Answered step by step

Verified Expert Solution

Question

1 Approved Answer

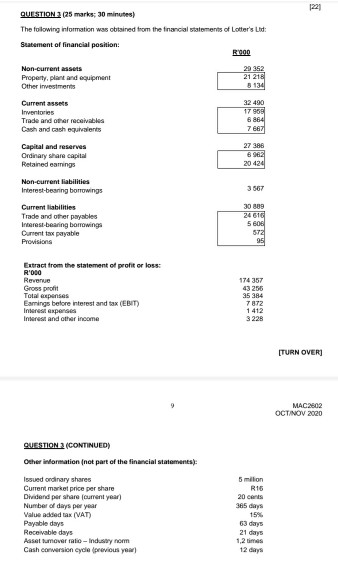

please show all the steps 1221 QUESTION 3 (25 marks: 30 minutes) The following information was obtained from the financial statements of Lotter's Lod: Statement

please show all the steps

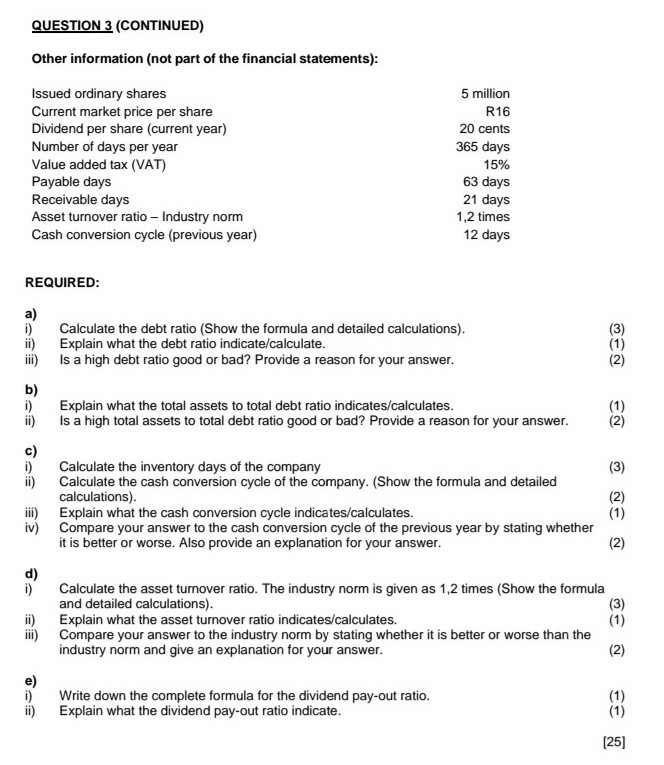

1221 QUESTION 3 (25 marks: 30 minutes) The following information was obtained from the financial statements of Lotter's Lod: Statement of financial position: R900 Non-current assets 29 352 Property, plant and equipment 21 216 Other investments 8134 Current assets 32 490 Inventories 17 965 Trade and other receivables 6864 Cash and cash equivalents 7667 Capital and reserves 27 386 Ordinary share capital B92 Retained earrings 20 424 Non-current liabilities Interest-bearing borrowings 3567 Current liabilities 30 889 Trade and other payables 24616 Interest-bearing borrowing 5606 Current tax payable 572 Provisions 95 Extract from the statement of profit or loss: R'ODO Revenue Gross pront Total expenses Earnings before interest and tax (EBIT) Interesit per Interest and other income 174 357 43 256 35 384 7872 1412 3 228 [TURN OVERI MAC2602 OCT NOV 2020 QUESTION (CONTINUED) Other information (not part of the financial statements: Issued ordinary shares Current market price per share Dividend per share current year) Number of days per year Value added tax (VAT) Payable days Receivable days Asset lumover ratio-industry nem Cash conversion cycle previous year 5 milion R16 20 cents 385 15% 21 days 1,2 times 12 days QUESTION 3 (CONTINUED) Other information (not part of the financial statements): Issued ordinary shares Current market price per share Dividend per share (current year) Number of days per year Value added tax (VAT) Payable days Receivable days Asset turnover ratio - Industry norm Cash conversion cycle (previous year) 5 million R16 20 cents 365 days 15% 63 days 21 days 1,2 times 12 days REQUIRED: ca a) i) Calculate the debt ratio (Show the formula and detailed calculations). ii) Explain what the debt ratio indicate/calculate. iii) is a high debt ratio good or bad? Provide a reason for your answer. b) i) Explain what the total assets to total debt ratio indicates/calculates. (1) ii) Is a high total assets to total debt ratio good or bad? Provide a reason for your answer. (2) c) i) Calculate the inventory days of the company (3) ii) Calculate the cash conversion cycle of the company. (Show the formula and detailed calculations). (2) iii) Explain what the cash conversion cycle indicates/calculates. (1) iv) Compare your answer to the cash conversion cycle of the previous year by stating whether it is better or worse. Also provide an explanation for your answer. (2) d) i) Calculate the asset turnover ratio. The industry norm is given as 1,2 times (Show the formula and detailed calculations). (3) ii) Explain what the asset turnover ratio indicates/calculates. (1) iii) Compare your answer to the industry norm by stating whether it is better or worse than the industry norm and give an explanation for your answer. (2) e) i) ii) Write down the complete formula for the dividend pay-out ratio. Explain what the dividend pay-out ratio indicate. (1) (1) [25]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started