Please see the attached file.

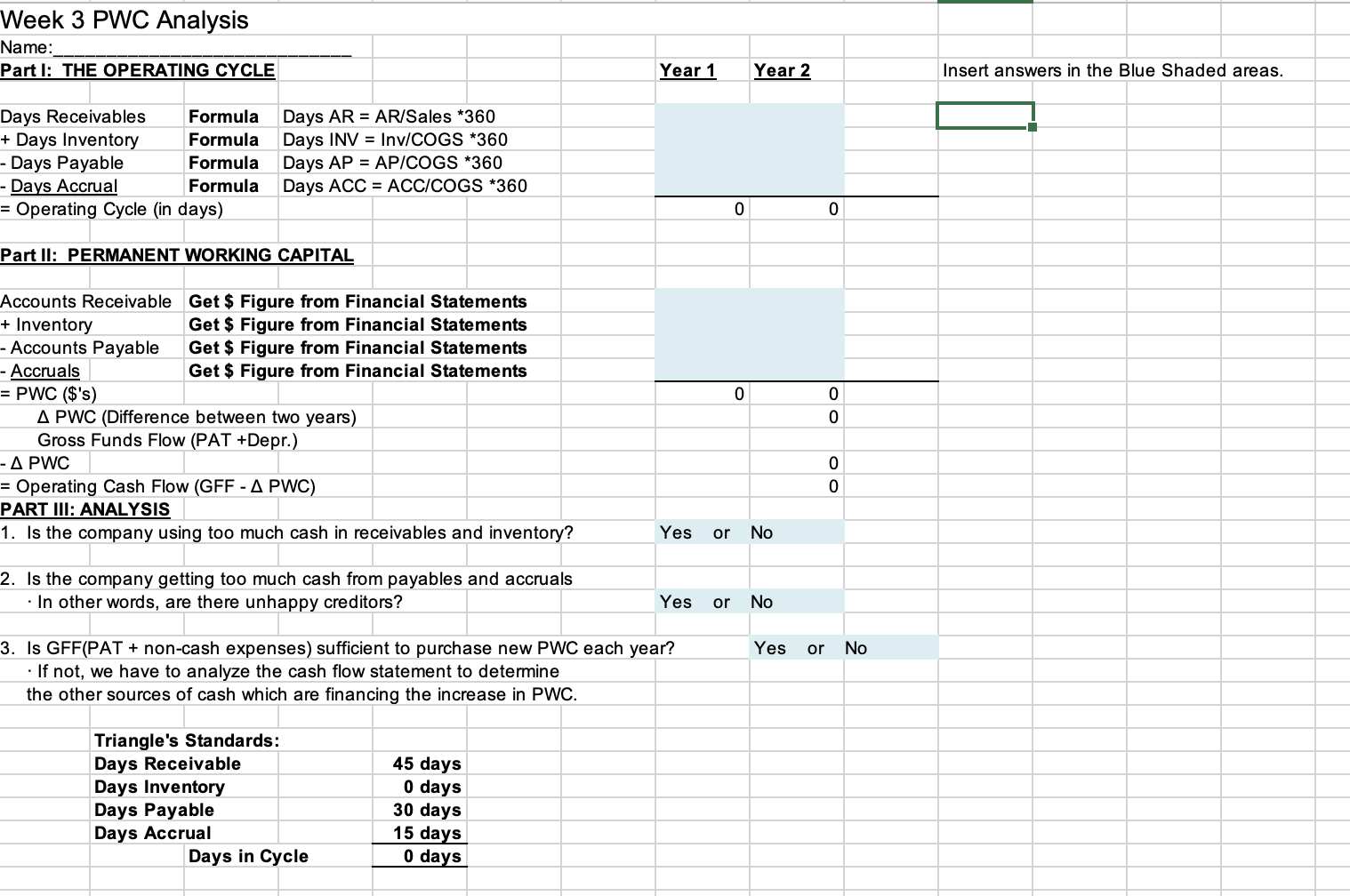

You will need to complete the blue shaded areas. Also, please answer yes or no to the blue shaded areas that contain that information.

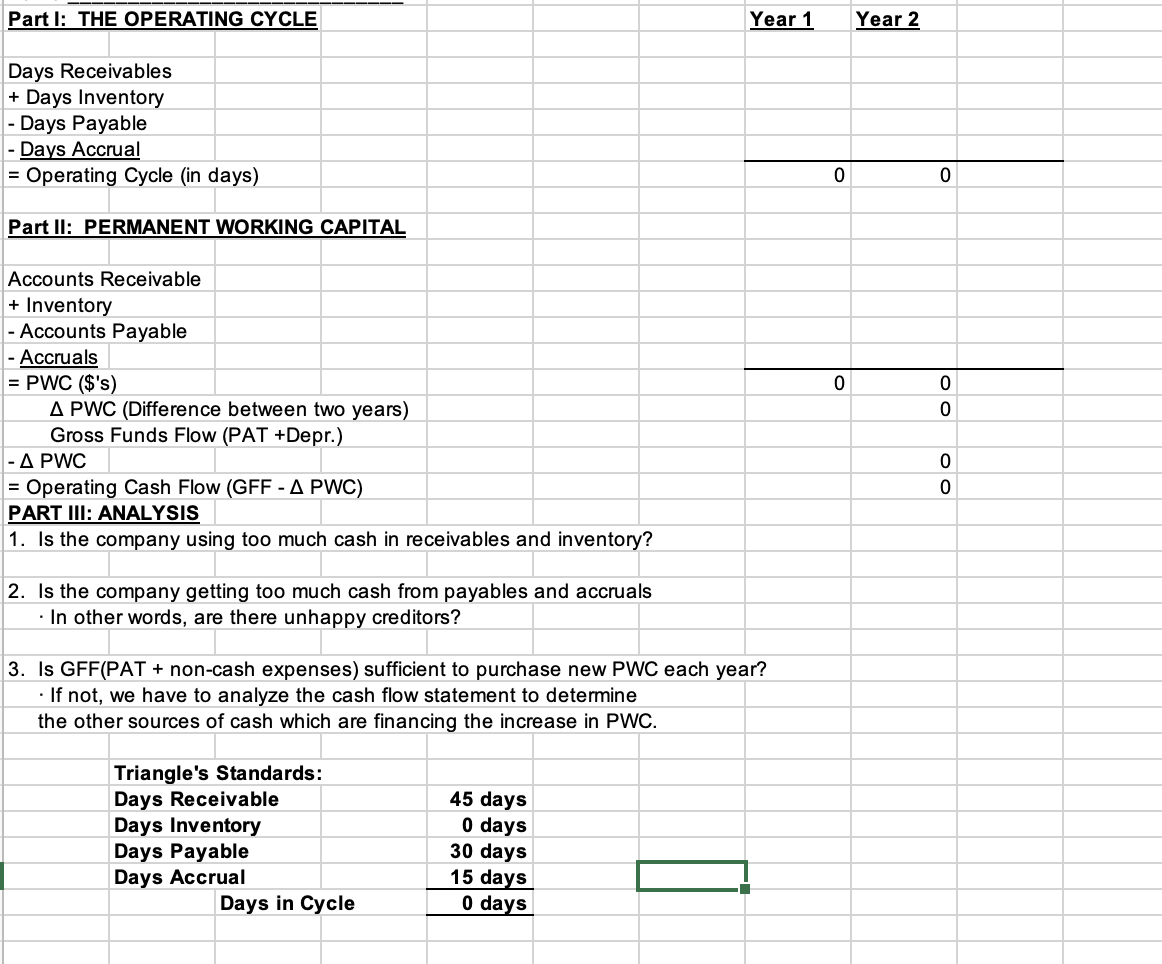

Please answer questions

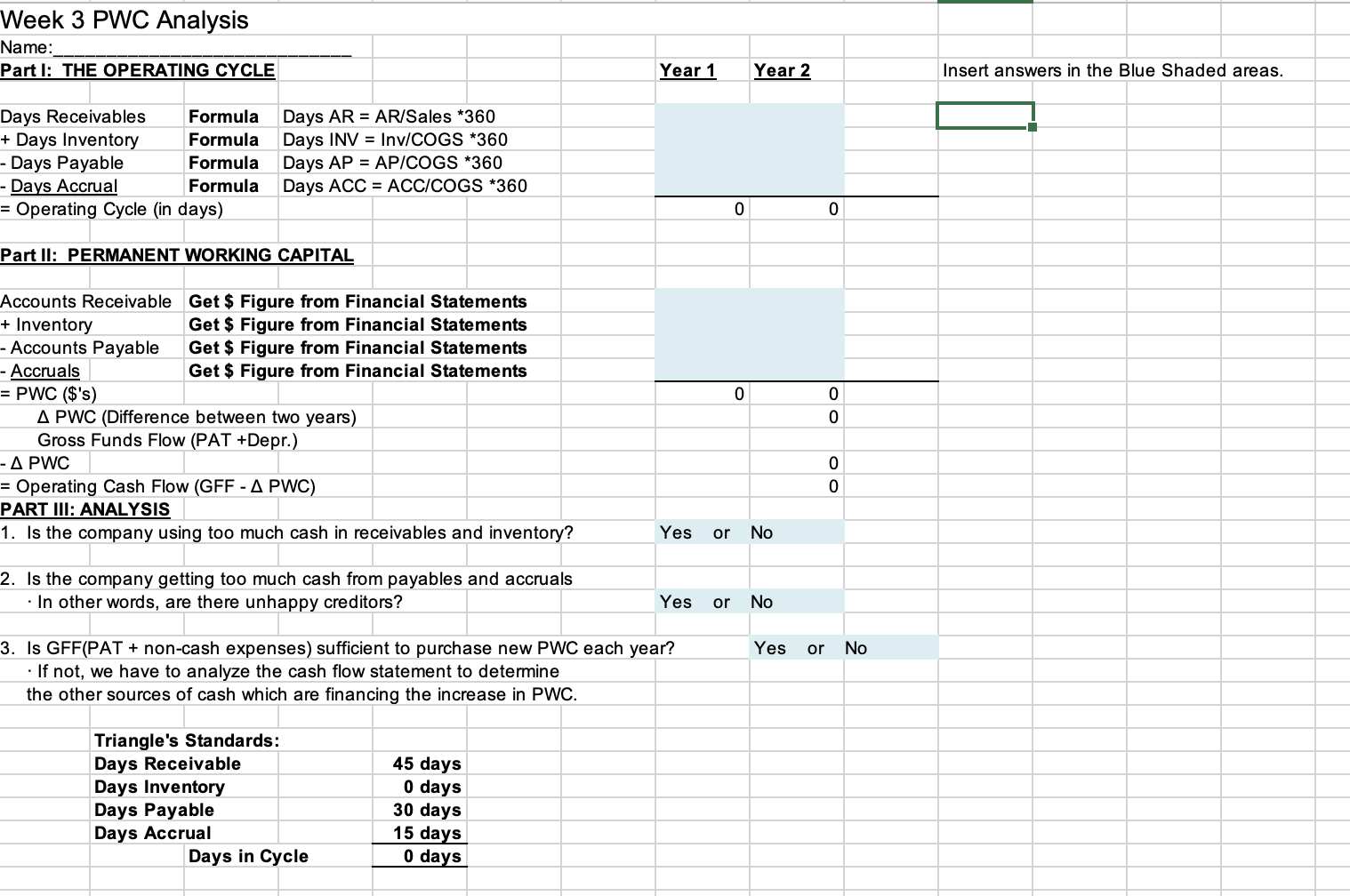

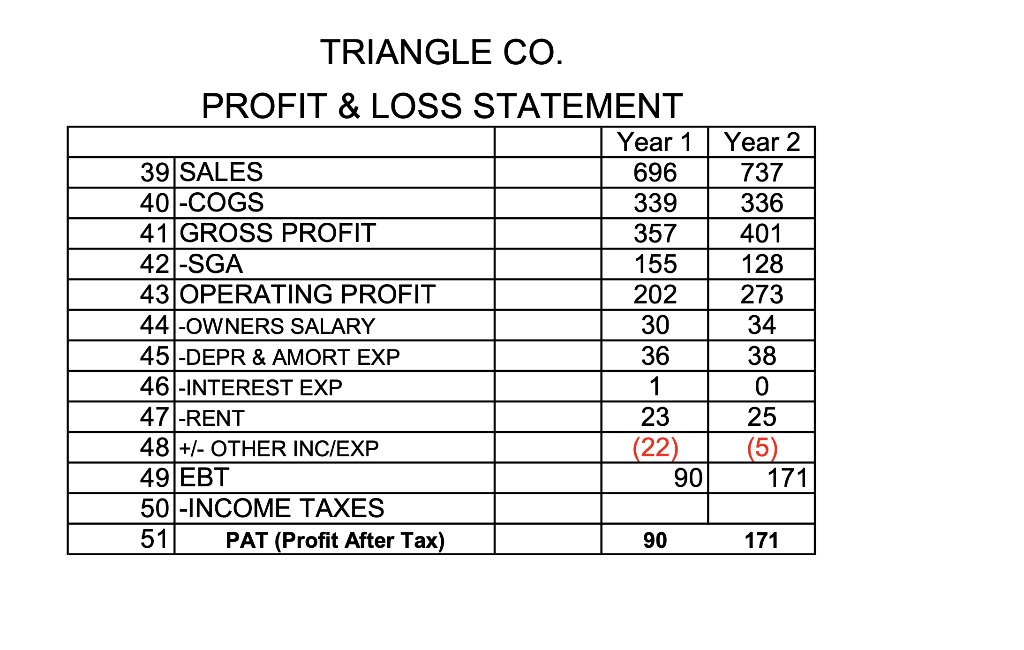

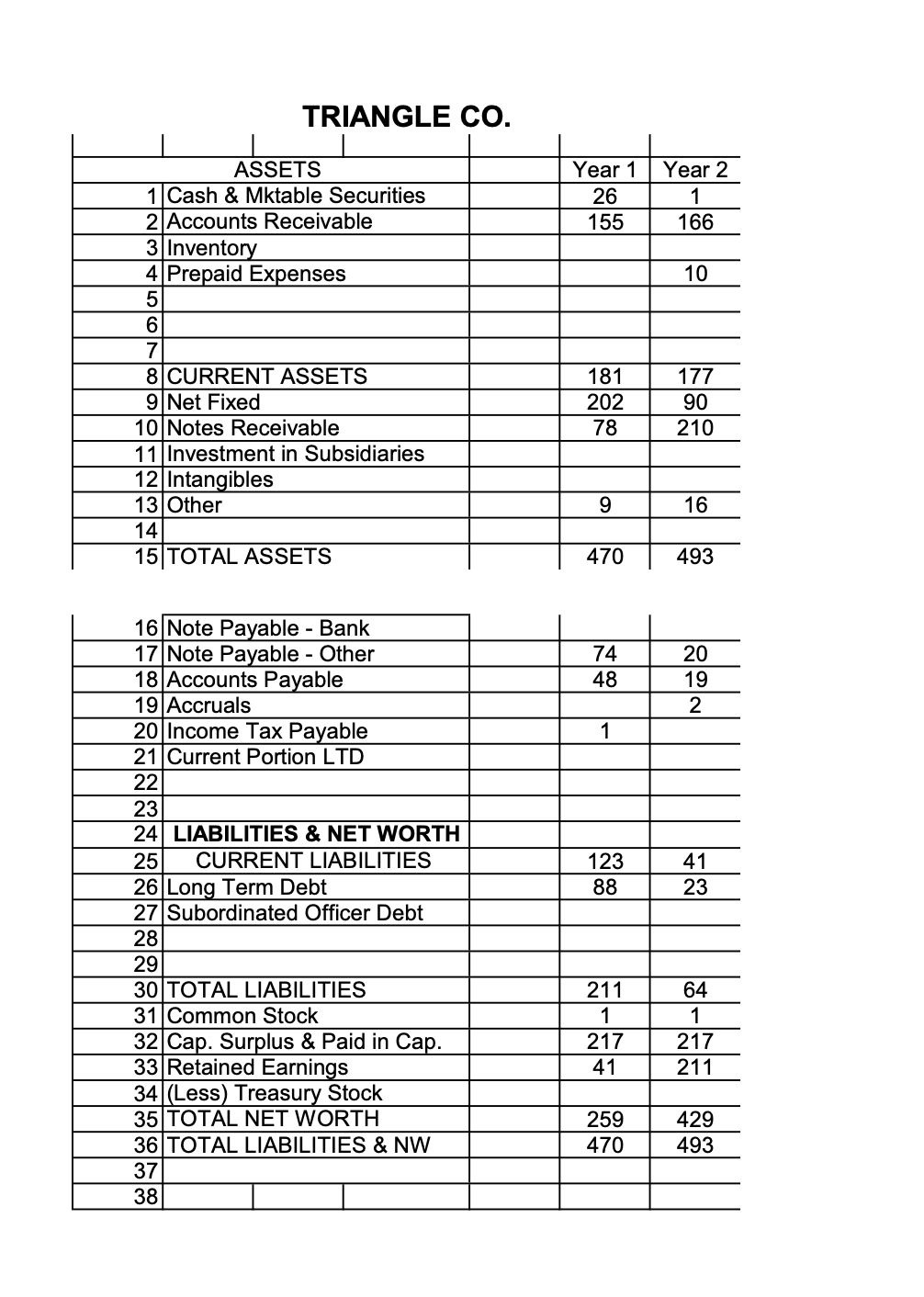

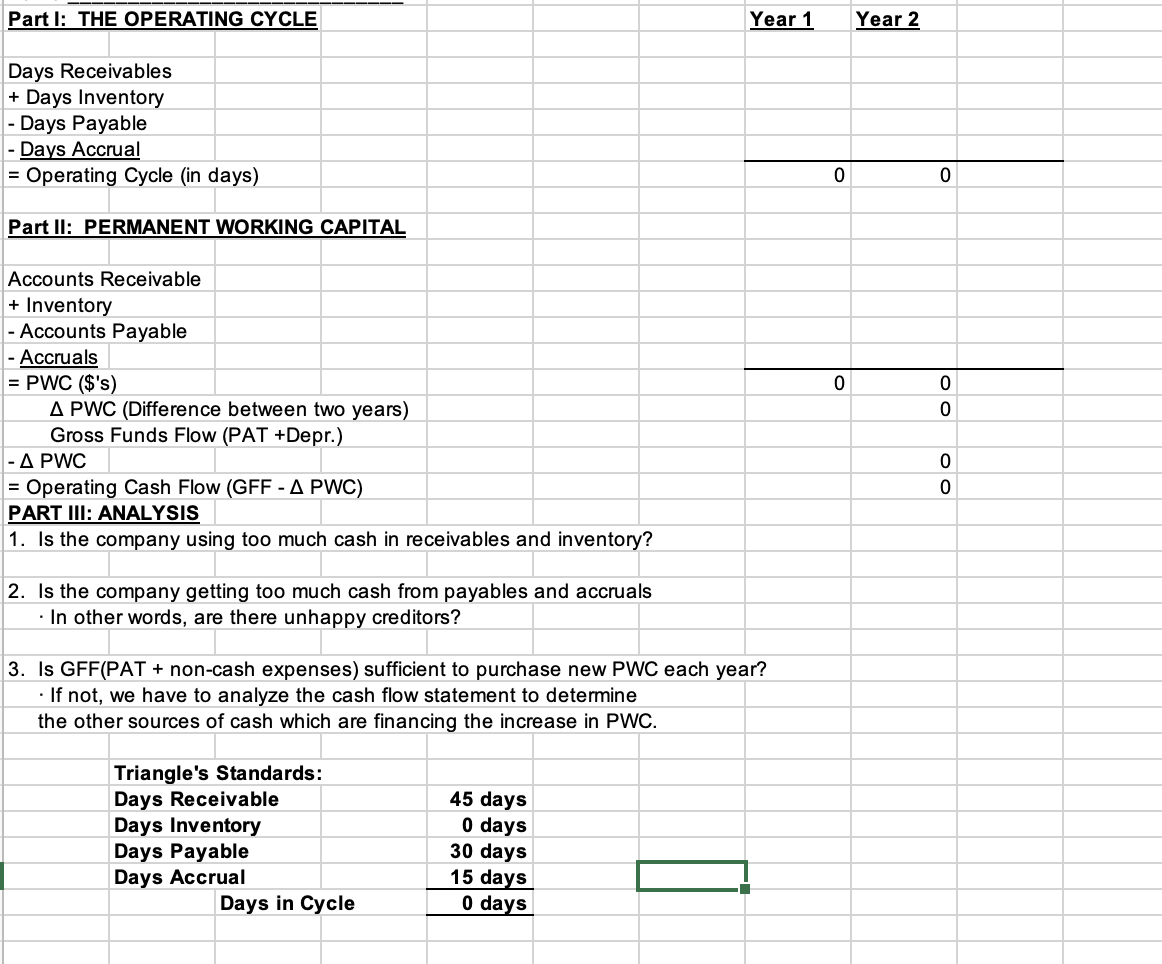

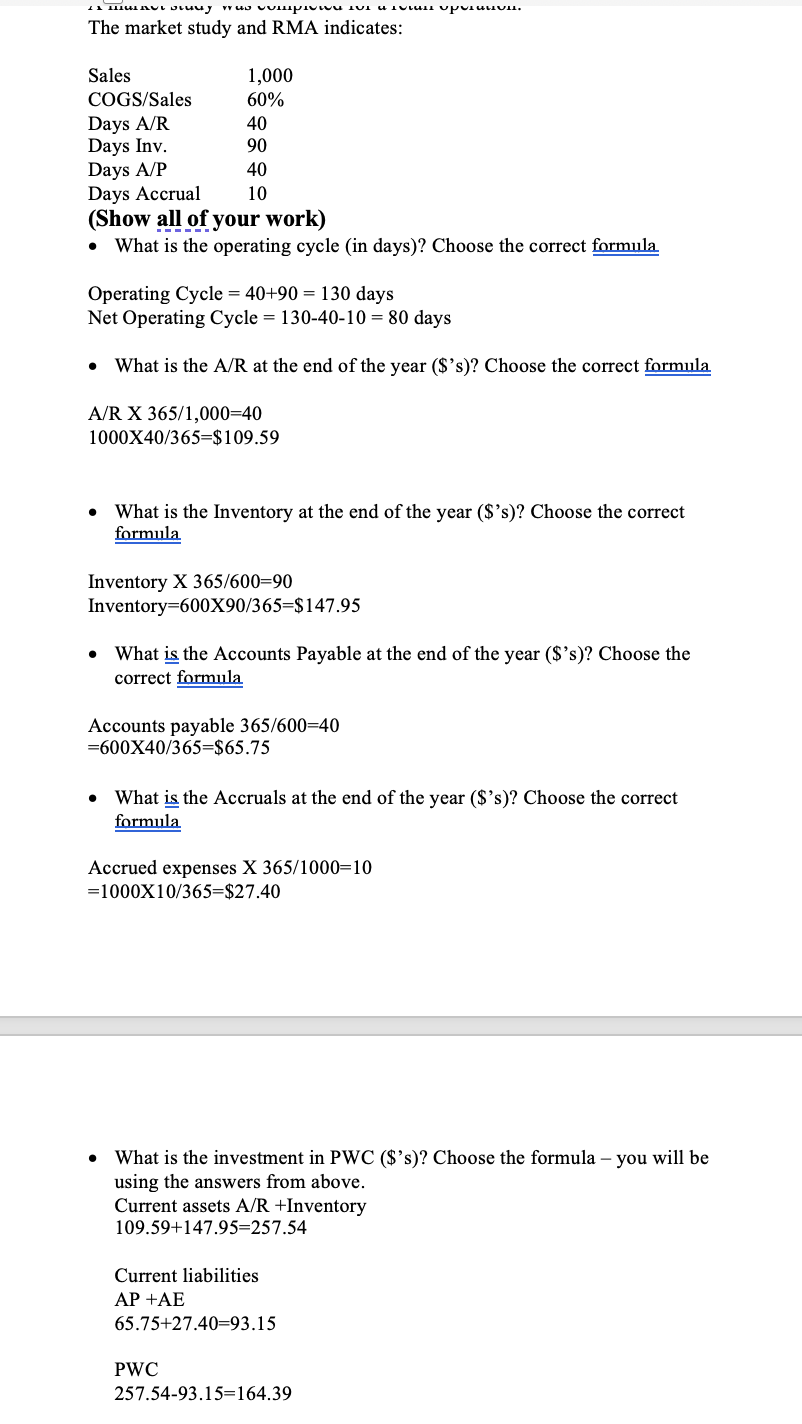

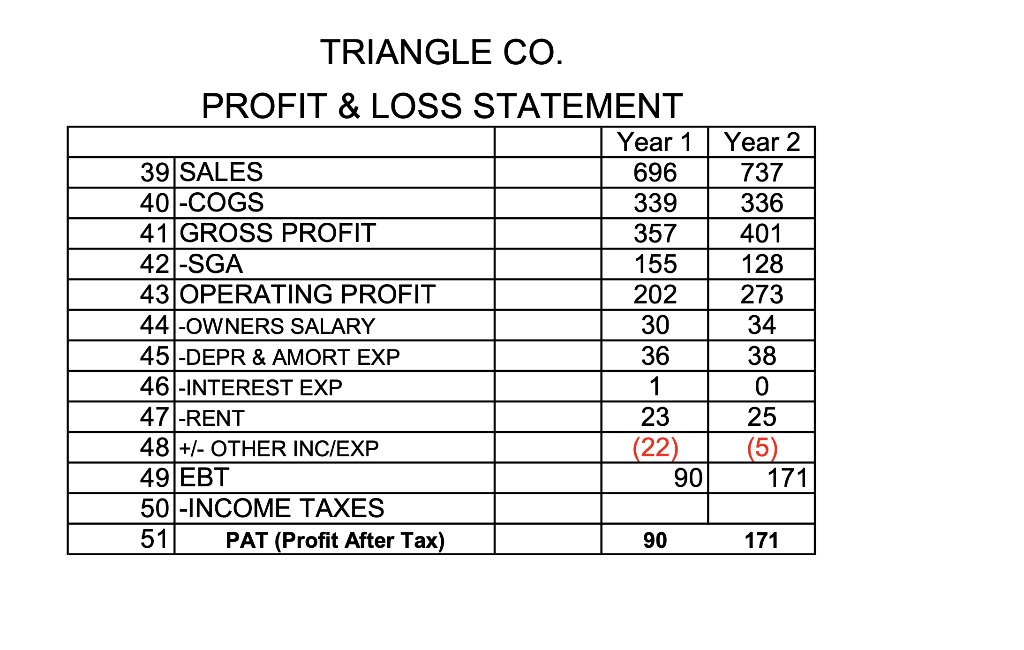

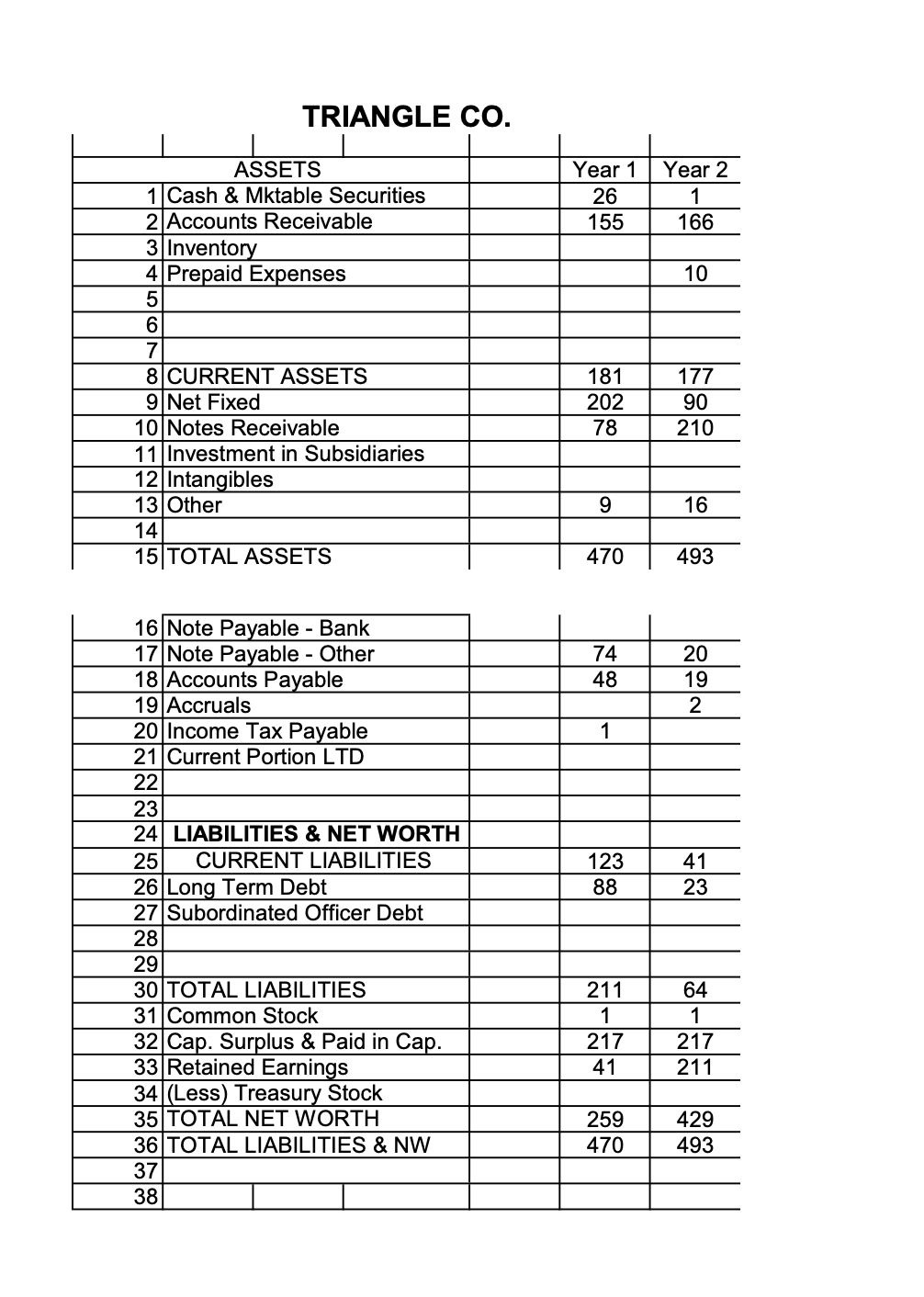

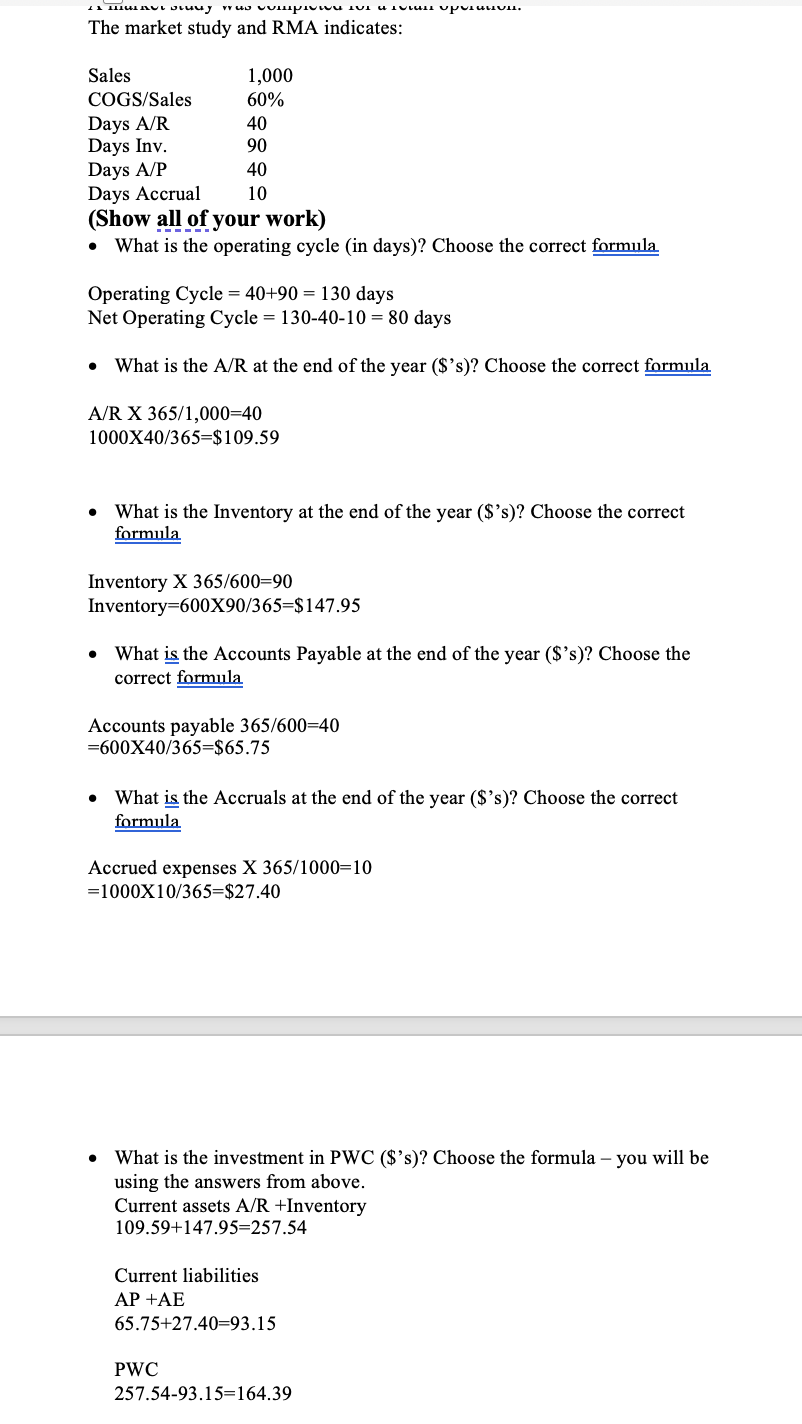

Week 3 PWC Analysis Name: Part I: THE OPERATING CYCLE Year1 Year 2 Insert answers in the Blue Shaded areas. Days Receivables Formula Days AR=AR/Sales * 360 + Days Inventory Formula Days INV = Inv/COGS *360 - Days Payable Formula Days AP = AP/COGS *360 - Days Accrual Formula Days ACC = ACC/COGS *360 = Operating Cycle (in days) \begin{tabular}{ll} \hline 0 & 0 \\ \hline \end{tabular} Part II: PERMANENT WORKING CAPITAL Accounts Receivable Get \$ Figure from Financial Statements + Inventory Get \$ Figure from Financial Statements - Accounts Payable Get \$ Figure from Financial Statements - Accruals Get \$ Figure from Financial Statements =PWC($s) PWC (Difference between two years) Gross Funds Flow (PAT +Depr.) PWC = Operating Cash Flow (GFF PWC) PART III: ANALYSIS 1. Is the company using too much cash in receivables and inventory? Yes or No 2. Is the company getting too much cash from payables and accruals - In other words, are there unhappy creditors? Yes or No 3. Is GFF(PAT + non-cash expenses) sufficient to purchase new PWC each year? Yes or No - If not, we have to analyze the cash flow statement to determine the other sources of cash which are financing the increase in PWC. Triangle's Standards: Days Receivable Days Inventory Days Payable \begin{tabular}{|r|} \hline 45 days \\ \hline 0 days \\ \hline 30 days \\ \hline 15 days \\ \hline 0 days \\ \hline \end{tabular} TRIANGLE CO. PROFIT \& LOSS STATEMENT TRIANGLE CO. Part I: THE OPERATING CYCLE Year 1 Year 2 Days Receivables + Days Inventory - Days Payable - Days Accrual = Operating Cycle (in days) \begin{tabular}{lll} \hline 0 & 0 \\ \hline \end{tabular} Part II: PERMANENT WORKING CAPITAL Accounts Receivable + Inventory - Accounts Payable - Accruals = PWC ($s) PWC (Difference between two years) Gross Funds Flow (PAT +Depr.) PWC = Operating Cash Flow (GFF - PWC) PART III: ANALYSIS 1. Is the company using too much cash in receivables and inventory? 2. Is the company getting too much cash from payables and accruals - In other words, are there unhappy creditors? 3. Is GFF(PAT + non-cash expenses) sufficient to purchase new PWC each year? - If not, we have to analyze the cash flow statement to determine the other sources of cash which are financing the increase in PWC. Triangle's Standards: \begin{tabular}{|l|r|r|} \hline Days Receivable & 45 days \\ \hline Days Inventory & 0 days \\ \hline Days Payable & 30 days \\ \hline Days Accrual & & \\ \hline \multicolumn{2}{|c|}{ Days in Cycle } & 0 days \\ \hline \end{tabular} The market study and RMA indicates: (Show all of your work) - What is the operating cycle (in days)? Choose the correct formula Operating Cycle =40+90=130 days Net Operating Cycle =1304010=80 days - What is the A/R at the end of the year (\$'s)? Choose the correct formula A/RX365/1,000=40 1000X40/365=$109.59 - What is the Inventory at the end of the year (\$'s)? Choose the correct formula Inventory X 365/600 =90 Inventory =600X90/365=$147.95 - What is the Accounts Payable at the end of the year (\$'s)? Choose the correct formula Accounts payable 365/600=40 =600X40/365=$65.75 - What is the Accruals at the end of the year (\$'s)? Choose the correct formula Accrued expenses X 365/1000 =10 =100010/365=$27.40 - What is the investment in PWC (\$'s)? Choose the formula - you will be using the answers from above. Current assets A/R+ Inventory 109.59+147.95=257.54 Current liabilities AP+AE65.75+27.40=93.15PWC257.5493.15=164.39