Answered step by step

Verified Expert Solution

Question

1 Approved Answer

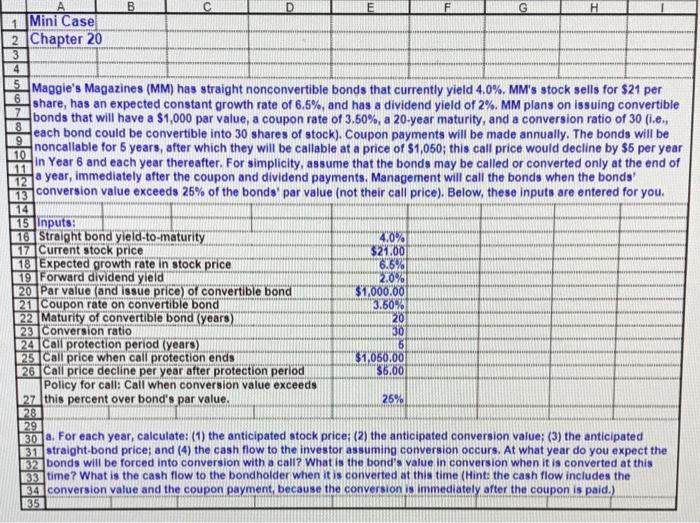

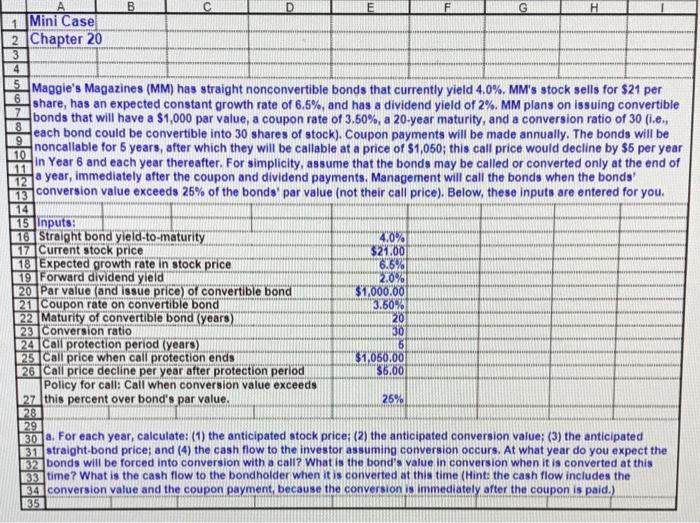

Please show all formulas and give explanantions for your answers! Thank you! M Maggie's Magazines (MM) has straight nonconvertible bonds that currently yield 4.0%. MM's

Please show all formulas and give explanantions for your answers! Thank you!

M Maggie's Magazines (MM) has straight nonconvertible bonds that currently yield 4.0%. MM's stock sells for $21 per 76 share, has an expected constant growth rate of 6.5%, and has a dividend yield of 2%. MM plans on issuing convertible bonds that will have a $1,000 par value, a coupon rate of 3.50%, a 20-year maturity, and a conversion ratio of 30 (i.e., each bond could be convertible into 30 shares of stock). Coupon payments will be made annually. The bonds will be noncallable for 5 years, after which they will be callable at a price of $1,050; this call price would decline by $5 per year In Year 6 and each year thereafter. For simplicity, assume that the bonds may be called or converted only at the end of a year, immediately after the coupon and dividend payments. Management will call the bonds when the bonds' conversion value exceeds 25% of the bonds' par value (not their call price). Below, these inputs are entered for you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started