cost $ 1,641,800 Required 1. Calculate the plantwide predetermined overhead rate 2. Complete the job cost sheet for Job Alpha Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the plantwide predetermined overhead rate. (Round your answer to 2 decimal places.) Partaide predetermined overhead rate per DLH Required: 1. Calculate the plantwide predetermined overhead rate. 2. Complete the job cost sheet for Job Alpha Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the job cost sheet for Job Alpha. (Round your intermediate calculations to 2 decimal places.) Direct materials Direct labor Manufacturing overhead applied Total job cost