Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all the calculation and formula used. (a) A project requires an initial outlay of $100 million and an additional investment in working capital

please show all the calculation and formula used.

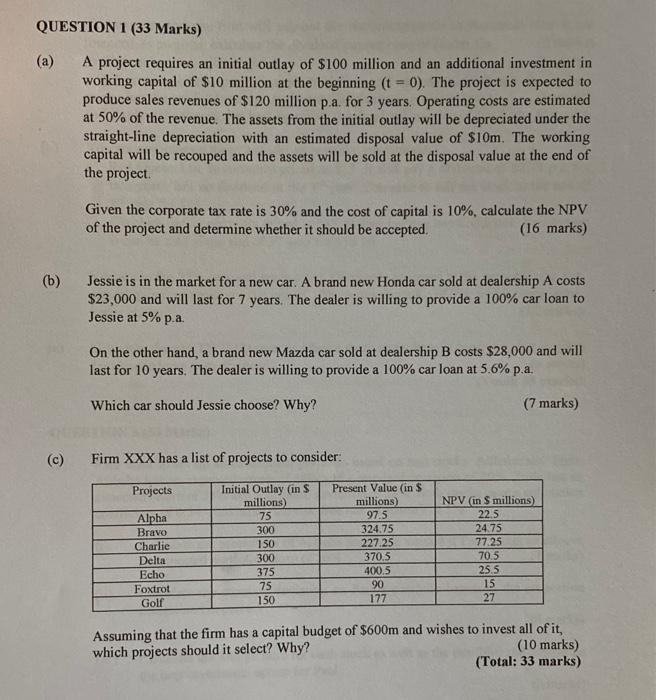

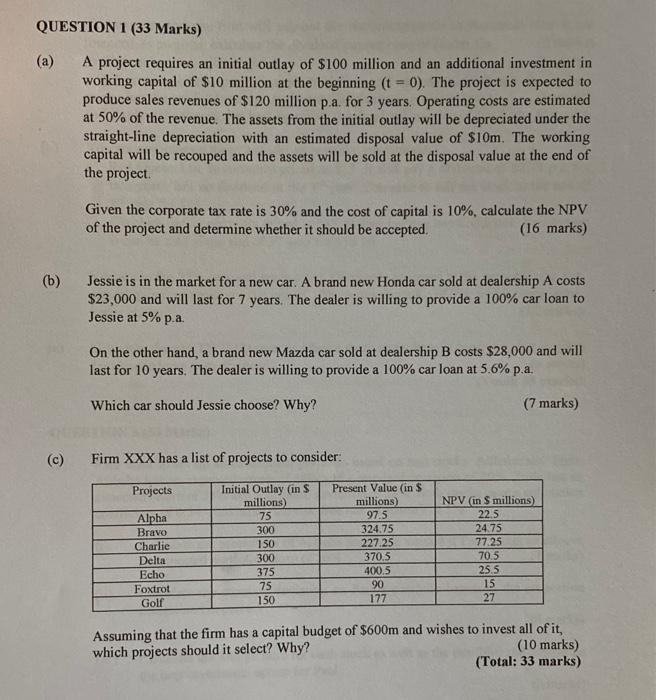

(a) A project requires an initial outlay of $100 million and an additional investment in working capital of $10 million at the beginning (t=0). The project is expected to produce sales revenues of $120 million p.a. for 3 years. Operating costs are estimated at 50% of the revenue. The assets from the initial outlay will be depreciated under the straight-line depreciation with an estimated disposal value of $10m. The working capital will be recouped and the assets will be sold at the disposal value at the end of the project. Given the corporate tax rate is 30% and the cost of capital is 10%, calculate the NPV of the project and determine whether it should be accepted. (16 marks) (b) Jessie is in the market for a new car. A brand new Honda car sold at dealership A costs $23,000 and will last for 7 years. The dealer is willing to provide a 100% car loan to Jessie at 5% p.a. On the other hand, a brand new Mazda car sold at dealership B costs $28,000 and will last for 10 years. The dealer is willing to provide a 100% car loan at 5.6% p.a. Which car should Jessie choose? Why? (7 marks) (c) Firm XXX has a list of projects to consider: Assuming that the firm has a capital budget of $600m and wishes to invest all of it, which projects should it select? Why? (10 marks) (Total: 33 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started