Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all formulas and workings and avoid using Excel in calculating. Thank you. B. The Ultimate Choice Limited (UCL) is contemplating two different projects

Please show all formulas and workings and avoid using Excel in calculating. Thank you.

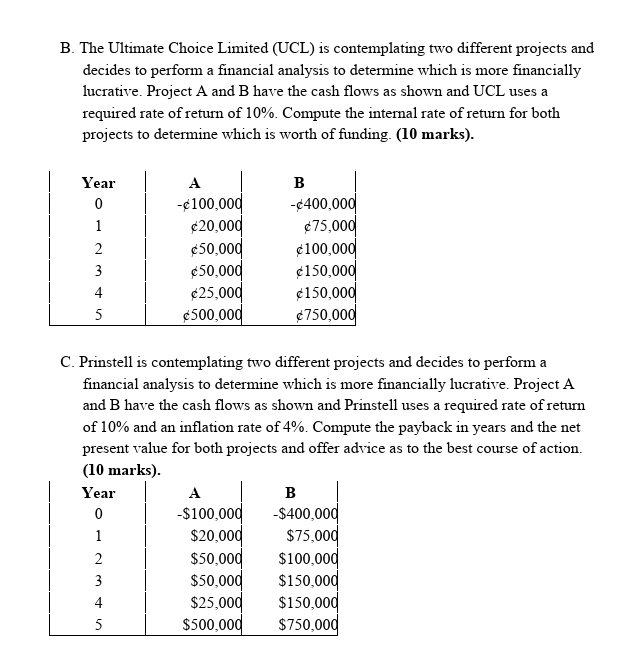

B. The Ultimate Choice Limited (UCL) is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative. Project A and B have the cash flows as shown and UCL uses a required rate of return of 10% Compute the internal rate of return for both projects to determine which is worth of funding. (10 marks). Year 0 1 2 3 4 5 A -100,000 20,000 50,000 50,000 25,000 500,000 B -400,000 75,000 100,000 150,000 150,000 750,000 C. Prinstell is contemplating two different projects and decides to perform a financial analysis to determine which is more financially lucrative. Project A and B have the cash flows as shown and Prinstell uses a required rate of return of 10% and an inflation rate of 4%. Compute the payback in years and the net present value for both projects and offer advice as to the best course of action. (10 marks). Year A B 0 -$100,000 -$400,000 1 $20,000 $75,000 2 $50,000 $100,000 3 $50,000 $150,000 4 $25,000 $150,000 5 $500,000 $750,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started