Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please send me the answers with the same format and please send me the answer in such wsy do that i can see full answer

please send me the answers with the same format and please send me the answer in such wsy do that i can see full answer clearly.Thank you

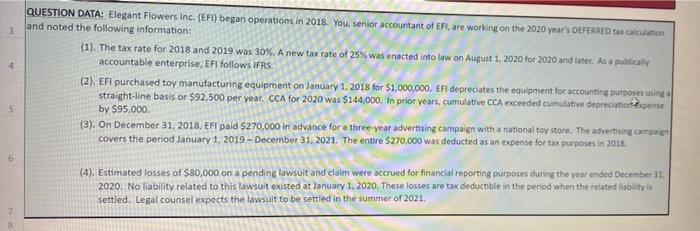

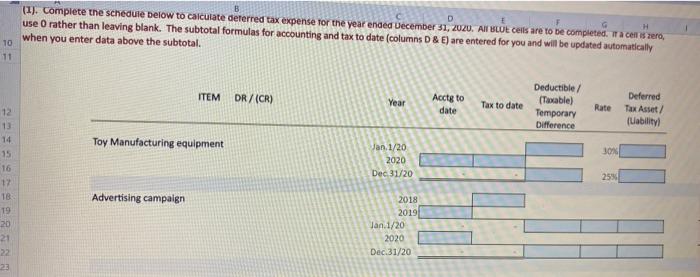

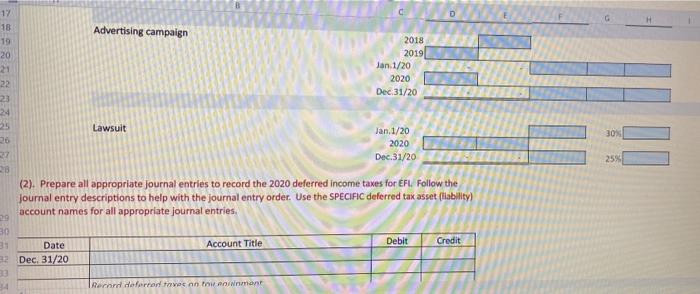

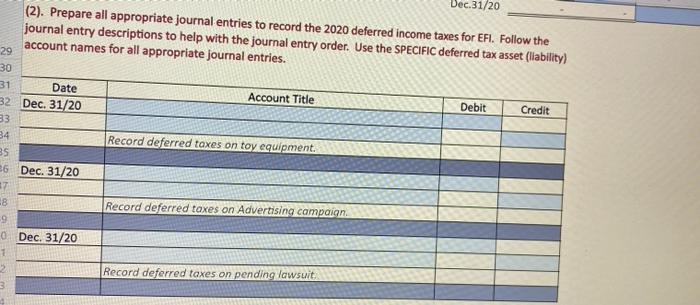

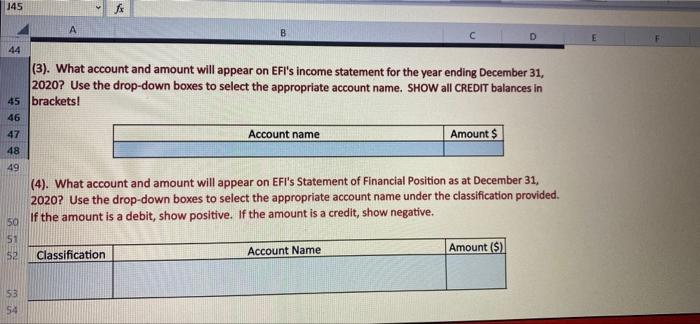

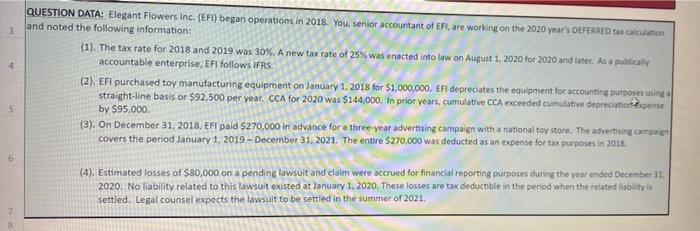

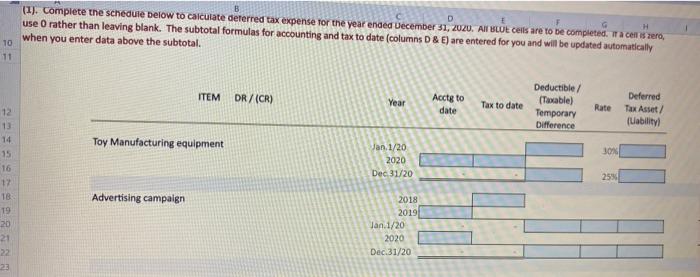

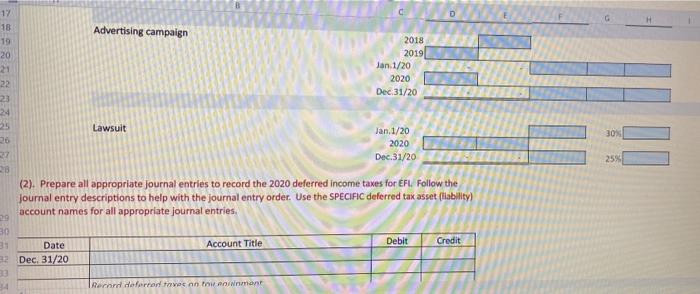

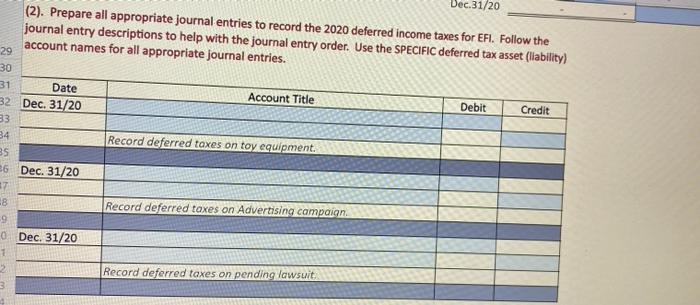

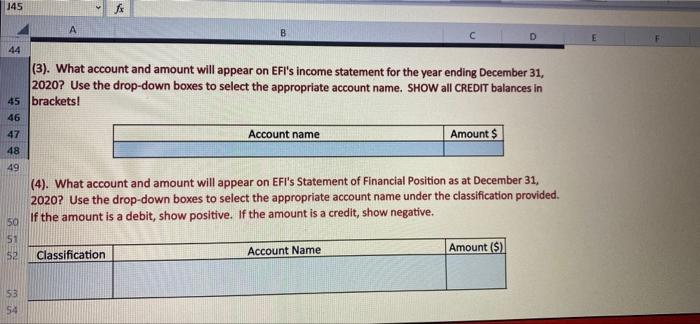

3 4 QUESTION DATA: Elegant Flowers Inc. (EFI) began operations in 2018. You senior accountant of EF, are working on the 2020 year's DEFERRED tax calculation and noted the following information: (1). The tax rate for 2018 and 2019 was 30%. A new tax rate of 25% was enacted into law on August 1, 2020 for 2020 and later. As a publically accountable enterprise, EFI follows IFRS (2). EFI purchased toy manufacturing equipment on January 1, 2018 for $1,000,000. El depreciates the equipment for accounting purposes usine straight line basis or $92,500 per year. CCA for 2020 was $144,000. In prior years, cumulative CCA exceeded cumulative depreciation pense by $95.000 (3). On December 31, 2018, EFI paid $270,000 in advance for a three-year advertising campaign with a national toy store. The advertising campaign covers the period January 1, 2019 - December 31, 2021. The entire $270,000 was deducted as an expense for tax purposes in 2018 5 6 (4). Estimated losses of $80,000 on a pending lawsuit and claim were accrued for financial reporting purposes during the year ended December 31, 2020. No liability related to this lawsuit existed at January 1, 2020. These fosses are tax deductible in the period when the related liability is settled. Legal counsel expects the lawsuit to be settled in the summer of 2021. D (1). Complete the schedule below to calculate Geferred tax expense for the year ended December 31, 2020. All BLUE Cells are to be completed. Tacens zero, H use rather than leaving blank. The subtotal formulas for accounting and tax to date (columns D&E) are entered for you and will be updated automatically when you enter data above the subtotal. 10 11 ITEM DR/(CR) Year Aucts to date Tax to date Deductible/ Taxable) Temporary Difference Rate Deferred Tax Asset (ability Toy Manufacturing equipment 30% Jan 1/20 2020 Dec 31/20 25% 12 13 14 15 16 12 TB 19 20 21 22 23 Advertising campaign 2018 2019 Jan. 1/20 2020 Dec 31/20 Advertising campaign 17 18 19 20 21 22 23 24 2 2018 2019 Jan. 1/20 2020 Dec 31/20 Lawsuit 30% Jan 1/20 2020 Dec. 31/20 37 25% (2). Prepare all appropriate journal entries to record the 2020 deferred income taxes for EFL. Follow the Journal entry descriptions to help with the journal entry order. Use the SPECIFIC deferred tax asset (ilability) account names for all appropriate journal entries, 30 13 Date Debit 12 Dec. 31/20 23 14 Account Title Credit Recand deferert oven to mant Dec.31/20 (2). Prepare all appropriate journal entries to record the 2020 deferred income taxes for EFI. Follow the journal entry descriptions to help with the journal entry order. Use the SPECIFIC deferred tax asset (liability) account names for all appropriate journal entries. 29 30 31 Date 32 Dec. 31/20 Account Title Debit Credit 33 34 BS Record deferred taxes on toy equipment. 26 Dec. 31/20 17 8 -9 Record deferred taxes on Advertising campaign 0 Dec. 31/20 1 Record deferred taxes on pending lawsuit. 3 J45 A 44 (3). What account and amount will appear on EFI's income statement for the year ending December 31, 2020? Use the drop-down boxes to select the appropriate account name. SHOW all CREDIT balances in 45 brackets! 46 47 Account name Amount $ 48 49 (4). What account and amount will appear on EFI's Statement of Financial Position as at December 31, 2020? Use the drop-down boxes to select the appropriate account name under the classification provided. If the amount is a debit, show positive. If the amount is a credit, show negative. 50 51 52 Amount ($) Classification Account Name 53 54 3 4 QUESTION DATA: Elegant Flowers Inc. (EFI) began operations in 2018. You senior accountant of EF, are working on the 2020 year's DEFERRED tax calculation and noted the following information: (1). The tax rate for 2018 and 2019 was 30%. A new tax rate of 25% was enacted into law on August 1, 2020 for 2020 and later. As a publically accountable enterprise, EFI follows IFRS (2). EFI purchased toy manufacturing equipment on January 1, 2018 for $1,000,000. El depreciates the equipment for accounting purposes usine straight line basis or $92,500 per year. CCA for 2020 was $144,000. In prior years, cumulative CCA exceeded cumulative depreciation pense by $95.000 (3). On December 31, 2018, EFI paid $270,000 in advance for a three-year advertising campaign with a national toy store. The advertising campaign covers the period January 1, 2019 - December 31, 2021. The entire $270,000 was deducted as an expense for tax purposes in 2018 5 6 (4). Estimated losses of $80,000 on a pending lawsuit and claim were accrued for financial reporting purposes during the year ended December 31, 2020. No liability related to this lawsuit existed at January 1, 2020. These fosses are tax deductible in the period when the related liability is settled. Legal counsel expects the lawsuit to be settled in the summer of 2021. D (1). Complete the schedule below to calculate Geferred tax expense for the year ended December 31, 2020. All BLUE Cells are to be completed. Tacens zero, H use rather than leaving blank. The subtotal formulas for accounting and tax to date (columns D&E) are entered for you and will be updated automatically when you enter data above the subtotal. 10 11 ITEM DR/(CR) Year Aucts to date Tax to date Deductible/ Taxable) Temporary Difference Rate Deferred Tax Asset (ability Toy Manufacturing equipment 30% Jan 1/20 2020 Dec 31/20 25% 12 13 14 15 16 12 TB 19 20 21 22 23 Advertising campaign 2018 2019 Jan. 1/20 2020 Dec 31/20 Advertising campaign 17 18 19 20 21 22 23 24 2 2018 2019 Jan. 1/20 2020 Dec 31/20 Lawsuit 30% Jan 1/20 2020 Dec. 31/20 37 25% (2). Prepare all appropriate journal entries to record the 2020 deferred income taxes for EFL. Follow the Journal entry descriptions to help with the journal entry order. Use the SPECIFIC deferred tax asset (ilability) account names for all appropriate journal entries, 30 13 Date Debit 12 Dec. 31/20 23 14 Account Title Credit Recand deferert oven to mant Dec.31/20 (2). Prepare all appropriate journal entries to record the 2020 deferred income taxes for EFI. Follow the journal entry descriptions to help with the journal entry order. Use the SPECIFIC deferred tax asset (liability) account names for all appropriate journal entries. 29 30 31 Date 32 Dec. 31/20 Account Title Debit Credit 33 34 BS Record deferred taxes on toy equipment. 26 Dec. 31/20 17 8 -9 Record deferred taxes on Advertising campaign 0 Dec. 31/20 1 Record deferred taxes on pending lawsuit. 3 J45 A 44 (3). What account and amount will appear on EFI's income statement for the year ending December 31, 2020? Use the drop-down boxes to select the appropriate account name. SHOW all CREDIT balances in 45 brackets! 46 47 Account name Amount $ 48 49 (4). What account and amount will appear on EFI's Statement of Financial Position as at December 31, 2020? Use the drop-down boxes to select the appropriate account name under the classification provided. If the amount is a debit, show positive. If the amount is a credit, show negative. 50 51 52 Amount ($) Classification Account Name 53 54

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started