Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all calculations and formulas used, please show how to do the tvm or bond questions using inputs for a financial calculator and not

please show all calculations and formulas used, please show how to do the tvm or bond questions using inputs for a financial calculator and not excel.

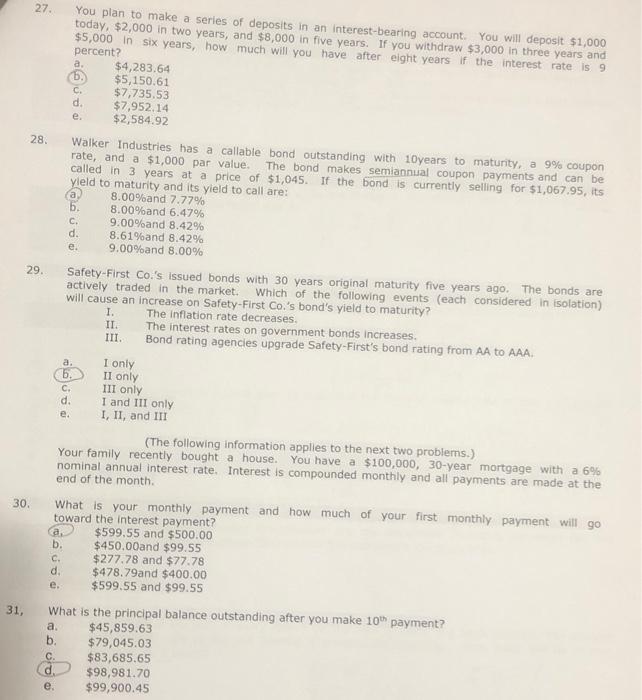

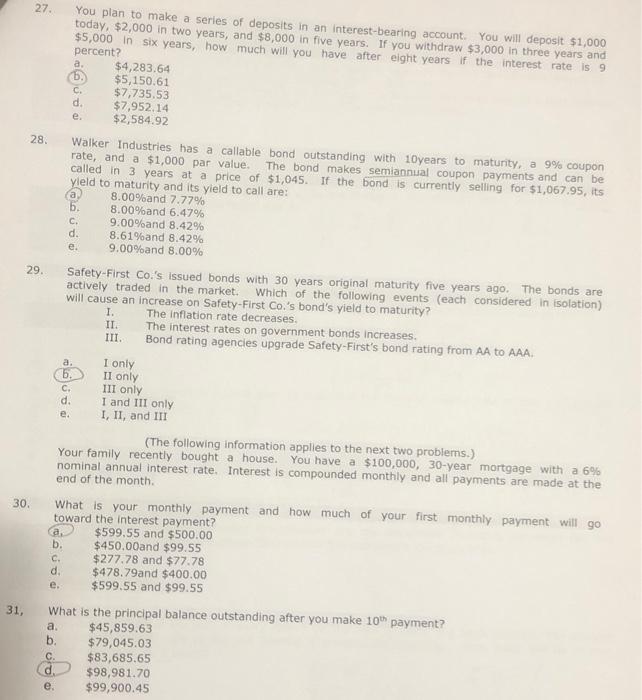

27 C. e. You plan to make a series of deposits in an interest-bearing account. You will deposit $1,000 today, $2,000 in two years, and $8,000 in five years. If you withdraw $3,000 in three years and $5,000 in six years, how much will you have after eight years if the interest rate is 9 percent? a $4,283.64 6. $5,150.61 $7,735.53 d. $7,952.14 $2,584.92 Walker Industries has a callable bond outstanding with 10years to maturity, a 9% coupon rate, and a $1,000 par value. The bond makes semiannual coupon payments and can be called in 3 years at a price of $1,045. If the bond is currently selling for $1,067.95, its yleld to maturity and its yield to call are: a 8.00%and 7.77% b. 8.00%and 6.47% C. 9.00%and 8.42% d. 8.61%and 8.42% e. 9.00%and 8.00% 28. 29. I only C. Safety-First Co.'s issued bonds with 30 years original maturity five years ago. The bonds are actively traded in the market. Which of the following events (each considered in isolation) will cause an increase on Safety-First Co.'s bond's yield to maturity? I. The Inflation rate decreases II. The interest rates on government bonds increases. III. Bond rating agencies upgrade Safety-First's bond rating from AA to AAA. a b. II only III only d. I and III only e. I, II, and III (The following information applies to the next two problems.) Your family recently bought a house. You have a $100,000, 30-year mortgage with a 6% nominal annual interest rate. Interest is compounded monthly and all payments are made at the end of the month. What is your monthly payment and how much of your first monthly payment will go toward the interest payment? a. $599.55 and $500.00 b. $450.00and $99.55 c. $277.78 and $77.78 d. $478.79and $400.00 e. $599.55 and $99.55 What is the principal balance outstanding after you make 10th payment? a $45,859.63 b. $ 79,045.03 $83,685.65 $98,981.70 $99,900.45 30. 31, C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started