Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all the calculations of tax also. Answer of a PART A: CASE 1 - Married young couple Dan and Judith Murphy are an

Please show all the calculations of tax also.

Answer of a

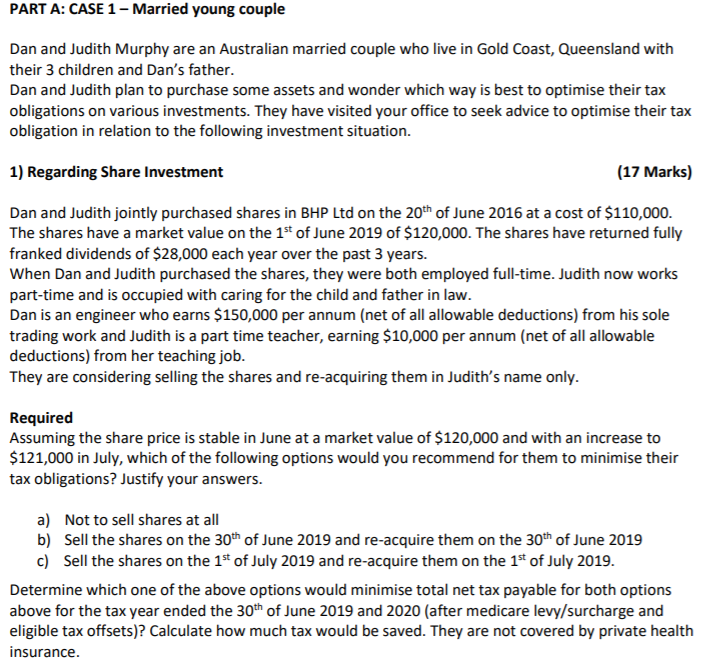

PART A: CASE 1 - Married young couple Dan and Judith Murphy are an Australian married couple who live in Gold Coast, Queensland with their 3 children and Dan's father. Dan and Judith plan to purchase some assets and wonder which way is best to optimise their tax obligations on various investments. They have visited your office to seek advice to optimise their tax obligation in relation to the following investment situation. 1) Regarding Share Investment (17 Marks) Dan and Judith jointly purchased shares in BHP Ltd on the 20th of June 2016 at a cost of $110,000. The shares have a market value on the 1st of June 2019 of $120,000. The shares have returned fully franked dividends of $28,000 each year over the past 3 years. When Dan and Judith purchased the shares, they were both employed full-time. Judith now works part-time and is occupied with caring for the child and father in law. Dan is an engineer who earns $150,000 per annum (net of all allowable deductions) from his sole trading work and Judith is a part time teacher, earning $10,000 per annum (net of all allowable deductions) from her teaching job. They are considering selling the shares and re-acquiring them in Judith's name only. Required Assuming the share price is stable in June at a market value of $120,000 and with an increase to $121,000 in July, which of the following options would you recommend for them to minimise their tax obligations? Justify your answers. a) Not to sell shares at all b) Sell the shares on the 30th of June 2019 and re-acquire them on the 30th of June 2019 c) Sell the shares on the 1st of July 2019 and re-acquire them on the 1st of July 2019. Determine which one of the above options would minimise total net tax payable for both options above for the tax year ended the 30th of June 2019 and 2020 (after medicare levy/surcharge and eligible tax offsets)? Calculate how much tax would be saved. They are not covered by private health insurance. PART A: CASE 1 - Married young couple Dan and Judith Murphy are an Australian married couple who live in Gold Coast, Queensland with their 3 children and Dan's father. Dan and Judith plan to purchase some assets and wonder which way is best to optimise their tax obligations on various investments. They have visited your office to seek advice to optimise their tax obligation in relation to the following investment situation. 1) Regarding Share Investment (17 Marks) Dan and Judith jointly purchased shares in BHP Ltd on the 20th of June 2016 at a cost of $110,000. The shares have a market value on the 1st of June 2019 of $120,000. The shares have returned fully franked dividends of $28,000 each year over the past 3 years. When Dan and Judith purchased the shares, they were both employed full-time. Judith now works part-time and is occupied with caring for the child and father in law. Dan is an engineer who earns $150,000 per annum (net of all allowable deductions) from his sole trading work and Judith is a part time teacher, earning $10,000 per annum (net of all allowable deductions) from her teaching job. They are considering selling the shares and re-acquiring them in Judith's name only. Required Assuming the share price is stable in June at a market value of $120,000 and with an increase to $121,000 in July, which of the following options would you recommend for them to minimise their tax obligations? Justify your answers. a) Not to sell shares at all b) Sell the shares on the 30th of June 2019 and re-acquire them on the 30th of June 2019 c) Sell the shares on the 1st of July 2019 and re-acquire them on the 1st of July 2019. Determine which one of the above options would minimise total net tax payable for both options above for the tax year ended the 30th of June 2019 and 2020 (after medicare levy/surcharge and eligible tax offsets)? Calculate how much tax would be saved. They are not covered by private health insuranceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started