Answered step by step

Verified Expert Solution

Question

1 Approved Answer

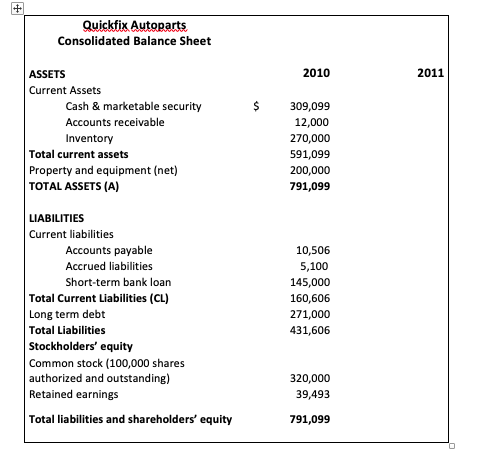

PLEASE SHOW ALL CALCULATIONS!!!!!!!!!!!!!!!!!!!!!!!!! Quickfix Autoparts Consolidated Balance Sheet ASSETS Current Assets Cash & marketable security Accounts receivable Inventory Total current assets Property and equipment

PLEASE SHOW ALL CALCULATIONS!!!!!!!!!!!!!!!!!!!!!!!!!

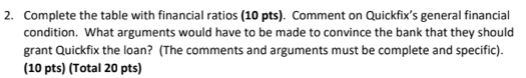

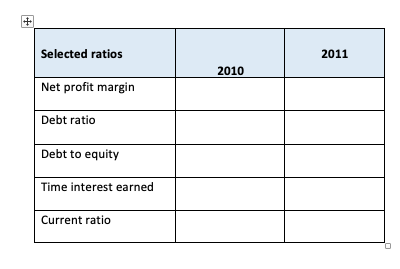

Quickfix Autoparts Consolidated Balance Sheet ASSETS Current Assets Cash & marketable security Accounts receivable Inventory Total current assets Property and equipment (net) TOTAL ASSETS (A) LIABILITIES Current liabilities Accounts payable Accrued liabilities Short-term bank loan Total Current Liabilities (CL) Long term debt Total Liabilities Stockholders' equity Common stock (100,000 shares authorized and outstanding) Retained earnings Total liabilities and shareholders' equity $ 2010 309,099 12,000 270,000 591,099 200,000 791,099 10,506 5,100 145,000 160,606 271,000 431,606 320,000 39,493 791,099 2011 2. Complete the table with financial ratios (10 pts). Comment on Quickfix's general financial condition. What arguments would have to be made to convince the bank that they should grant Quickfix the loan? (The comments and arguments must be complete and specific). (10 pts) (Total 20 pts) + Selected ratios Net profit margin Debt ratio Debt to equity Time interest earned Current ratio 2010 2011 Quickfix Autoparts Consolidated Balance Sheet ASSETS Current Assets Cash & marketable security Accounts receivable Inventory Total current assets Property and equipment (net) TOTAL ASSETS (A) LIABILITIES Current liabilities Accounts payable Accrued liabilities Short-term bank loan Total Current Liabilities (CL) Long term debt Total Liabilities Stockholders' equity Common stock (100,000 shares authorized and outstanding) Retained earnings Total liabilities and shareholders' equity $ 2010 309,099 12,000 270,000 591,099 200,000 791,099 10,506 5,100 145,000 160,606 271,000 431,606 320,000 39,493 791,099 2011 2. Complete the table with financial ratios (10 pts). Comment on Quickfix's general financial condition. What arguments would have to be made to convince the bank that they should grant Quickfix the loan? (The comments and arguments must be complete and specific). (10 pts) (Total 20 pts) + Selected ratios Net profit margin Debt ratio Debt to equity Time interest earned Current ratio 2010 2011Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started