Answered step by step

Verified Expert Solution

Question

1 Approved Answer

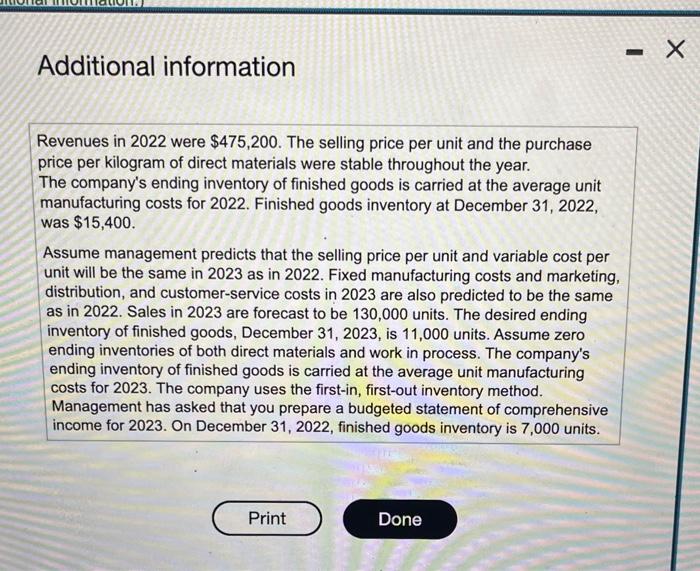

please see the data you might need in the 1st and 2nd image. then complete requiremnt 1 Additional information Revenues in 2022 were $475,200. The

please see the data you might need in the 1st and 2nd image. then complete requiremnt 1

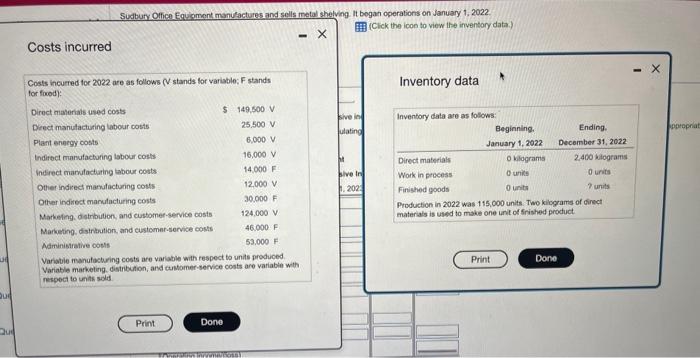

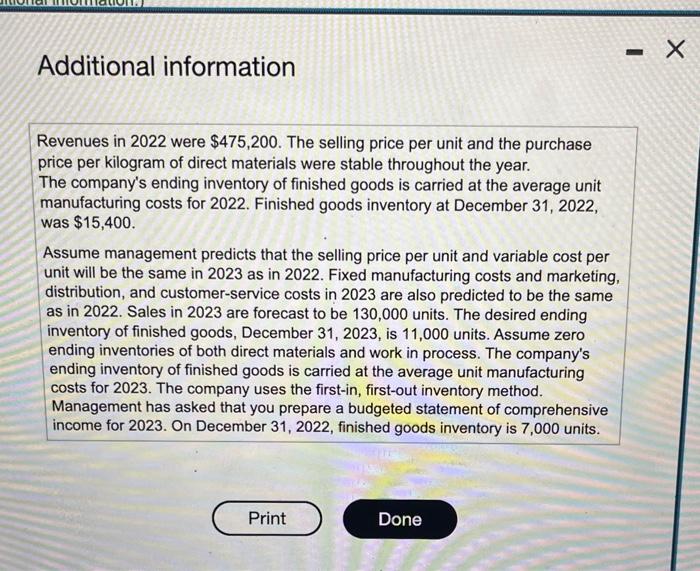

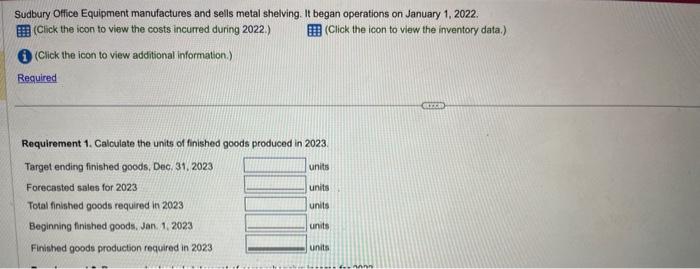

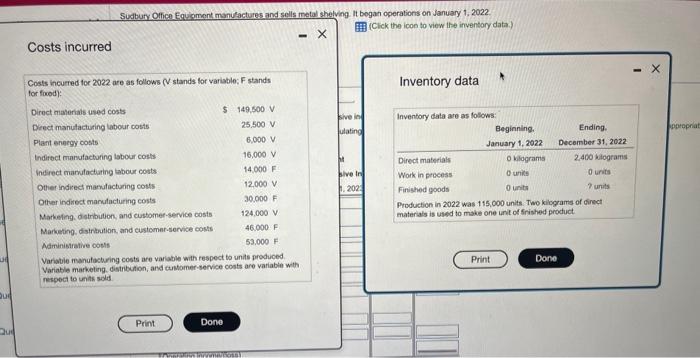

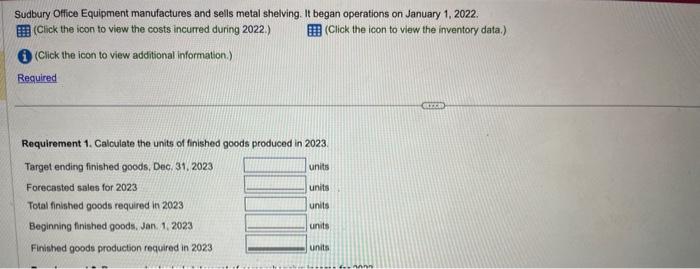

Additional information Revenues in 2022 were $475,200. The selling price per unit and the purchase price per kilogram of direct materials were stable throughout the year. The company's ending inventory of finished goods is carried at the average unit manufacturing costs for 2022. Finished goods inventory at December 31, 2022, was $15,400. Assume management predicts that the selling price per unit and variable cost per unit will be the same in 2023 as in 2022. Fixed manufacturing costs and marketing, distribution, and customer-service costs in 2023 are also predicted to be the same as in 2022. Sales in 2023 are forecast to be 130,000 units. The desired ending inventory of finished goods, December 31,2023 , is 11,000 units. Assume zero ending inventories of both direct materials and work in process. The company's ending inventory of finished goods is carried at the average unit manufacturing costs for 2023. The company uses the first-in, first-out inventory method. Management has asked that you prepare a budgeted statement of comprehensive income for 2023. On December 31,2022, finished goods inventory is 7,000 units. Sudbury Office Equipment manufactures and sells metal shelving. It began operations on January 1, 2022. (Click the icon to view the costs incurred during 2022.) (Click the icon to view the inventory data.) (Click the icon to view additional information.) Requirement 1. Calculate the units of finished goods produced in 2023. Costs incurred

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started