PLEASE SHOW ALL WORK - ADDITIONAL INFO

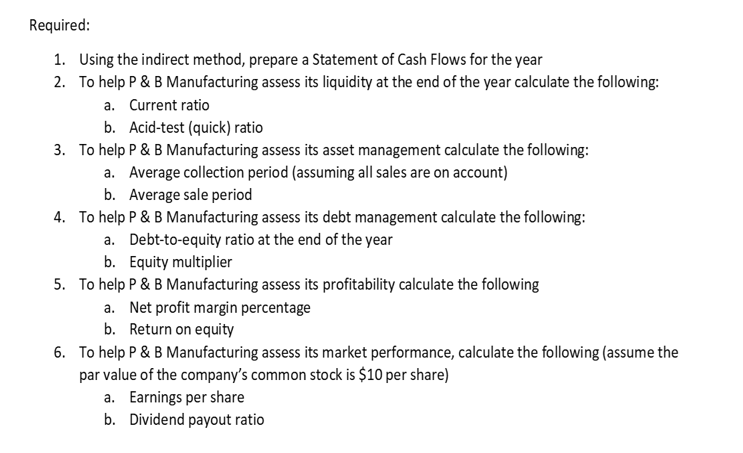

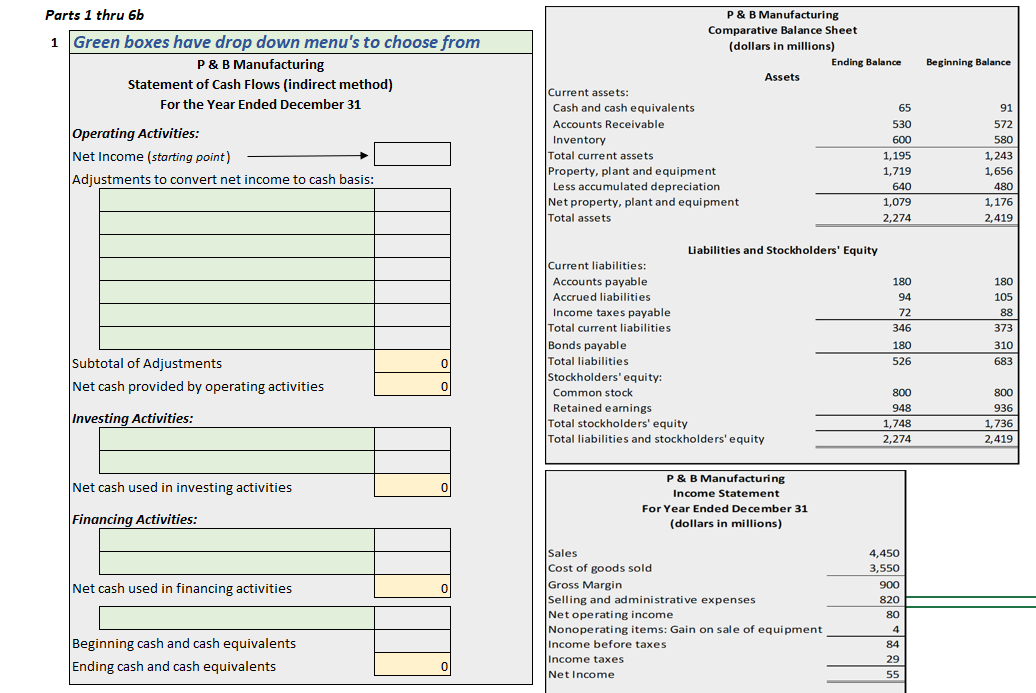

P & B Manufacturing: Requirement #1 (Statement of Cash Flows) the Ending cash and cash equivalents should be $65

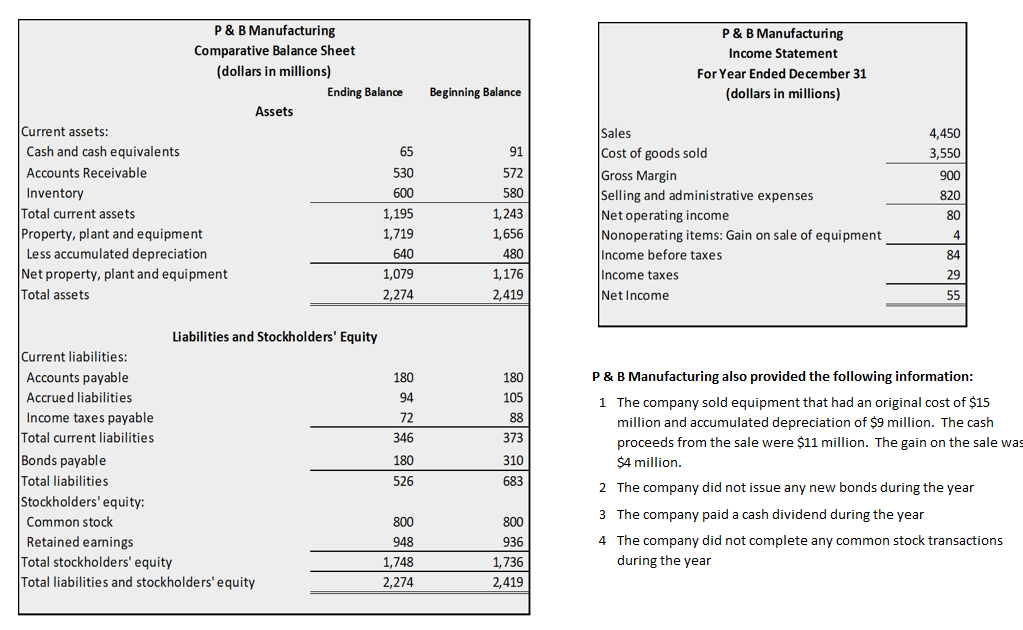

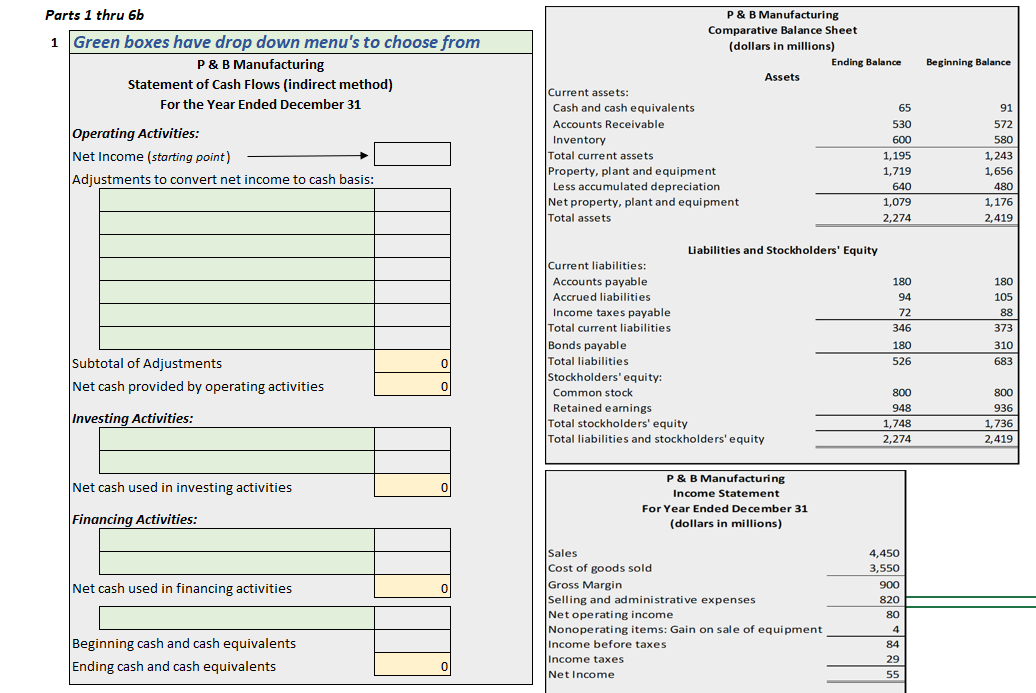

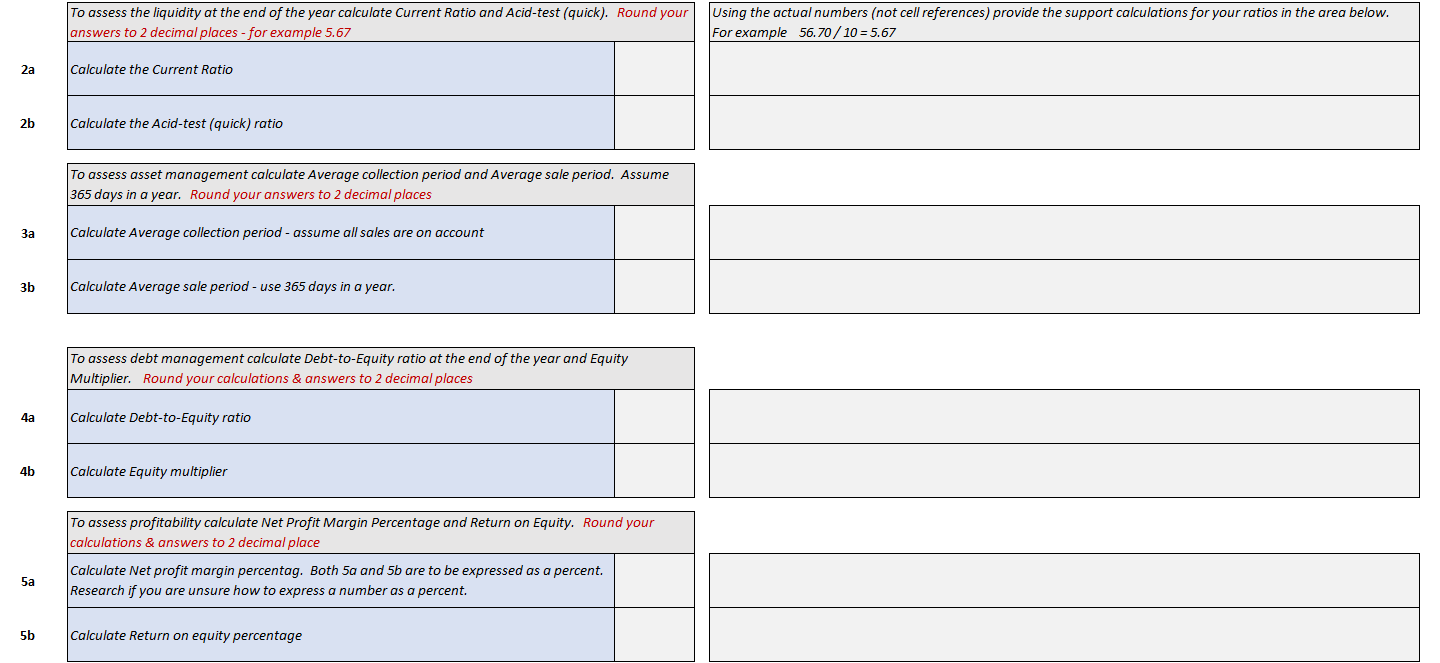

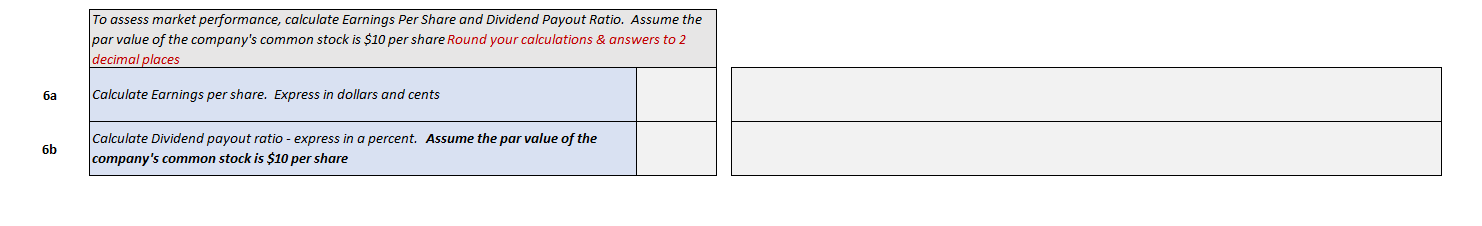

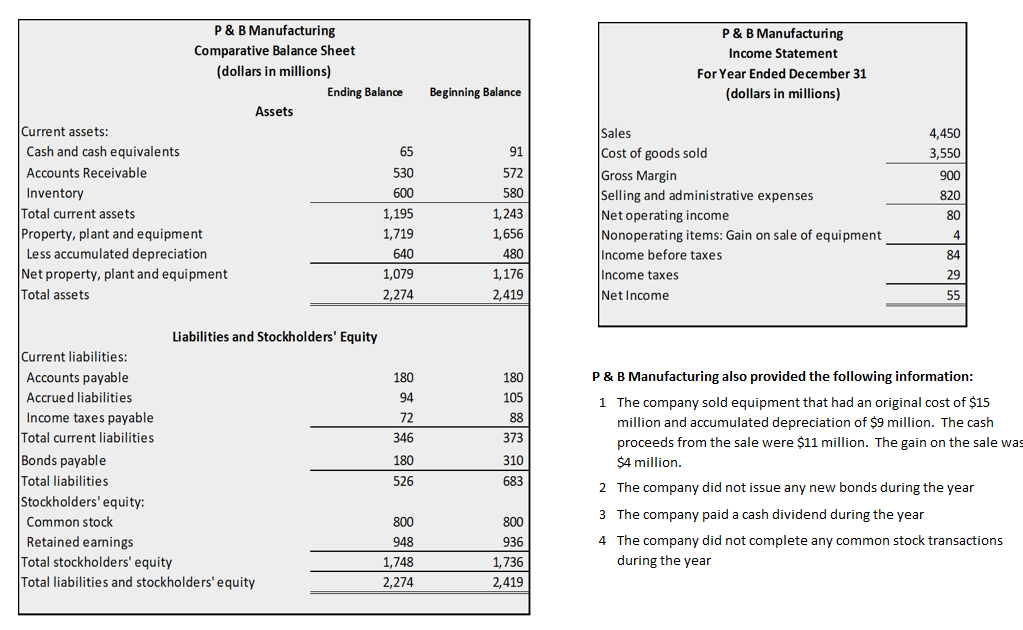

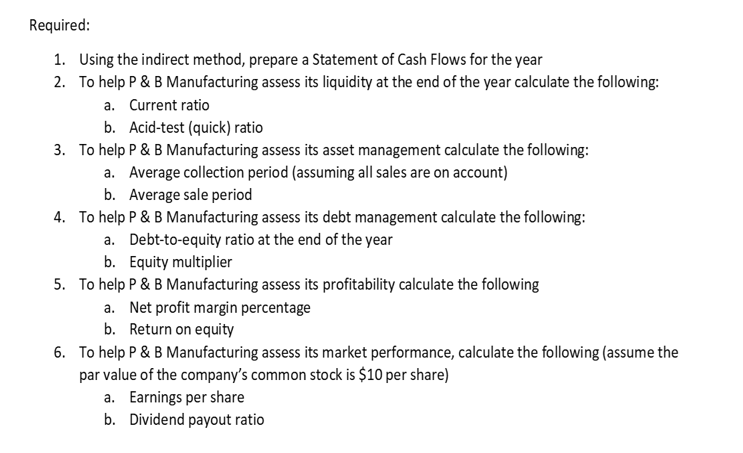

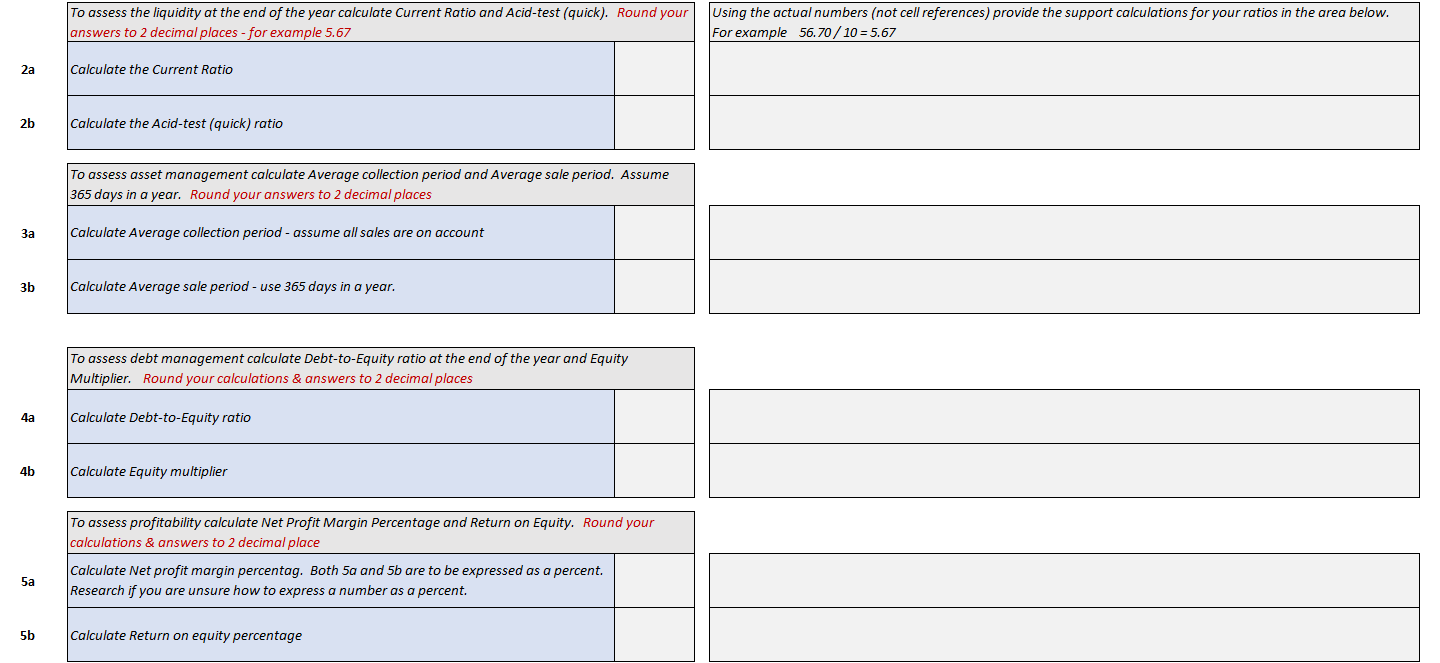

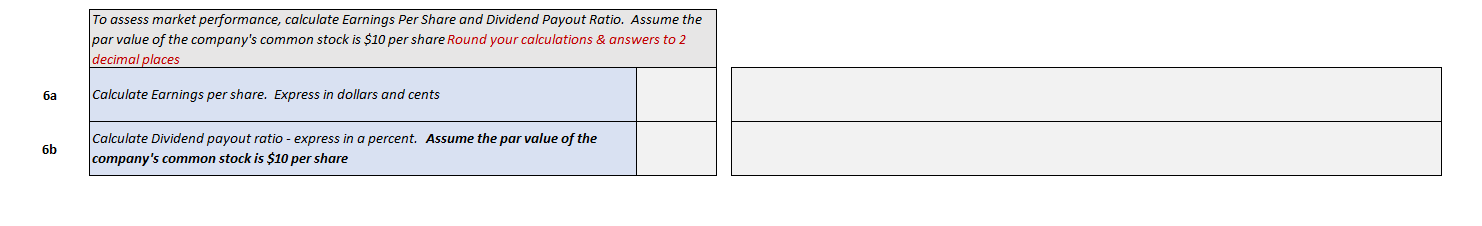

P \& B Manufacturing also provided the following information: 1 The company sold equipment that had an original cost of $15 million and accumulated depreciation of $9 million. The cash proceeds from the sale were $11 million. The gain on the sale was $4 million. 2 The company did not issue any new bonds during the year 3 The company paid a cash dividend during the year 4 The company did not complete any common stock transactions during the year 1. Using the Indirect method, prepare a Statement of Cash Hlows for the year 2. To help P \& B Manufacturing assess its liquidity at the end of the year calculate the following: a. Current ratio b. Acid-test (quick) ratio 3. To help P \& B Manufacturing assess its asset management calculate the following: a. Average collection period (assuming all sales are on account) b. Average sale period 4. To help P \& B Manufacturing assess its debt management calculate the following: a. Debt-to-equity ratio at the end of the year b. Equity multiplier 5. To help P \& B Manufacturing assess its profitability calculate the following a. Net profit margin percentage b. Return on equity 6. To help P \& B Manufacturing assess its market performance, calculate the following (assume the par value of the company's common stock is $10 per share) a. Earnings per share b. Dividend payout ratio P \& B Manufacturing Statement of Cash Flows (indirect method) For the Year Ended December 31 Operating Activities: Net Income (starting point) Adjustments to convert net income to cash basis: Su Invertine Artinitior. Net Net \begin{tabular}{|l|l|l|} \hline ToassesstheliquidityattheendoftheyearcalculateCurrentRatioandAcid-test(quick).Roundyouranswersto2decimalplaces-forexample5.67 \\ \hline \multirow{2a}{2}{2b} & Calculate the Current Ratio & \\ \hline Calculate the Acid-test (quick) ratio & \\ \hline \end{tabular} Using the actual numbers (not cell references) provide the support calculations for your ratios in the area below. For example 56.70/10=5.67 \begin{tabular}{|l|l|} \hline ToassessassetmanagementcalculateAveragecollectionperiodandAveragesaleperiod.Assume365daysinayear.Roundyouranswersto2decimalplaces \\ \hline Calculate Average collection period - assume all sales are on account & \\ \hline Calculate Average sale period - use 365 days in a year. & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \\ \hline \end{tabular} 4a 4b \begin{tabular}{|l|l|} \hline ToassessdebtmanagementcalculateDebt-to-EquityratioattheendoftheyearandEquityMultiplier.Roundyourcalculations&answersto2decimalplaces \\ \hline Calculate Debt-to-Equity ratio & \\ \hline Calculate Equity multiplier & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline 2 \\ \hline 2 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline ToassessprofitabilitycalculateNetProfitMarginPercentageandReturnonEquity.Roundyourcalculations&answersto2decimalplace \\ \hline CalculateNetprofitmarginpercentag.Both5aand5baretobeexpressedasapercent.Researchifyouareunsurehowtoexpressanumberasapercent. & \\ \hline Calculate Return on equity percentage & \\ \hline \end{tabular} P \& B Manufacturing also provided the following information: 1 The company sold equipment that had an original cost of $15 million and accumulated depreciation of $9 million. The cash proceeds from the sale were $11 million. The gain on the sale was $4 million. 2 The company did not issue any new bonds during the year 3 The company paid a cash dividend during the year 4 The company did not complete any common stock transactions during the year 1. Using the Indirect method, prepare a Statement of Cash Hlows for the year 2. To help P \& B Manufacturing assess its liquidity at the end of the year calculate the following: a. Current ratio b. Acid-test (quick) ratio 3. To help P \& B Manufacturing assess its asset management calculate the following: a. Average collection period (assuming all sales are on account) b. Average sale period 4. To help P \& B Manufacturing assess its debt management calculate the following: a. Debt-to-equity ratio at the end of the year b. Equity multiplier 5. To help P \& B Manufacturing assess its profitability calculate the following a. Net profit margin percentage b. Return on equity 6. To help P \& B Manufacturing assess its market performance, calculate the following (assume the par value of the company's common stock is $10 per share) a. Earnings per share b. Dividend payout ratio P \& B Manufacturing Statement of Cash Flows (indirect method) For the Year Ended December 31 Operating Activities: Net Income (starting point) Adjustments to convert net income to cash basis: Su Invertine Artinitior. Net Net \begin{tabular}{|l|l|l|} \hline ToassesstheliquidityattheendoftheyearcalculateCurrentRatioandAcid-test(quick).Roundyouranswersto2decimalplaces-forexample5.67 \\ \hline \multirow{2a}{2}{2b} & Calculate the Current Ratio & \\ \hline Calculate the Acid-test (quick) ratio & \\ \hline \end{tabular} Using the actual numbers (not cell references) provide the support calculations for your ratios in the area below. For example 56.70/10=5.67 \begin{tabular}{|l|l|} \hline ToassessassetmanagementcalculateAveragecollectionperiodandAveragesaleperiod.Assume365daysinayear.Roundyouranswersto2decimalplaces \\ \hline Calculate Average collection period - assume all sales are on account & \\ \hline Calculate Average sale period - use 365 days in a year. & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \\ \hline \end{tabular} 4a 4b \begin{tabular}{|l|l|} \hline ToassessdebtmanagementcalculateDebt-to-EquityratioattheendoftheyearandEquityMultiplier.Roundyourcalculations&answersto2decimalplaces \\ \hline Calculate Debt-to-Equity ratio & \\ \hline Calculate Equity multiplier & \\ \hline \end{tabular} \begin{tabular}{|l|} \hline 2 \\ \hline 2 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline ToassessprofitabilitycalculateNetProfitMarginPercentageandReturnonEquity.Roundyourcalculations&answersto2decimalplace \\ \hline CalculateNetprofitmarginpercentag.Both5aand5baretobeexpressedasapercent.Researchifyouareunsurehowtoexpressanumberasapercent. & \\ \hline Calculate Return on equity percentage & \\ \hline \end{tabular}