Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE SHOW ALL STEPS NO EXCEL 4. [3 points) Dr. Bhattacharya and Dr. Malinowski are considering purchasing a house together after spending 2 years as

PLEASE SHOW ALL STEPS

NO EXCEL

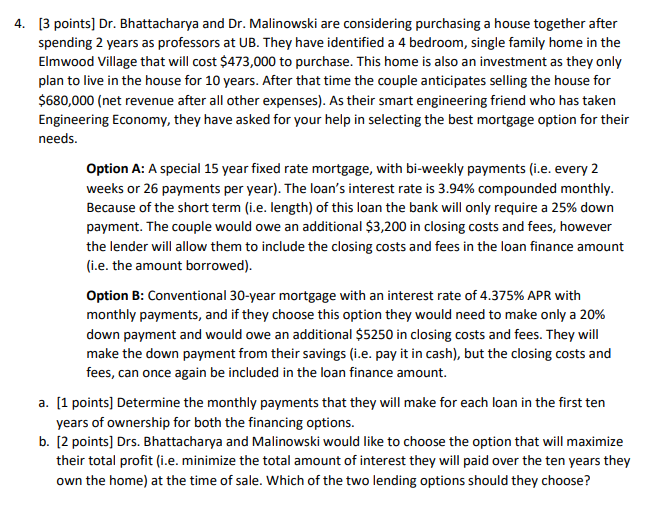

4. [3 points) Dr. Bhattacharya and Dr. Malinowski are considering purchasing a house together after spending 2 years as professors at UB. They have identified a 4 bedroom, single family home in the Elmwood Village that will cost $473,000 to purchase. This home is also an investment as they only plan to live in the house for 10 years. After that time the couple anticipates selling the house for $680,000 (net revenue after all other expenses). As their smart engineering friend who has taken Engineering Economy, they have asked for your help in selecting the best mortgage option for their needs. Option A: A special 15 year fixed rate mortgage, with bi-weekly payments (i.e. every 2 weeks or 26 payments per year). The loan's interest rate is 3.94% compounded monthly. Because of the short term (i.e. length) of this loan the bank will only require a 25% down payment. The couple would owe an additional $3,200 in closing costs and fees, however the lender will allow them to include the closing costs and fees in the loan finance amount (i.e. the amount borrowed). Option B: Conventional 30-year mortgage with an interest rate of 4.375% APR with monthly payments, and if they choose this option they would need to make only a 20% down payment and would owe an additional $5250 in closing costs and fees. They will make the down payment from their savings (i.e. pay it in cash), but the closing costs and fees, can once again be included in the loan finance amount. a. [1 points] Determine the monthly payments that they will make for each loan in the first ten years of ownership for both the financing options. b. [2 points) Drs. Bhattacharya and Malinowski would like to choose the option that will maximize their total profit (i.e. minimize the total amount of interest they will paid over the ten years they own the home) at the time of sale. Which of the two lending options should they choose? 4. [3 points) Dr. Bhattacharya and Dr. Malinowski are considering purchasing a house together after spending 2 years as professors at UB. They have identified a 4 bedroom, single family home in the Elmwood Village that will cost $473,000 to purchase. This home is also an investment as they only plan to live in the house for 10 years. After that time the couple anticipates selling the house for $680,000 (net revenue after all other expenses). As their smart engineering friend who has taken Engineering Economy, they have asked for your help in selecting the best mortgage option for their needs. Option A: A special 15 year fixed rate mortgage, with bi-weekly payments (i.e. every 2 weeks or 26 payments per year). The loan's interest rate is 3.94% compounded monthly. Because of the short term (i.e. length) of this loan the bank will only require a 25% down payment. The couple would owe an additional $3,200 in closing costs and fees, however the lender will allow them to include the closing costs and fees in the loan finance amount (i.e. the amount borrowed). Option B: Conventional 30-year mortgage with an interest rate of 4.375% APR with monthly payments, and if they choose this option they would need to make only a 20% down payment and would owe an additional $5250 in closing costs and fees. They will make the down payment from their savings (i.e. pay it in cash), but the closing costs and fees, can once again be included in the loan finance amount. a. [1 points] Determine the monthly payments that they will make for each loan in the first ten years of ownership for both the financing options. b. [2 points) Drs. Bhattacharya and Malinowski would like to choose the option that will maximize their total profit (i.e. minimize the total amount of interest they will paid over the ten years they own the home) at the time of sale. Which of the two lending options should they chooseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started