Please show all the steps. Thank you. Need the steps as soon as possible. Provide as much details as you can.

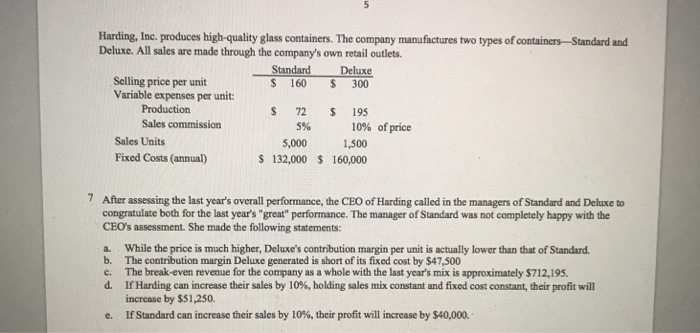

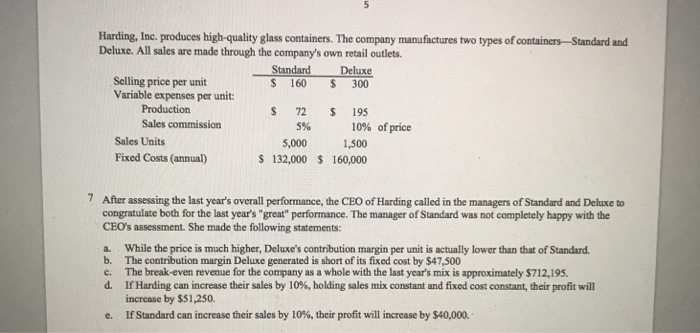

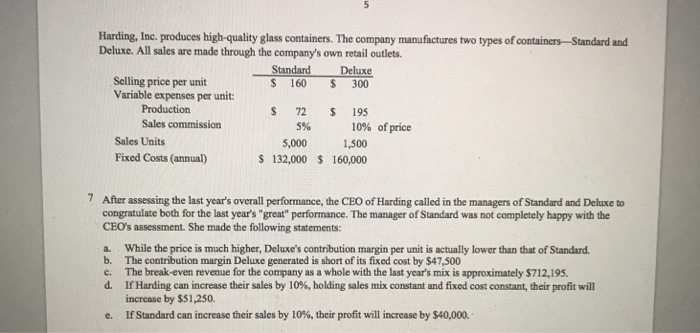

Harding, Inc. produces high-quality glass containers. The company manufactures two types of containers Standard and Deluxe. All sales are made through the company's own retail outlets. Standard Deluxe Selling price per unit Variable expenses per unit: S 160 S 300 S 72 195 5,000 1,500 Sales commission 5% 1096 ofprice Sales Units Fixed Costs (annual) S 132,000 160,000 7 After assessing the last years overall performance, the CEO of Harding called in the managers of Standard and Deluxe to congratulate both for the last year's "great performance. The manager of Standard was not completely happy with the CEO's assessment. She made the following statements a. While the price is much higher, Deluxe's contribution margin per unit is actually lower than that of Standard b. The contribution margin Deluxe generated is short of its fixed cost by $47,500 c. The break-even revenue for the company as a whole with the last year's mix is approximately $712,195 d if Harding can increase their sales by 10%, holding sales mix constant and fixed cost constant, their profit will increase by $51,250. If Standard can increase their sales by 10%, their profit will increase by $40,000. Harding, Inc. produces high-quality glass containers. The company manufactures two types of containers Standard and Deluxe. All sales are made through the company's own retail outlets. Standard Deluxe Selling price per unit Variable expenses per unit: S 160 S 300 S 72 195 5,000 1,500 Sales commission 5% 1096 ofprice Sales Units Fixed Costs (annual) S 132,000 160,000 7 After assessing the last years overall performance, the CEO of Harding called in the managers of Standard and Deluxe to congratulate both for the last year's "great performance. The manager of Standard was not completely happy with the CEO's assessment. She made the following statements a. While the price is much higher, Deluxe's contribution margin per unit is actually lower than that of Standard b. The contribution margin Deluxe generated is short of its fixed cost by $47,500 c. The break-even revenue for the company as a whole with the last year's mix is approximately $712,195 d if Harding can increase their sales by 10%, holding sales mix constant and fixed cost constant, their profit will increase by $51,250. If Standard can increase their sales by 10%, their profit will increase by $40,000