please show all step on a excel document

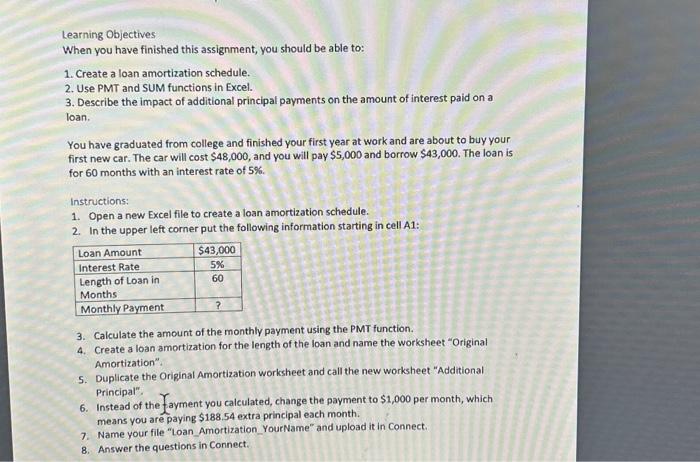

Learning Objectives When you have finished this assignment, you should be able to: 1. Create a loan amortization schedule. 2. Use PMT and SUM functions in Excel. 3. Describe the impact of additional principal payments on the amount of interest paid on a loan. You have graduated from college and finished your first year at work and are about to buy your first new car. The car will cost $48,000, and you will pay $5,000 and borrow $43,000. The loan is for 60 months with an interest rate of 5%. Instructions: 1. Open a new Excel file to create a loan amortization schedule. 2. In the upper left corner put the following information starting in cell A1: 3. Calculate the amount of the monthly payment using the PMT function. 4. Create a loan amortization for the length of the loan and name the worksheet "Original Amortization". 5. Duplicate the Original Amortization worksheet and call the new worksheet "Additional Principal", 6. Instead of the fayment you calculated, change the payment to $1,000 per month, which means you are paying $188.54 extra principal each month. 7. Name your file "Loan_Amortization_YourName" and upload it in Connect. 8. Answer the questions in Connect. Learning Objectives When you have finished this assignment, you should be able to: 1. Create a loan amortization schedule. 2. Use PMT and SUM functions in Excel. 3. Describe the impact of additional principal payments on the amount of interest paid on a loan. You have graduated from college and finished your first year at work and are about to buy your first new car. The car will cost $48,000, and you will pay $5,000 and borrow $43,000. The loan is for 60 months with an interest rate of 5%. Instructions: 1. Open a new Excel file to create a loan amortization schedule. 2. In the upper left comer put the following infog:mation starting in cell A1: 3. Calculate the amount of the monthly payment using the PMT function. 4. Create a loan amortization for the length of the loan and name the worksheet "Original Amortization". 5. Duplicate the Original Amortization worksheet and call the new worksheet "Additional Principal". 6. Instead of the payment you calculated, change the payment to $1,000 per month, which means you are paying $188.54 extra principal each month. 7. Name your file "Loan_Amortization_YourName" and upload it in Connect. 8. Answer the questions in Connect