Please show all the work. The correct answer is: 7.0%.

Please show all the work. The correct answer is: 7.0%.

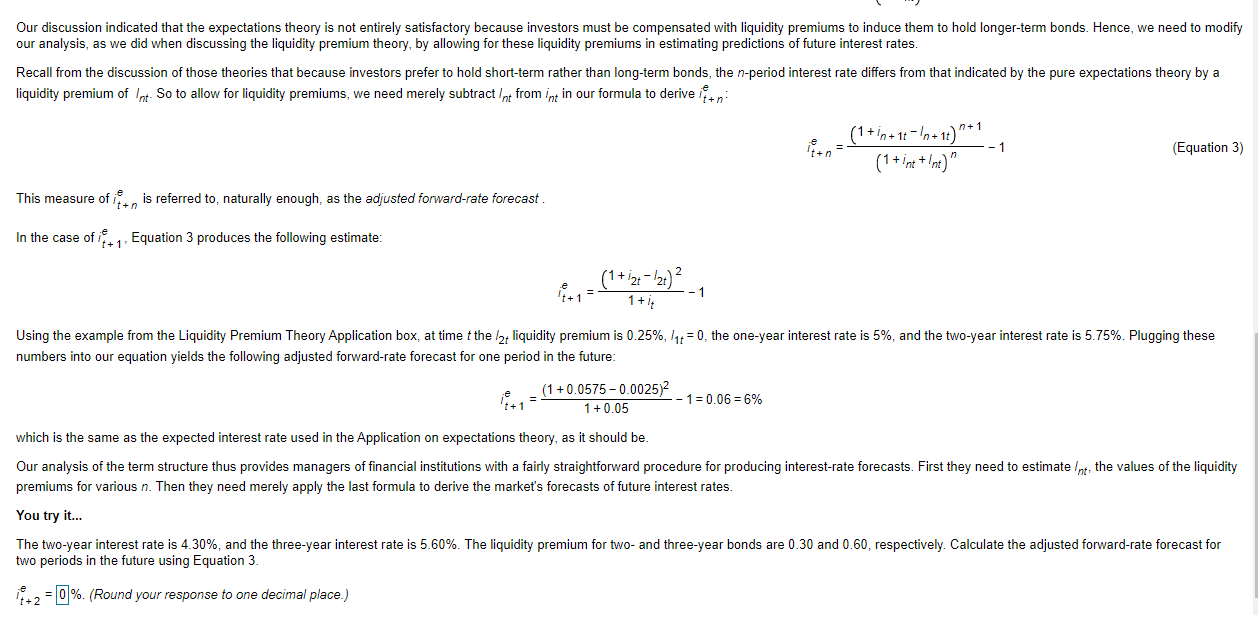

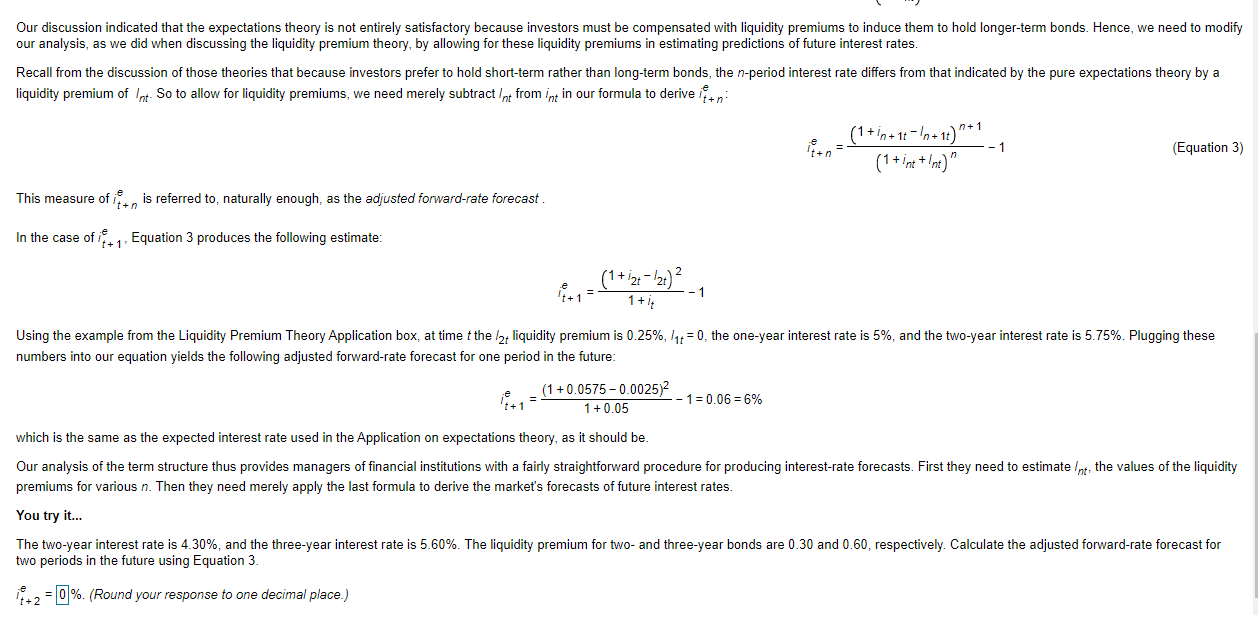

Our discussion indicated that the expectations theory is not entirely satisfactory because investors must be compensated with liquidity premiums to induce them to hold longer-term bonds. Hence, we need to modify our analysis, as we did when discussing the liquidity premium theory, by allowing for these liquidity premiums in estimating predictions of future interest rates. Recall from the discussion of those theories that because investors prefer to hold short-term rather than long-term bonds, the n-period interest rate differs from that indicated by the pure expectations theory by a liquidity premium of Int-So to allow for liquidity premiums, we need merely subtract Int from int in our formula to derive if +n: n+ 1 (1+in+ 14 - In+18) "* (1+ine + Ine)" - 1 (Equation 3) This measure of if +n is referred to, naturally enough, as the adjusted forward-rate forecast. In the case of it, Equation 3 produces the following estimate: (1 + 12 12). + 1 = 1 + it Using the example from the Liquidity Premium Theory Application box, at time t the 12t liquidity premium is 0.25%, 111 = 0, the one-year interest rate is 5%, and the two-year interest rate is 5.75%. Plugging these numbers into our equation yields the following adjusted forward-rate forecast for one period in the future: (1 +0.0575 -0.0025)2 - 1 = 0.06 = 6% 1 +0.05 which is the same as the expected interest rate used in the Application on expectations theory, as it should be Our analysis of the term structure thus provides managers of financial institutions with a fairly straightforward procedure for producing interest-rate forecasts. First they need to estimate Int, the values of the liquidity premiums for various n. Then they need merely apply the last formula to derive the market's forecasts of future interest rates. You try it... The two-year interest rate is 4.30%, and the three-year interest rate is 5.60%. The liquidity premium for two- and three-year bonds are 0.30 and 0.60, respectively. Calculate the adjusted forward-rate forecast for two periods in the future using Equation 3. +2 = 0% (Round your response to one decimal place.) Our discussion indicated that the expectations theory is not entirely satisfactory because investors must be compensated with liquidity premiums to induce them to hold longer-term bonds. Hence, we need to modify our analysis, as we did when discussing the liquidity premium theory, by allowing for these liquidity premiums in estimating predictions of future interest rates. Recall from the discussion of those theories that because investors prefer to hold short-term rather than long-term bonds, the n-period interest rate differs from that indicated by the pure expectations theory by a liquidity premium of Int-So to allow for liquidity premiums, we need merely subtract Int from int in our formula to derive if +n: n+ 1 (1+in+ 14 - In+18) "* (1+ine + Ine)" - 1 (Equation 3) This measure of if +n is referred to, naturally enough, as the adjusted forward-rate forecast. In the case of it, Equation 3 produces the following estimate: (1 + 12 12). + 1 = 1 + it Using the example from the Liquidity Premium Theory Application box, at time t the 12t liquidity premium is 0.25%, 111 = 0, the one-year interest rate is 5%, and the two-year interest rate is 5.75%. Plugging these numbers into our equation yields the following adjusted forward-rate forecast for one period in the future: (1 +0.0575 -0.0025)2 - 1 = 0.06 = 6% 1 +0.05 which is the same as the expected interest rate used in the Application on expectations theory, as it should be Our analysis of the term structure thus provides managers of financial institutions with a fairly straightforward procedure for producing interest-rate forecasts. First they need to estimate Int, the values of the liquidity premiums for various n. Then they need merely apply the last formula to derive the market's forecasts of future interest rates. You try it... The two-year interest rate is 4.30%, and the three-year interest rate is 5.60%. The liquidity premium for two- and three-year bonds are 0.30 and 0.60, respectively. Calculate the adjusted forward-rate forecast for two periods in the future using Equation 3. +2 = 0% (Round your response to one decimal place.)

Please show all the work. The correct answer is: 7.0%.

Please show all the work. The correct answer is: 7.0%.