Answered step by step

Verified Expert Solution

Question

1 Approved Answer

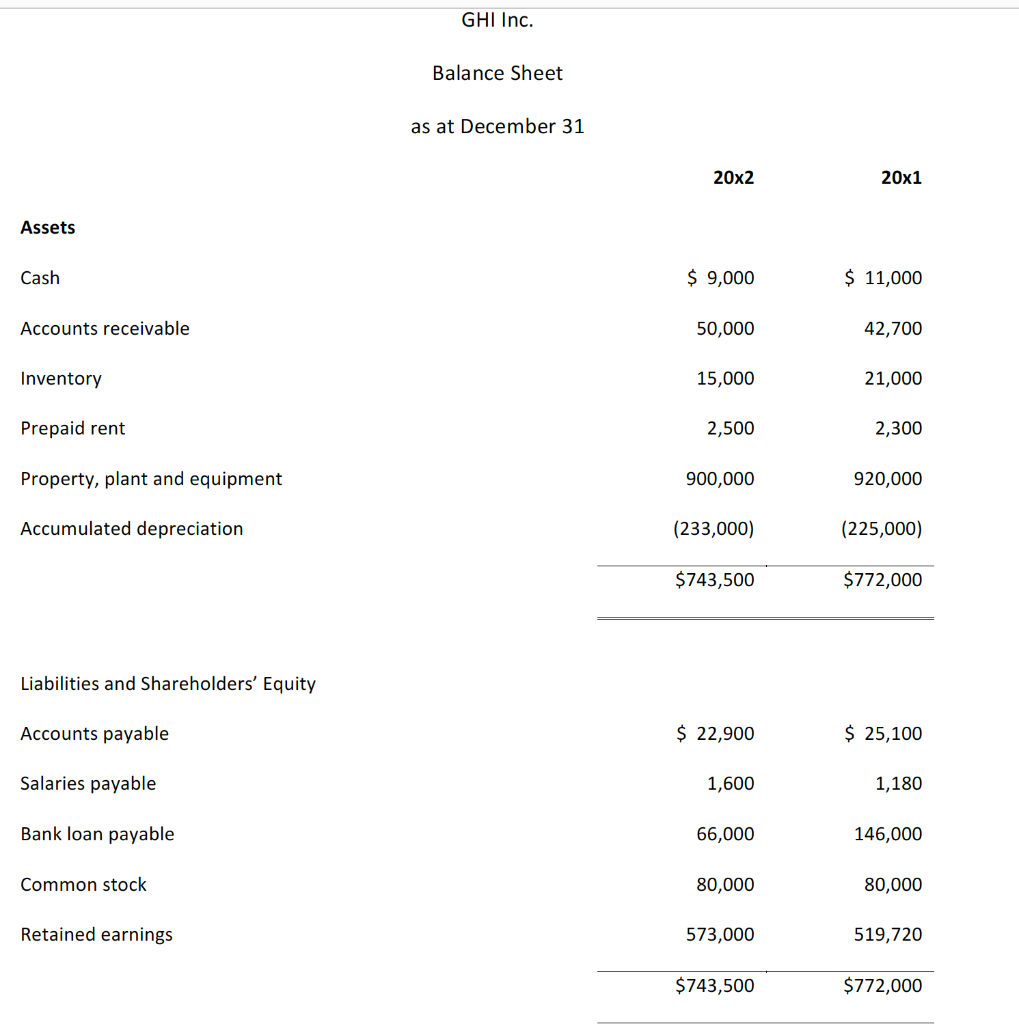

Please show all calculations GHI Inc. Balance Sheet as at December 31 20x2 20x1 Assets Cash $ 9,000 $ 11,000 Accounts receivable 50,000 42,700 Inventory

Please show all calculations

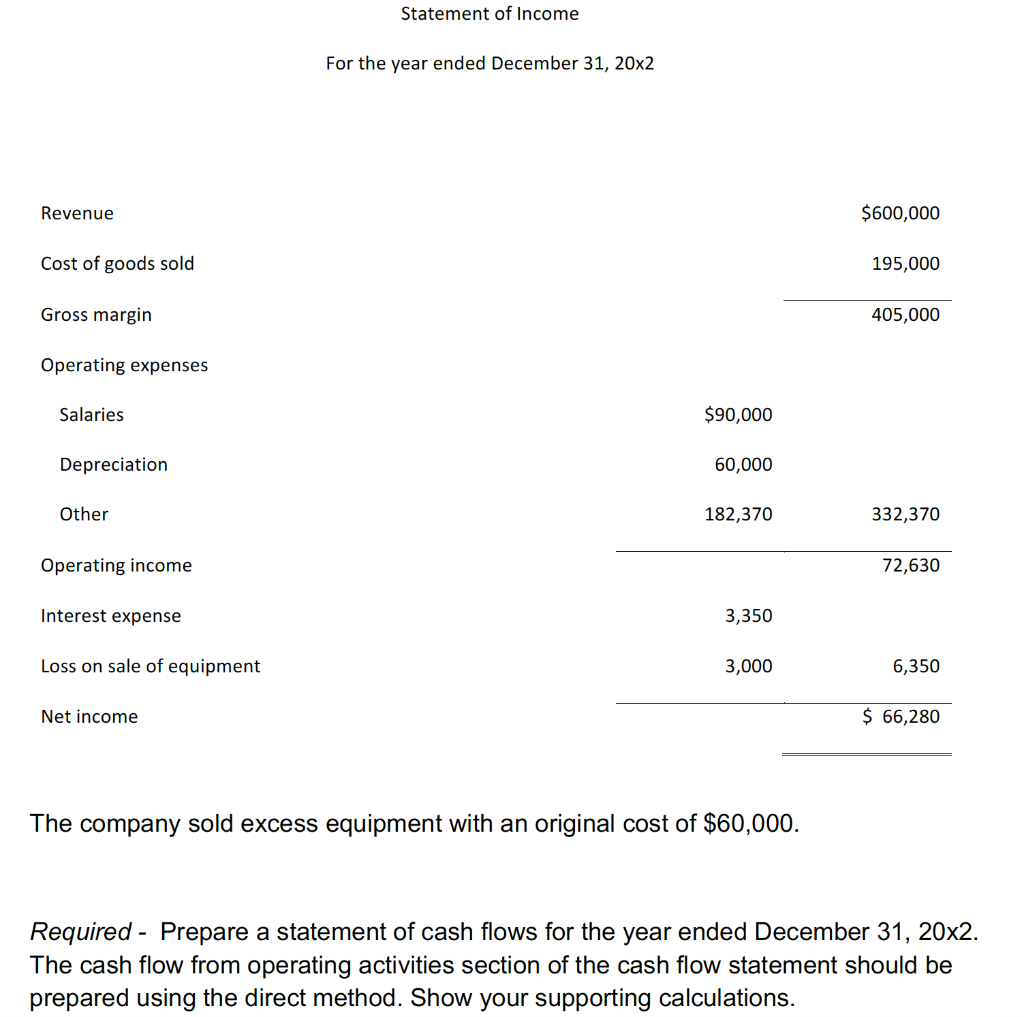

GHI Inc. Balance Sheet as at December 31 20x2 20x1 Assets Cash $ 9,000 $ 11,000 Accounts receivable 50,000 42,700 Inventory 15,000 21,000 Prepaid rent 2,500 2,300 Property, plant and equipment 900,000 920,000 Accumulated depreciation (233,000) (225,000) $743,500 $772,000 Liabilities and Shareholders' Equity Accounts payable $ 22,900 $ 25,100 Salaries payable 1,600 1,180 Bank loan payable 66,000 146,000 Common stock 80,000 80,000 Retained earnings 573,000 519,720 $743,500 $772,000 Statement of Income For the year ended December 31, 20x2 Revenue $600,000 Cost of goods sold 195,000 Gross margin 405,000 Operating expenses Salaries $90,000 Depreciation 60,000 Other 182,370 332,370 Operating income 72,630 Interest expense 3,350 Loss on sale of equipment 3,000 6,350 Net income $ 66,280 The company sold excess equipment with an original cost of $60,000. Required - Prepare a statement of cash flows for the year ended December 31, 20x2. The cash flow from operating activities section of the cash flow statement should be prepared using the direct method. Show your supporting calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started