Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all steps and formulas used in excel. The other answers posted for this question are incomplete and do not show the steps. l.

Please show all steps and formulas used in excel. The other answers posted for this question are incomplete and do not show the steps.

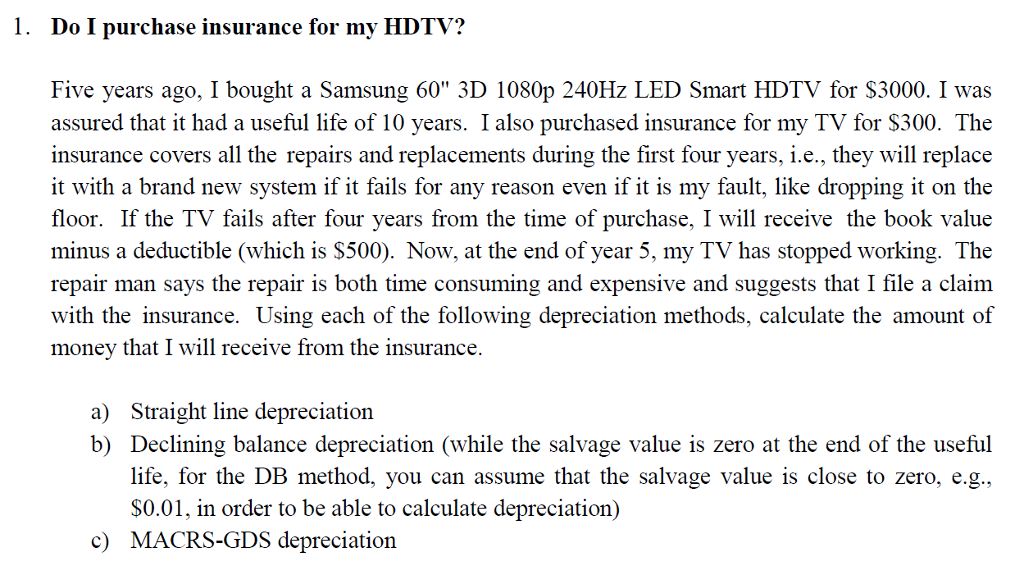

l. Do I purchase insurance for my HDTV? Five years ago, I bought a Samsung 60" 3D 1080p 240Hz LED Smart HDTV for $3000. I was assured that it had a useful life of 10 years. I also purchased insurance for my TV for $300. The insurance covers all the repairs and replacements during the first four years, i.e., they will replace it with a brand new system if it fails for any reason even if it is my fault, like dropping it on the floor. If the TV fails after four years from the time of purchase, I will receive the book value minus a deductible (which is $500). Now, at the end of year 5, my TV has stopped working. The repair man says the repair is both time consuming and expensive and suggests that I file a claim with the insurance. Using each of the following depreciation methods, calculate the amount of money that I will receive from the insurance. a) Straight line depreciation b) Declining balance depreciation (while the salvage value is zero at the end of the useful life, for the DB method, you can assume that the salvage value is close to zero, e.g., $0.01, in order to be able to calculate depreciation) c) MACRS-GDS depreciationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started