Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all the calculation a) b) and c) thanks DK Ple. currently earns a profit after tax of 10% on capital employed. The company

please show all the calculation a) b) and c) thanks

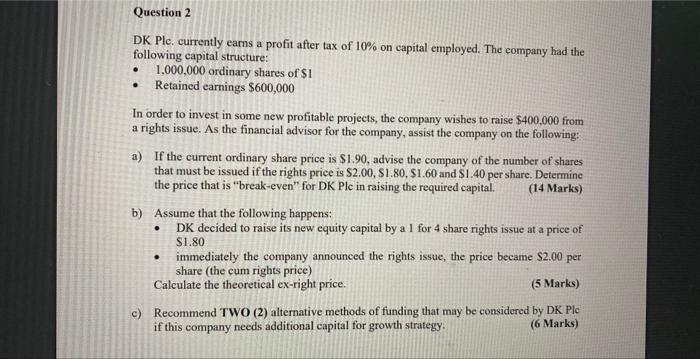

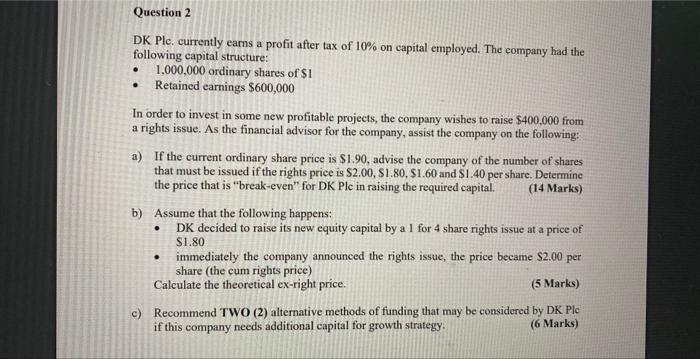

DK Ple. currently earns a profit after tax of 10% on capital employed. The company had the following capital structure: - 1,000,000 ordinary shares of \$1 - Retained carnings $600,000 In order to invest in some new profitable projects, the company wishes to raise $400,000 from a rights issue. As the financial advisor for the company, assist the company on the following: a) If the current ordinary share price is $1.90, advise the company of the number of shares that must be issued if the rights price is $2.00,$1.80,$1.60 and $1.40 per share. Determine the price that is "break-even" for DK Ple in raising the required capital. (14 Marks) b) Assume that the following happens: - DK decided to raise its new equity capital by a 1 for 4 share rights issue at a price of $1.80 - immediately the company announced the rights issue, the price became $2.00 per share (the cum rights price) Calculate the theoretical ex-right price. (5 Marks) c) Recommend TWO (2) alternative methods of funding that may be considered by DK Ple if this company needs additional capital for growth strategy. (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started