Answered step by step

Verified Expert Solution

Question

1 Approved Answer

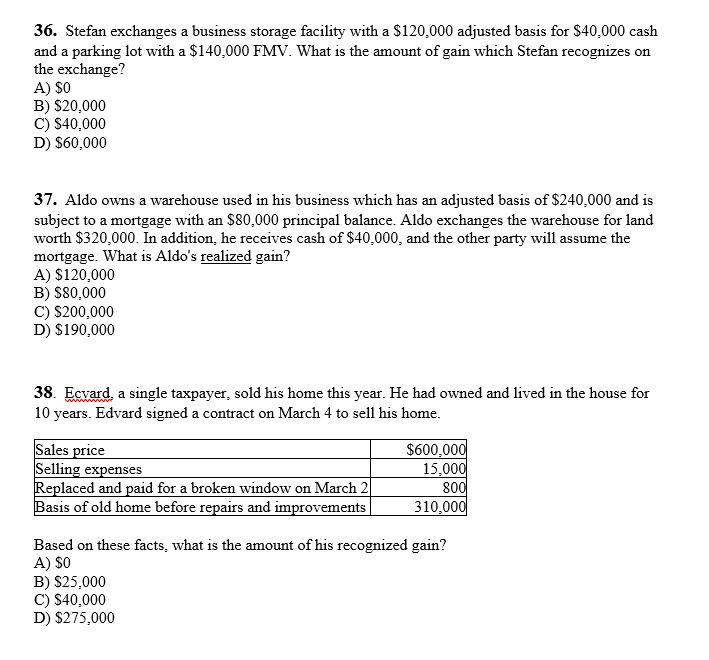

Please show all work 36. Stefan exchanges a business storage facility with a $120.000 adjusted basis for $40.000 cash and a parking lot with a

Please show all work

36. Stefan exchanges a business storage facility with a $120.000 adjusted basis for $40.000 cash and a parking lot with a $140,000 FMV. What is the amount of gain which Stefan recognizes on the exchange? A) SO B) $20,000 C) $40,000 D) $60,000 37. Aldo owns a warehouse used in his business which has an adjusted basis of $240,000 and is subject to a mortgage with an $80,000 principal balance. Aldo exchanges the warehouse for land worth $320,000. In addition, he receives cash of $40,000, and the other party will assume the mortgage. What is Aldo's realized gain? A) $120,000 B) $80,000 C) $200,000 D) $190,000 38. Ecvard, a single taxpayer, sold his home this year. He had owned and lived in the house for 10 years. Edvard signed a contract on March 4 to sell his home. Sales price Selling expenses Replaced and paid for a broken window on March 2 Basis of old home before repairs and improvements $600,000 15,000 800 310,000 Based on these facts, what is the amount of his recognized gain? A) SO B) $25,000 C) $40,000 D) $275,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started