Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all calculations on how you got the amounts for the journal entry. *E10.26 (LO 5, 9) (Measurement after Acquisition-Revaluation Model) On January 1,

Please show all calculations on how you got the amounts for the journal entry.

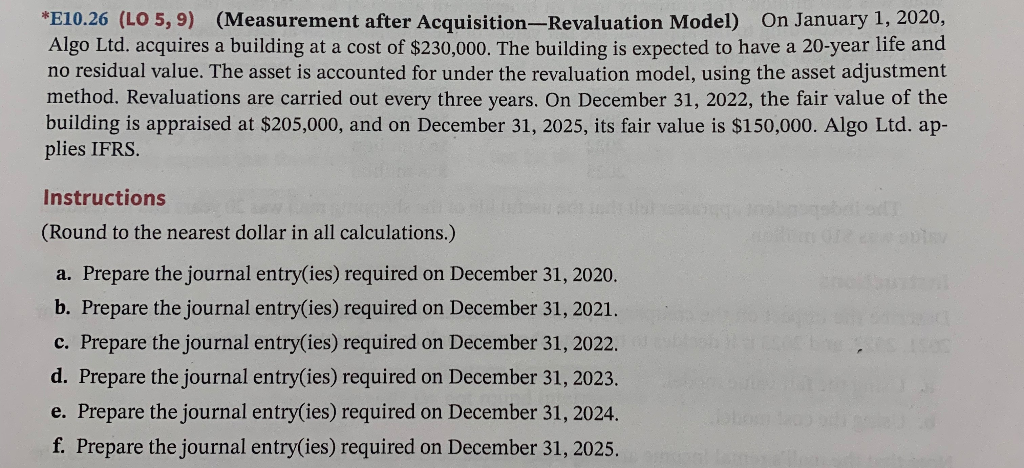

*E10.26 (LO 5, 9) (Measurement after Acquisition-Revaluation Model) On January 1, 2020, Algo Ltd. acquires a building at a cost of $230,000. The building is expected to have a 20-year life and no residual value. The asset is accounted for under the revaluation model, using the asset adjustment method. Revaluations are carried out every three years. On December 31, 2022, the fair value of the building is appraised at $205,000, and on December 31, 2025, its fair value is $150,000. Algo Ltd. ap- plies IFRS. Instructions (Round to the nearest dollar in all calculations.) a. Prepare the journal entry(ies) required on December 31, 2020. b. Prepare the journal entry(ies) required on December 31, 2021. c. Prepare the journal entry(ies) required on December 31, 2022. d. Prepare the journal entry(ies) required on December 31, 2023. e. Prepare the journal entry(ies) required on December 31, 2024. f. Prepare the journal entry(ies) required on December 31, 2025Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started