Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all formulas and would be great if you do it by hand Problem 3 Net Present Value. A company has four project investment

Please show all formulas and would be great if you do it by hand

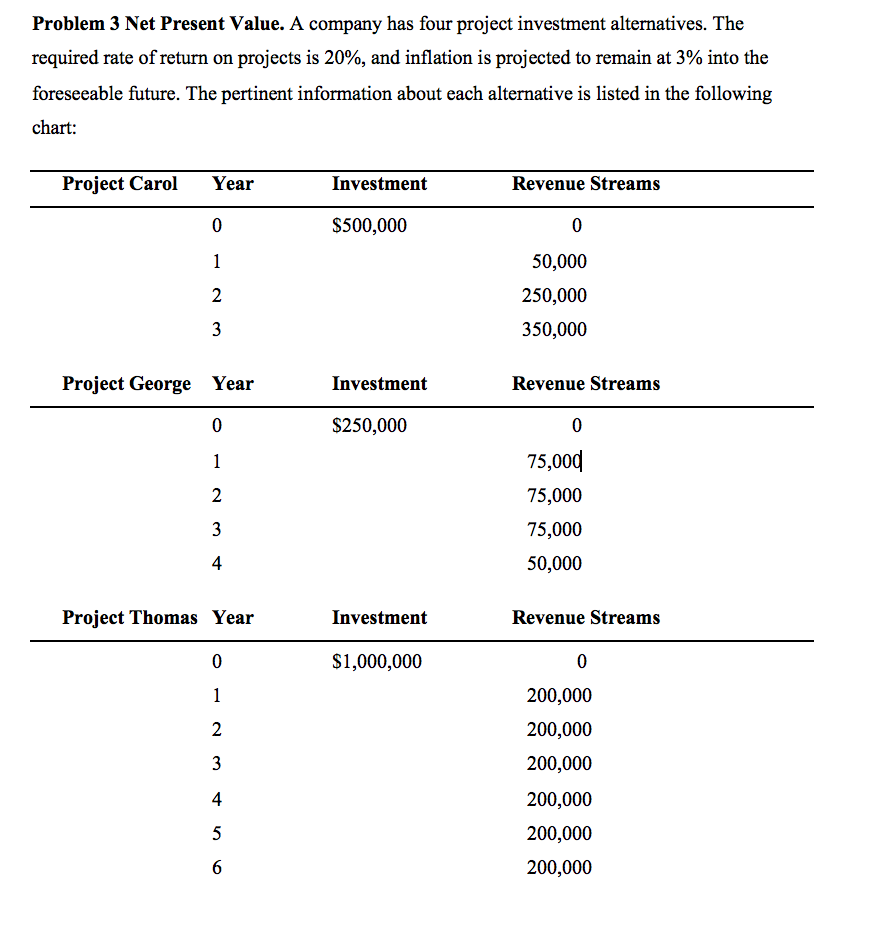

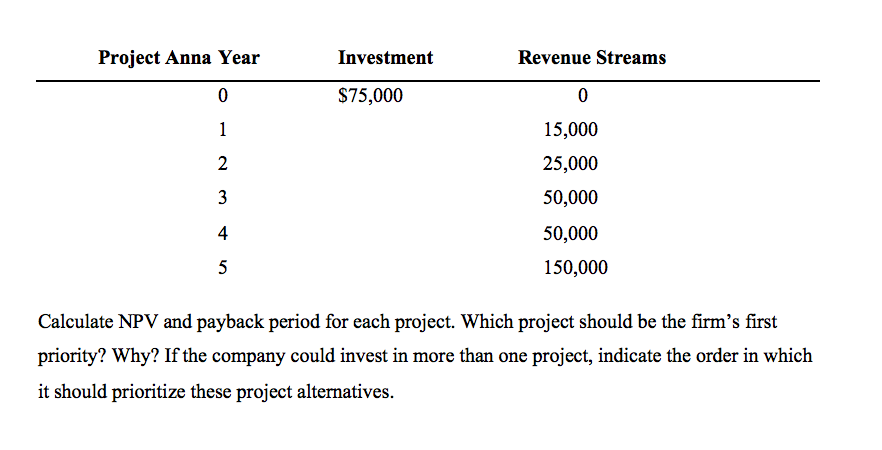

Problem 3 Net Present Value. A company has four project investment alternatives. The required rate of return on projects is 20%, and inflation is projected to remain at 3% into the foreseeable future. The pertinent information about each alternative is listed in the following chart: Project Carol Year Investment Revenue Streams 0 $500,000 0 1 N 2 50,000 250,000 350,000 3 Project George Year Investment Revenue Streams 0 $250,000 0 1 2 75,000 75,000 75,000 50,000 3 4 Project Thomas Year Investment Revenue Streams 0 $1,000,000 0 1 2 3 200,000 200,000 200,000 200,000 200,000 200,000 4 5 6 Project Anna Year Investment Revenue Streams 0 $75,000 0 1 2 3 15,000 25,000 50,000 50,000 150,000 4 5 Calculate NPV and payback period for each project. Which project should be the firm's first priority? Why? If the company could invest in more than one project, indicate the order in which it should prioritize these project alternativesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started