Answered step by step

Verified Expert Solution

Question

1 Approved Answer

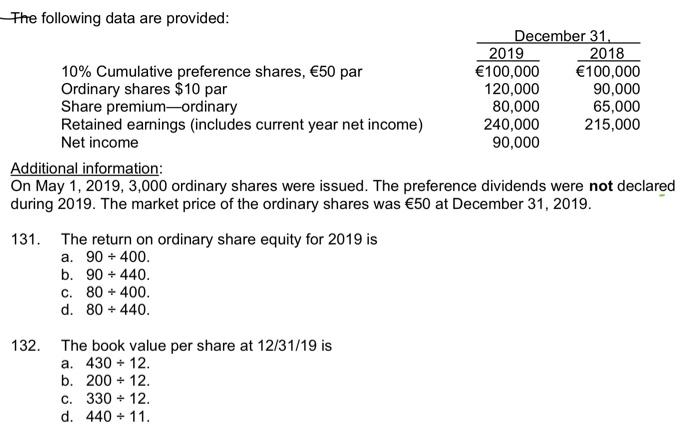

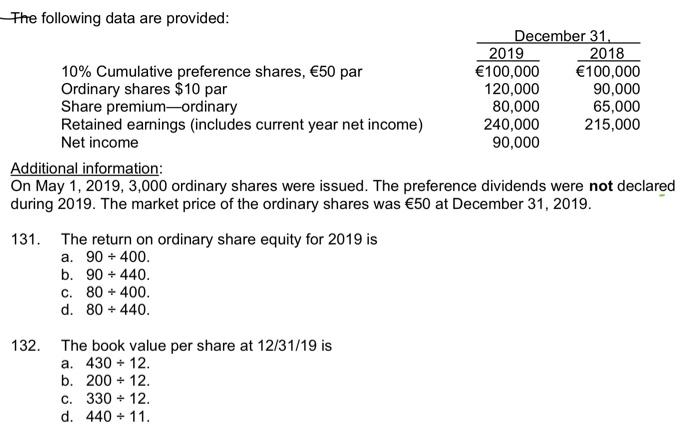

Please show all steps. Thanks The following data are provided: December 31, 2018 2019 100,000 100,000 10% Cumulative preference shares, 50 par Ordinary shares $10

Please show all steps. Thanks

The following data are provided: December 31, 2018 2019 100,000 100,000 10% Cumulative preference shares, 50 par Ordinary shares $10 par 120,000 90,000 Share premium ordinary 80,000 65,000 240,000 215,000 Retained earnings (includes current year net income) Net income 90,000 Additional information: On May 1, 2019, 3,000 ordinary shares were issued. The preference dividends were not declared during 2019. The market price of the ordinary shares was 50 at December 31, 2019. 131. The return on ordinary share equity for 2019 is a. 90 + 400. b. 90 + 440. c. 80 + 400. d. 80+ 440. 132. The book value per share at 12/31/19 is a. 430 + 12. b. 200+ 12. c. 330 + 12. d. 440 + 11. The following data are provided: December 31, 2018 2019 100,000 100,000 10% Cumulative preference shares, 50 par Ordinary shares $10 par 120,000 90,000 Share premium ordinary 80,000 65,000 240,000 215,000 Retained earnings (includes current year net income) Net income 90,000 Additional information: On May 1, 2019, 3,000 ordinary shares were issued. The preference dividends were not declared during 2019. The market price of the ordinary shares was 50 at December 31, 2019. 131. The return on ordinary share equity for 2019 is a. 90 + 400. b. 90 + 440. c. 80 + 400. d. 80+ 440. 132. The book value per share at 12/31/19 is a. 430 + 12. b. 200+ 12. c. 330 + 12. d. 440 + 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started