Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all major calculations/formulas (without using excel)! Thanks in advance! waggers, Inc., is proposing to construct a new bagging plant in a couny Europe.

Please show all major calculations/formulas (without using excel)! Thanks in advance!

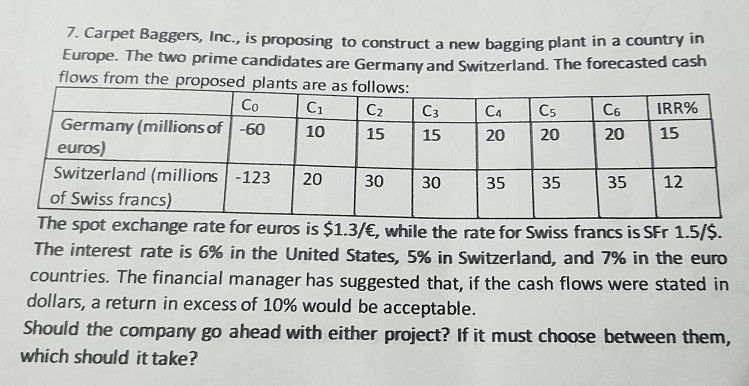

waggers, Inc., is proposing to construct a new bagging plant in a couny Europe. The two prime candidates are Germany and Switzerland. The forecas flows from the proposed plants are as follows: Co C C C3 CA CS 6 IRR% Germany (millions of -60 10 15 15 20 20 20 15 euros) Switzerland (millions | -123 20 30 30 35 35 35 12 of Swiss francs) The spot exchange rate for euros is $1.3/, while the rate for Swiss francs is SFr 1.5/$. The interest rate is 6% in the United States, 5% in Switzerland, and 7% in the euro countries. The financial manager has suggested that, if the cash flows were stated in dollars, a return in excess of 10% would be acceptable. Should the company go ahead with either project? If it must choose between them, which should it takeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started