Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please select all that apply Consider an investor based in the DC that invests in the FC. To hedge the FX risk the DC investor

Please select all that apply

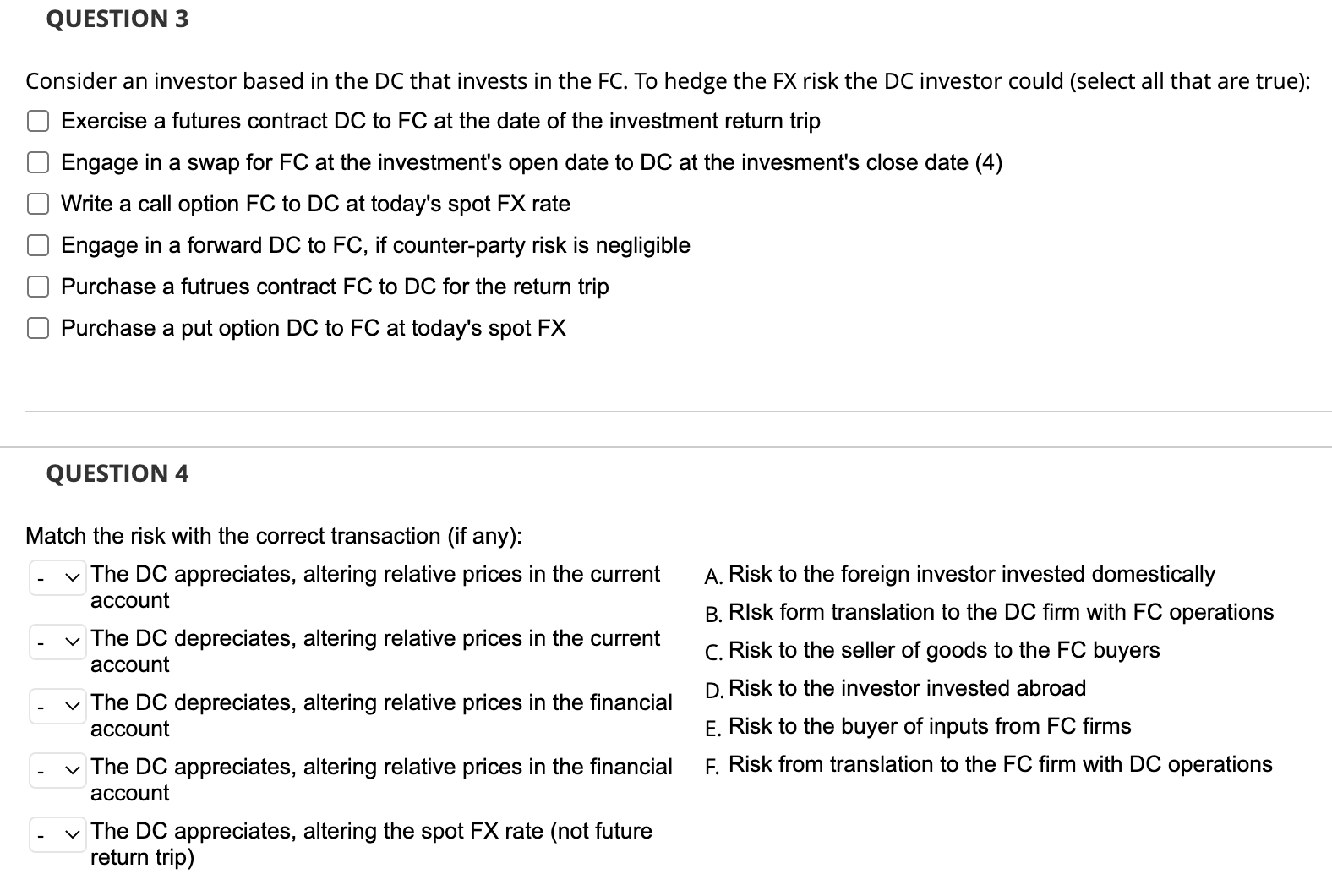

Consider an investor based in the DC that invests in the FC. To hedge the FX risk the DC investor could (select all that are true): Exercise a futures contract DC to FC at the date of the investment return trip Engage in a swap for FC at the investment's open date to DC at the invesment's close date (4) Write a call option FC to DC at today's spot FX rate Engage in a forward DC to FC, if counter-party risk is negligible Purchase a futrues contract FC to DC for the return trip Purchase a put option DC to FC at today's spot FX QUESTION 4 Match the risk with the correct transaction (if any): The DC appreciates, altering relative prices in the current A. Risk to the foreign investor invested domestically account B. RIsk form translation to the DC firm with FC operations The DC depreciates, altering relative prices in the current C. Risk to the seller of goods to the FC buyers account The DC depreciates, altering relative prices in the financial D. Risk to the investor invested abroad account E. Risk to the buyer of inputs from FC firms The DC appreciates, altering relative prices in the financial F. Risk from translation to the FC firm with DC operations account The DC appreciates, altering the spot FX rate (not future return trip)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started