Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all calculation and explanation Pronghorn Corp. has three notes payable outstanding on December 31, 2020, as follows: 1. A six-year, 6%, $82,200 note

Please show all calculation and explanation

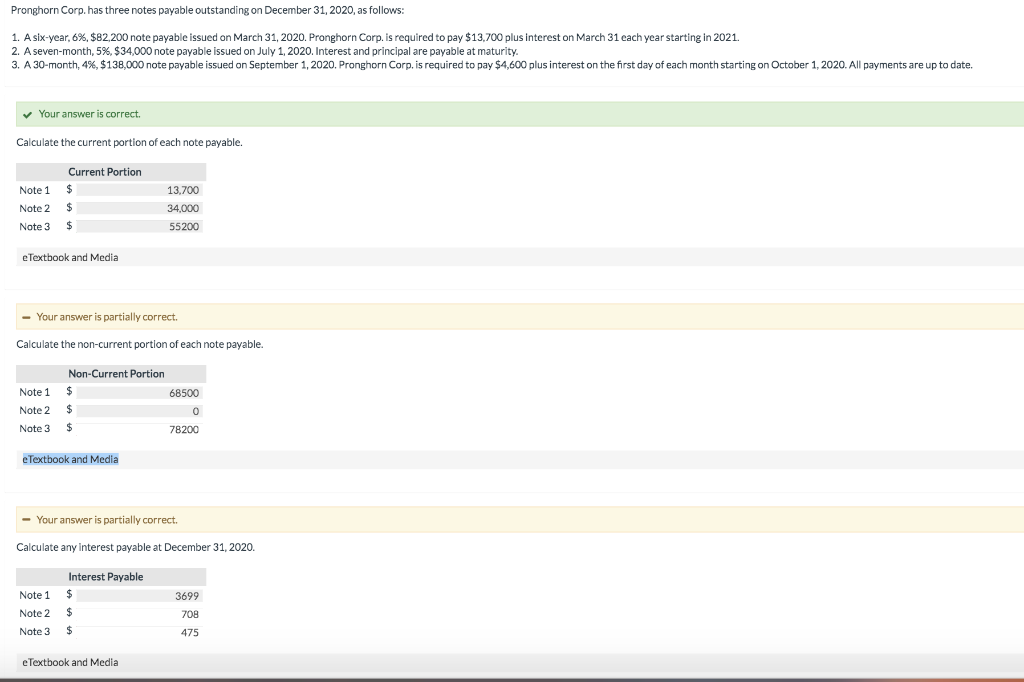

Pronghorn Corp. has three notes payable outstanding on December 31, 2020, as follows: 1. A six-year, 6%, $82,200 note payable issued on March 31, 2020. Pronghorn Corp. is required to pay $13,700 plus interest on March 31 each year starting in 2021. 2. A seven-month, 5%. $34,000 note payable issued on July 1, 2020. Interest and principal are payable at maturity. 3. A 30-month, 4%, $138,000 note payable issued on September 1, 2020. Pronghorn Corp. is required to pay $4,600 plus interest on the first day of each month starting on October 1, 2020. All payments are up to date. Your answer is correct. Calculate the current portion of each note payable. Note 1 Note 2 Note 3 Current Portion $ $ $ 13,700 34.000 55200 e Textbook and Media - Your answer is partially correct. Calculate the non-current portion of each note payable. Note 1 Note 2 Note 3 Non-Current Portion $ 68500 $ $ 78200 eTextbook and Media - Your answer is partially correct. Calculate any interest payable at December 31, 2020. Note 1 Note 2 Interest Payable $ $ $ 3699 708 475 Note 3 e Textbook and MediaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started