Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please see the attached questions and solve them with steps ( better if typing please ) 5 (20 points). An engineer plans to set up

please see the attached questions and solve them with steps ( better if typing please )

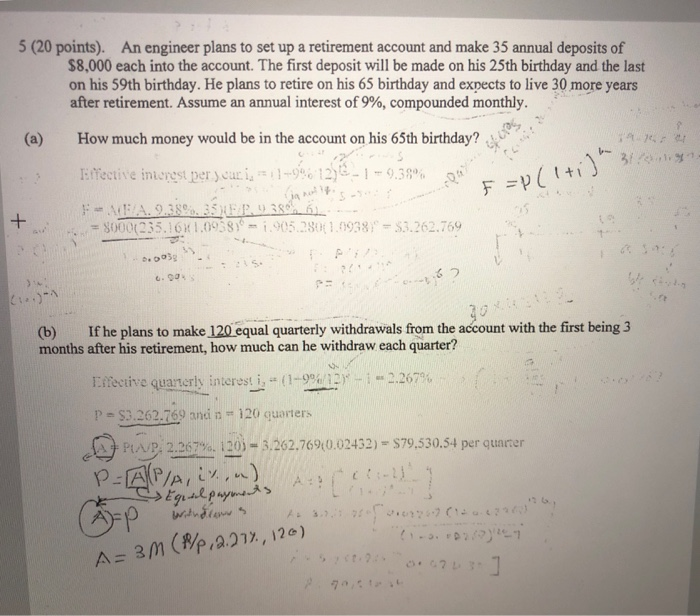

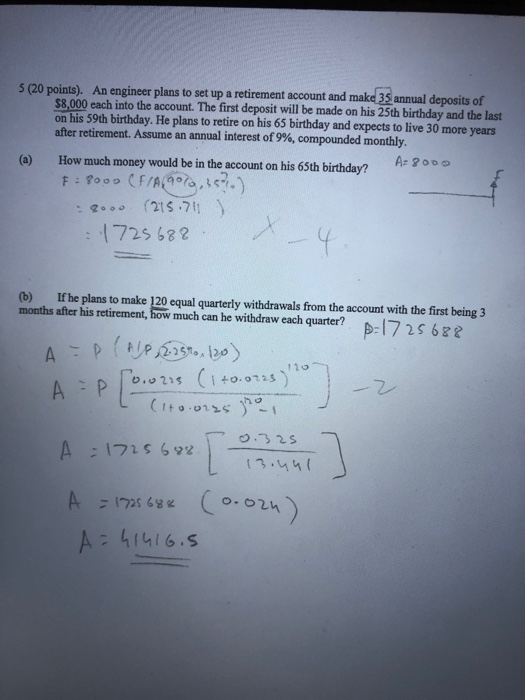

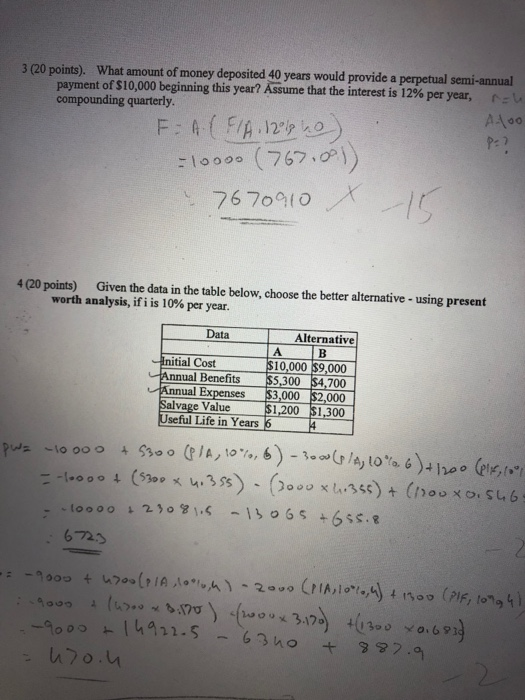

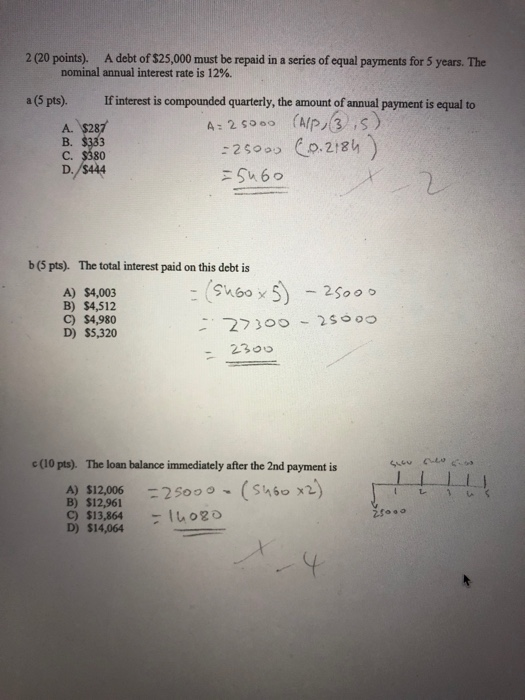

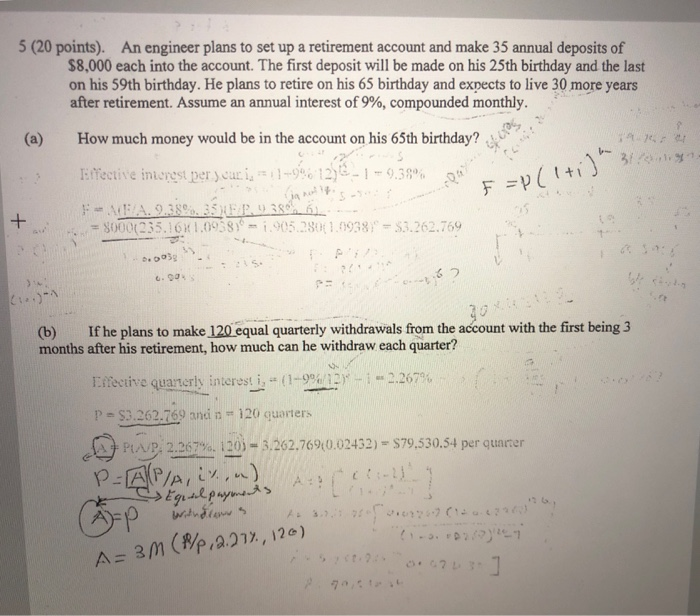

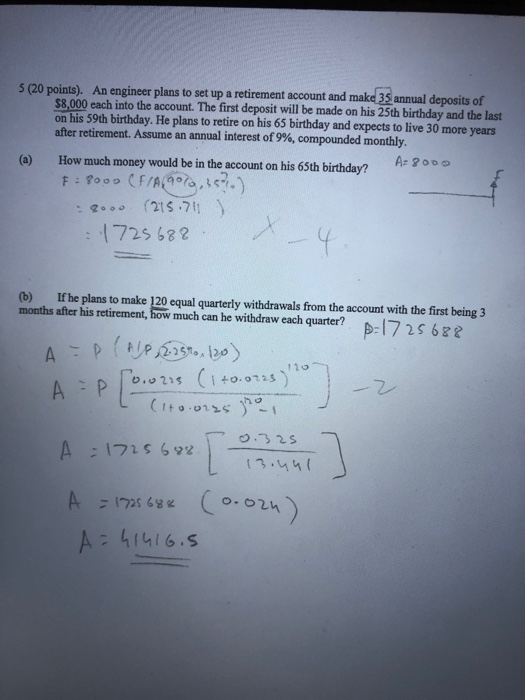

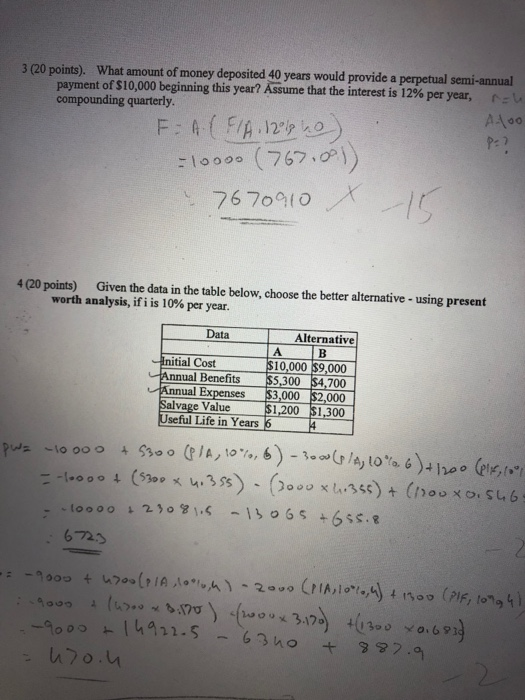

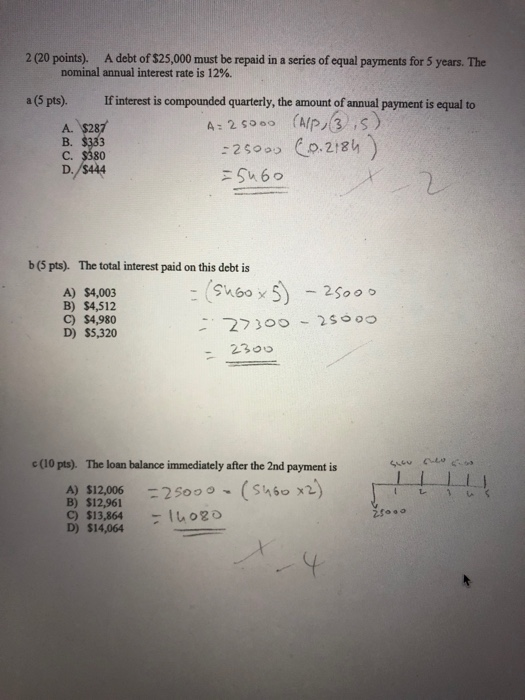

5 (20 points). An engineer plans to set up a retirement account and make 35 annual deposits of $8,000 each into the account. The first deposit will be made on his 25th birthday and the last on his 59th birthday. He plans to retire on his 65 birthday and expects to live 30 more years after retirement. Assume an annual interest of 9%, compounded monthly. How much money would be in the account on his 65th birthday? Effective interest per, cur in = 11-0326 12) - 1 = 9,38% OM F-AHA 2.38%.35 .93886 = 80000235.10X1.0958 = 1.905.2011.0938) - 53.262.769 .. (b) If he plans to make 120 equal quarterly withdrawals from the account with the first being 3 months after his retirement, how much can be withdraw each quarter? Effective quarterly interest i, - (1-9% ) -1 -2.267% P = 33.262.769 and a = 120 quarters PAP: 2.267, 120- 3.262.7690.02452) = $79,530.54 per quarter PAPA, AI! :21 S>Egul.paymwk's A CAP Windows 7 2 -7 21-0 A=3m (H/p , 2.277., 126)" 70, 5 (20 points). An engineer plans to set up a retirement account and make 35 annual deposits of $8,000 each into the account. The first deposit will be made on his 25th birthday and the last on his 59th birthday. He plans to retire on his 65 birthday and expects to live 30 more years after retirement. Assume an annual interest of 9%, compounded monthly. How much money would be in the account on his 65th birthday? A-900 F: 9009 (F/A97,15.) 2. (215.71 ) 1725 682 (6) If he plans to make 120 equal quarterly withdrawals from the account with the first being 3 months after his retirement, how much can he withdraw each quarter? 172568 A P (A) 1. 25. 120) A : Ploons (1to.ores) (toores jro, T 0.325 A : 1725692 Tiziuni A = 1725 682 A=41416.5 3 (20 points). What amount of money deposited 40 years would provide a perpetual semi-annual payment of S10,000 beginning this year? Assume that the interest is 12% per year, compounding quarterly. Aloo FACELA. 120126) PA? -1009 (767,00) 7670910 X 15 4 (20 points) Given the data in the table below, choose the better alternative - using present worth analysis, if i is 10% per year. Data Alternative TAB Initial Cost $10,000 $9,000 Annual Benefits $5,300 $4,700 Annual Expenses $3,000 $2,000 Salvage Value $1,200 $1,300 Useful Life in Years 6 wa -10000 5300 (PIA, 10%, 6) - 3000 (6/A, 10 % 6) + 1200 (16,600 =-10000 + (5300 X 40 355) - (2000 x 4,355) + (hroux 0.566 - 10000 230815 -13065 +658.8 : 6723 9000 & 4200 (1 1A, 10% ) 2000 (11A, 106,4) 1900 (PIF, 1094 9000 & luo 8.180) woux 3.170) +1300 x0,6810 -9000 14922.5 - 6340 + 887.9. = uro.u 2 (20 points). A debt of $25,000 must be repaid in a series of equal payments for 5 years. The nominal annual interest rate is 12%. a (5 pts). If interest is compounded quarterly, the amount of annual payment is equal to A. $287 A= 25000 (Alp, (3,5) B. $333 C. $380 25000 (0.218h) D. $444 = 5460 b(5 pts). The total interest paid on this debt is A) $4,003 - (shoo x5 - 25000 B) $4,512 C) $4,980 27300 - 25000 D) $5,320 2300 SUGU cheo cha c (10 pts). The loan balance immediately after the 2nd payment is A) $12,006 = 2500 - (S460 x2) B) $12,961 C) $13,864 -14020 D) $14,064 Zso.o 5 (20 points). An engineer plans to set up a retirement account and make 35 annual deposits of $8,000 each into the account. The first deposit will be made on his 25th birthday and the last on his 59th birthday. He plans to retire on his 65 birthday and expects to live 30 more years after retirement. Assume an annual interest of 9%, compounded monthly. How much money would be in the account on his 65th birthday? Effective interest per, cur in = 11-0326 12) - 1 = 9,38% OM F-AHA 2.38%.35 .93886 = 80000235.10X1.0958 = 1.905.2011.0938) - 53.262.769 .. (b) If he plans to make 120 equal quarterly withdrawals from the account with the first being 3 months after his retirement, how much can be withdraw each quarter? Effective quarterly interest i, - (1-9% ) -1 -2.267% P = 33.262.769 and a = 120 quarters PAP: 2.267, 120- 3.262.7690.02452) = $79,530.54 per quarter PAPA, AI! :21 S>Egul.paymwk's A CAP Windows 7 2 -7 21-0 A=3m (H/p , 2.277., 126)" 70, 5 (20 points). An engineer plans to set up a retirement account and make 35 annual deposits of $8,000 each into the account. The first deposit will be made on his 25th birthday and the last on his 59th birthday. He plans to retire on his 65 birthday and expects to live 30 more years after retirement. Assume an annual interest of 9%, compounded monthly. How much money would be in the account on his 65th birthday? A-900 F: 9009 (F/A97,15.) 2. (215.71 ) 1725 682 (6) If he plans to make 120 equal quarterly withdrawals from the account with the first being 3 months after his retirement, how much can he withdraw each quarter? 172568 A P (A) 1. 25. 120) A : Ploons (1to.ores) (toores jro, T 0.325 A : 1725692 Tiziuni A = 1725 682 A=41416.5 3 (20 points). What amount of money deposited 40 years would provide a perpetual semi-annual payment of S10,000 beginning this year? Assume that the interest is 12% per year, compounding quarterly. Aloo FACELA. 120126) PA? -1009 (767,00) 7670910 X 15 4 (20 points) Given the data in the table below, choose the better alternative - using present worth analysis, if i is 10% per year. Data Alternative TAB Initial Cost $10,000 $9,000 Annual Benefits $5,300 $4,700 Annual Expenses $3,000 $2,000 Salvage Value $1,200 $1,300 Useful Life in Years 6 wa -10000 5300 (PIA, 10%, 6) - 3000 (6/A, 10 % 6) + 1200 (16,600 =-10000 + (5300 X 40 355) - (2000 x 4,355) + (hroux 0.566 - 10000 230815 -13065 +658.8 : 6723 9000 & 4200 (1 1A, 10% ) 2000 (11A, 106,4) 1900 (PIF, 1094 9000 & luo 8.180) woux 3.170) +1300 x0,6810 -9000 14922.5 - 6340 + 887.9. = uro.u 2 (20 points). A debt of $25,000 must be repaid in a series of equal payments for 5 years. The nominal annual interest rate is 12%. a (5 pts). If interest is compounded quarterly, the amount of annual payment is equal to A. $287 A= 25000 (Alp, (3,5) B. $333 C. $380 25000 (0.218h) D. $444 = 5460 b(5 pts). The total interest paid on this debt is A) $4,003 - (shoo x5 - 25000 B) $4,512 C) $4,980 27300 - 25000 D) $5,320 2300 SUGU cheo cha c (10 pts). The loan balance immediately after the 2nd payment is A) $12,006 = 2500 - (S460 x2) B) $12,961 C) $13,864 -14020 D) $14,064 Zso.o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started