please show all formulas.

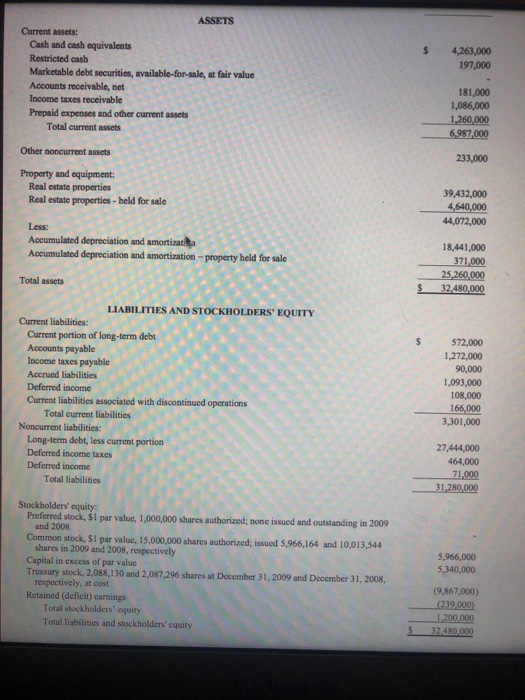

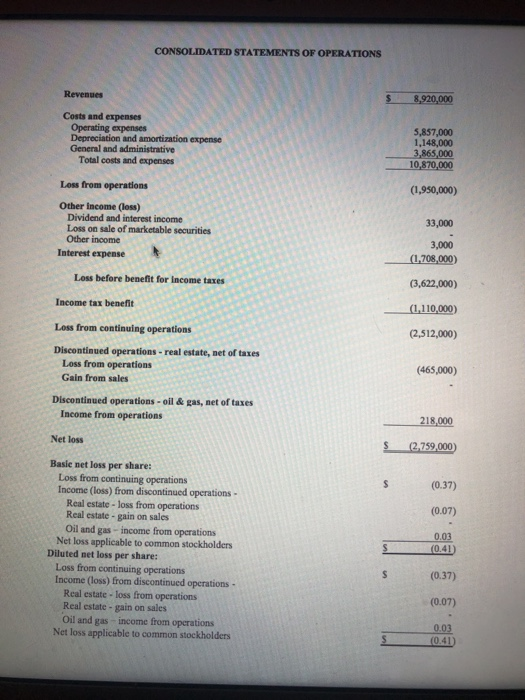

Problem 1 (10 Points): Compute the following Ratios based upon the financial statements provided below (1 Point Each): 1.) Current Ratio 2.) Quick Ratio 3.) Accounts Receivable Turnover 4) Days Sales Outstanding ("DSO") 5.) Total Asset Turnover Ratio 6.) Debt Ratio 7.) Operating Margin 8.) Profit Margin 9.) Return on Assets 10.) Return on Equity ASSETS Current assets: Cash and cash equivalents $ 4,263,000 Restricted cash 197,000 Marketable debt securities, available-for-sale, at fair value Accounts receivable, net 181,000 Income taxes receivable 1,086,000 1,260,000 6,987,000 Prepaid expenses and other current assets Total current assets Other noncurrent assets 233,000 Property and equipment: Real estate properties Real estate properties-held for sale 39,432,000 4,640,000 44,072,000 Less: Accumulated depreciation and amortizatia Accumulated depreciation and amortization-property held for sale 18,441,000 371,000 25,260,000 Total assets 32,480,000 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Current portion of long-term debt 572,000 Accounts payable Income taxes payable 1,272,000 90,000 Accrued liabilities Deferred income Current liabilities associated with discontinued operations 1,093,000 108,000 166,000 Total current liabilities Noncurrent liabilities: Long-term debt, less current portion Deferred income taxes 3,301,000 27,444,000 464,000 Deferred income 71,000 31,280,000 Total liabilities Stockholders' equity Preferred stock, $1 par value, 1,000,000 shares authorized; none issued and outstanding in 2009 and 2008 Common stock, $1 par value, 15,000,000 shares authorized; issued 5,966,164 and 10,013,544 shares in 2009 and 2008, respectively Capital in excess of par value Treasury stock, 2,088,130 and 2,087,296 shares at December 31, 2009 and December 31, 2008, respectively, at cost Retained (deficit) earnings Total stockholders' equity 5,966,000 5,340,000 (9,867,000) (239,000) 1,200,000 Total liabilities and stockholders' equity 32,480,000 CONSOLIDATED STATEMENTS OF OPERATIONS Revenues 8,920,000 Costs and expenses Operating expenses Depreciation and amortization expense General and administrative Total costs and expenses 5,857,000 1,148,000 3,865,000 10,870,000 Loss from operations (1,950,000) Other Income (loss) Dividend and interest income Loss on sale of marketable securities Other income 33,000 3,000 Interest expense (1,708,000) Loss before benefit for Income taxes (3,622,000) Income tax benefit (1,110,000) Loss from continuing operations (2,512,000) Discontinued operations- real estate, net of taxes Loss from operations Gain from sales (465,000) Discontinued operations- oil & gas, net of taxes Income from operations 218,000 Net loss S (2,759,000) Basie net loss per share: Loss from continuing operations Income (loss) from discontinued operations- Real estate - loss from operations Real estate - gain on sales (0.37) (0.07) Oil and gas-income from operations Net loss applicable to common stockholders Diluted net loss per share: Loss from continuing operations Income (loss) from discontinued operations- Real estate- loss from operations Real estate - gain on sales Oil and gas -income from operations Net loss applicable to common stockholders 0.03 (0.41) S S (0.37) (0.07) 0.03 S (0.41)