Answered step by step

Verified Expert Solution

Question

1 Approved Answer

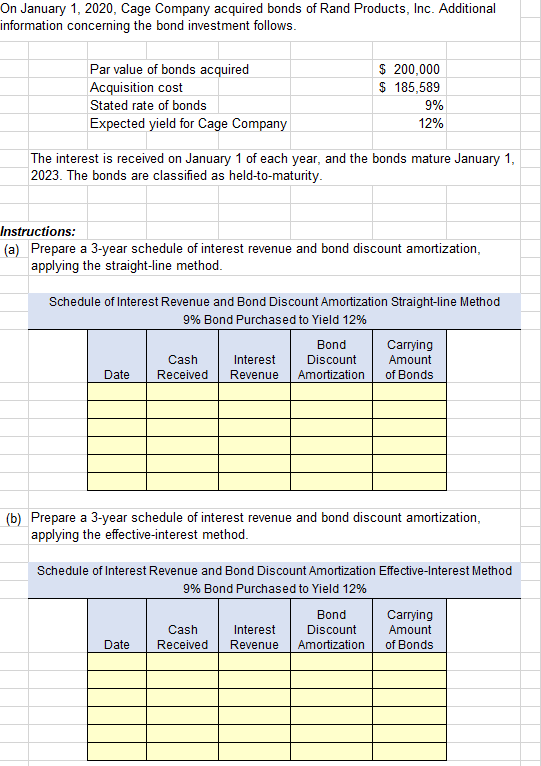

Please show all the related work On January 1, 2020, Cage Company acquired bonds of Rand Products, Inc. Additional information concerning the bond investment follows.

Please show all the related work

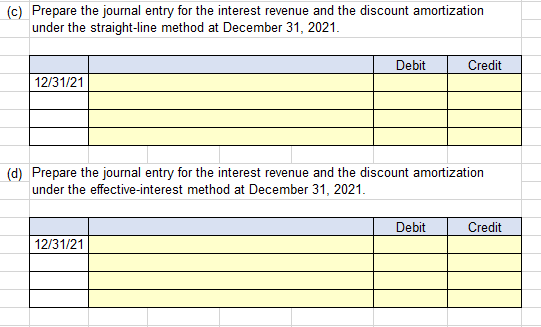

On January 1, 2020, Cage Company acquired bonds of Rand Products, Inc. Additional information concerning the bond investment follows. Par value of bonds acquired Acquisition cost Stated rate of bonds Expected yield for Cage Company $ 200,000 $ 185,589 9% 12% The interest is received on January 1 of each year, and the bonds mature January 1, 2023. The bonds are classified as held-to-maturity. Instructions: (a) Prepare a 3-year schedule of interest revenue and bond discount amortization, applying the straight-line method. Schedule of Interest Revenue and Bond Discount Amortization Straight-line Method 9% Bond Purchased to Yield 12% Bond Carrying Cash Interest Discount Amount Date Received Revenue Amortization of Bonds (6) Prepare a 3-year schedule of interest revenue and bond discount amortization, applying the effective-interest method. Schedule of Interest Revenue and Bond Discount Amortization Effective Interest Method 9% Bond Purchased to Yield 12% Bond Carrying Cash Interest Discount Amount Date Received Revenue Amortization of Bonds (c) Prepare the journal entry for the interest revenue and the discount amortization under the straight-line method at December 31, 2021. Debit Credit 12/31/21 (d) Prepare the journal entry for the interest revenue and the discount amortization under the effective-interest method at December 31, 2021. Debit Credit 12/31/21Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started