Answered step by step

Verified Expert Solution

Question

1 Approved Answer

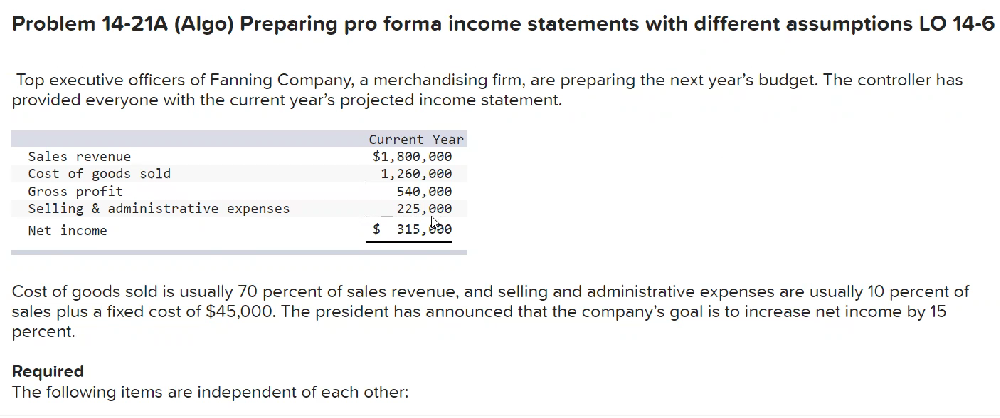

Please show all calculations. Problem 14-21A (Algo) Preparing pro forma income statements with different assumptions LO 14-6 Top executive officers of Fanning Company, a merchandising

Please show all calculations.

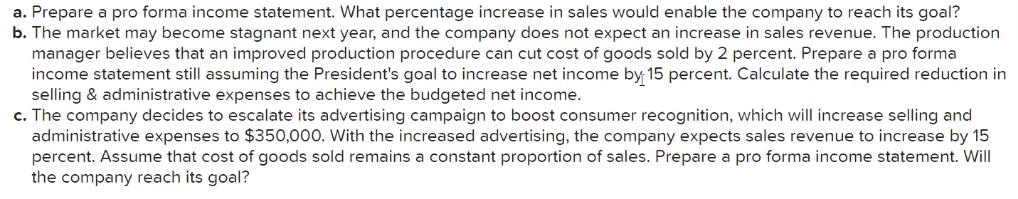

Problem 14-21A (Algo) Preparing pro forma income statements with different assumptions LO 14-6 Top executive officers of Fanning Company, a merchandising firm, are preparing the next year's budget. The controller has provided everyone with the current year's projected income statement. Cost of goods sold is usually 70 percent of sales revenue, and selling and administrative expenses are usually 10 percent of sales plus a fixed cost of $45,000. The president has announced that the company's goal is to increase net income by 15 percent. Required The following items are independent of each other: a. Prepare a pro forma income statement. What percentage increase in sales would enable the company to reach its goal? b. The market may become stagnant next year, and the company does not expect an increase in sales revenue. The production manager believes that an improved production procedure can cut cost of goods sold by 2 percent. Prepare a pro forma income statement still assuming the President's goal to increase net income by 15 percent. Calculate the required reduction in selling \& administrative expenses to achieve the budgeted net income. c. The company decides to escalate its advertising campaign to boost consumer recognition, which will increase selling and administrative expenses to $350,000. With the increased advertising, the company expects sales revenue to increase by 15 percent. Assume that cost of goods sold remains a constant proportion of sales. Prepare a pro forma income statement. Will the company reach its goalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started