Answered step by step

Verified Expert Solution

Question

1 Approved Answer

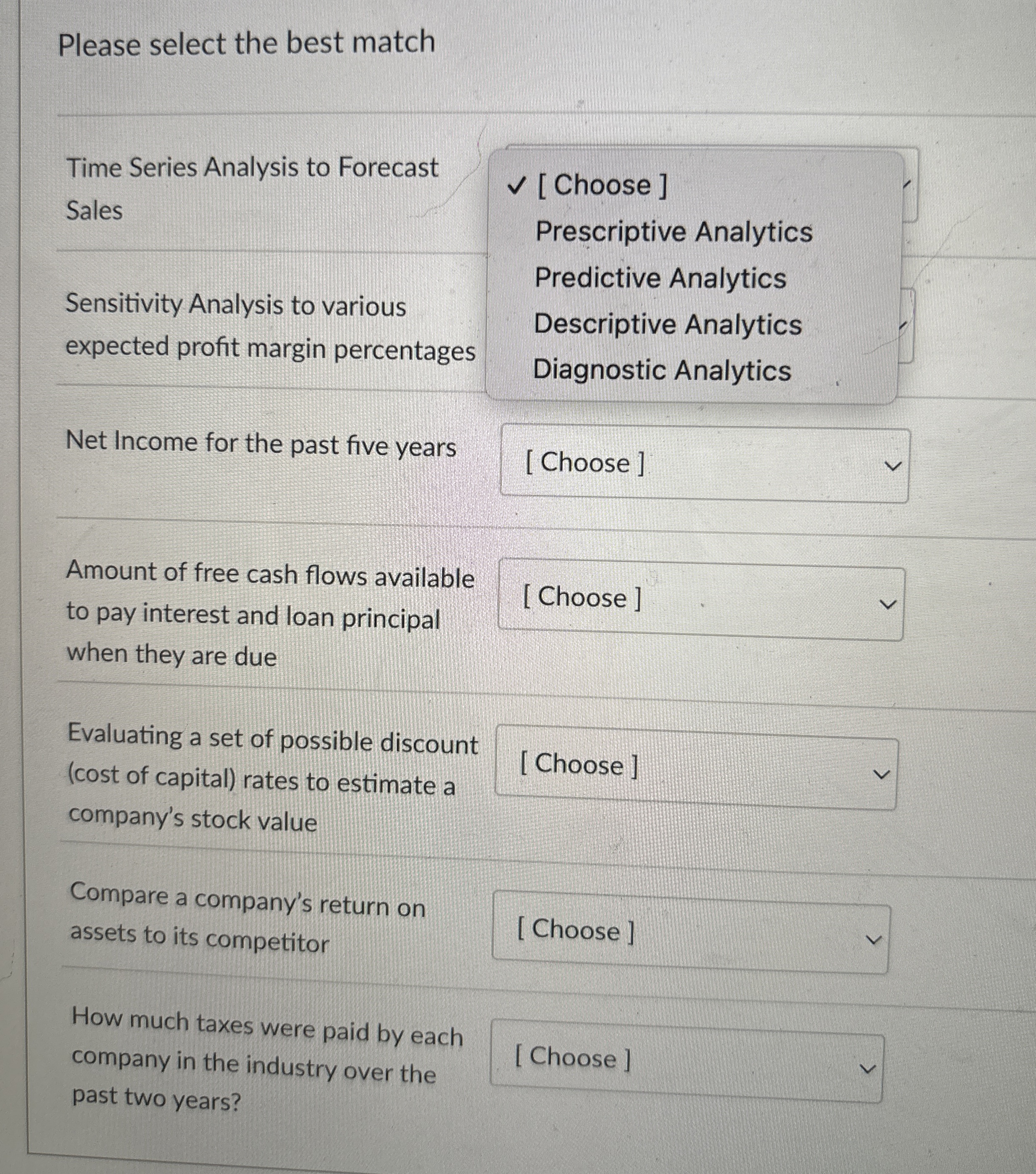

Please select the best match Time Series Analysis to Forecast Sales Sensitivity Analysis to various expected profit margin percentages Net Income for the past five

Please select the best match

Time Series Analysis to Forecast

Sales

Sensitivity Analysis to various

expected profit margin percentages

Net Income for the past five years

Amount of free cash flows available

to pay interest and loan principal

when they are due

Evaluating a set of possible discount

cost of capital rates to estimate a

company's stock value

Compare a company's return on

assets to its competitor

How much taxes were paid by each

company in the industry over the

past two years?

Choose

Prescriptive Analytics

Predictive Analytics

Descriptive Analytics

Diagnostic Analytics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started