Answered step by step

Verified Expert Solution

Question

1 Approved Answer

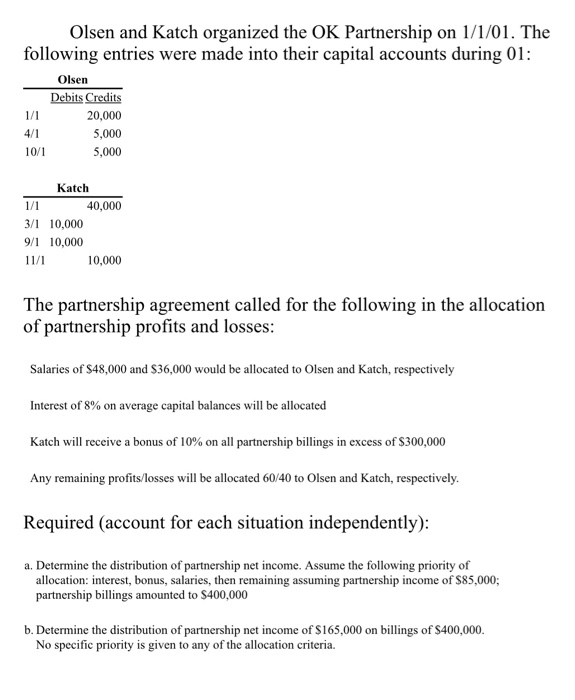

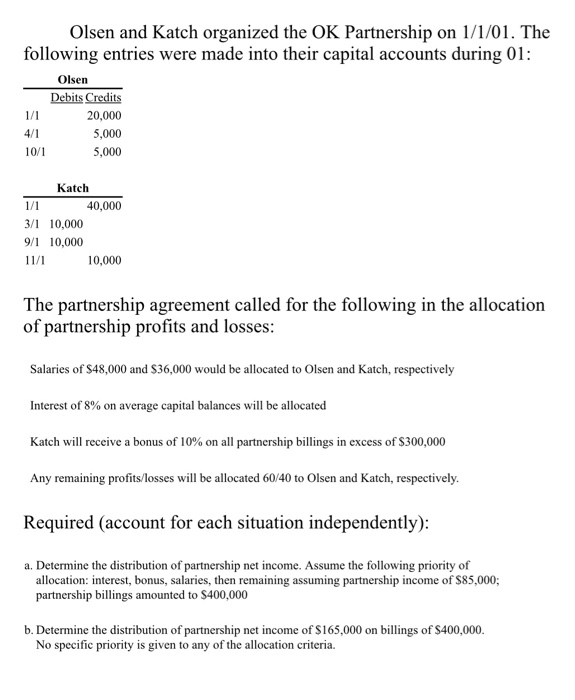

Please show all work and calculations. Olsen and Katch organized the OK Partnership on 1/1/01. The following entries were made into their capital accounts during

Please show all work and calculations.

Olsen and Katch organized the OK Partnership on 1/1/01. The following entries were made into their capital accounts during 01: Olsen Debits Credits 20,000 5,000 5,000 10/1 Katch 40,000 / 10,000 9/1 10,000 10,000 The partnership agreement called for the following in the allocation of partnership profits and losses Salaries of S48,000 and S36,000 would be allocated to Olsen and Katch, respectively Interest of 8% on average capital balances will be allocated Katch will receive a bonus of 10% on all partnership billings in excess of $300,000 Any remaining profits/losses will be allocated 60/40 to Olsen and Katch, respectively. Required (account for each situation independently): a. Determine the distribution of partnership net income. Assume the following priority of allocation: interest, bonus, salaries, then remaining assuming partnership income of $85,000; partnership blings amounted to $400,000 b. Determine the distribution of partnership net income of $165,000 on billings of $400,000. No specific priority is given to any of the allocation criteria

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started