please show all work and formuals used !!

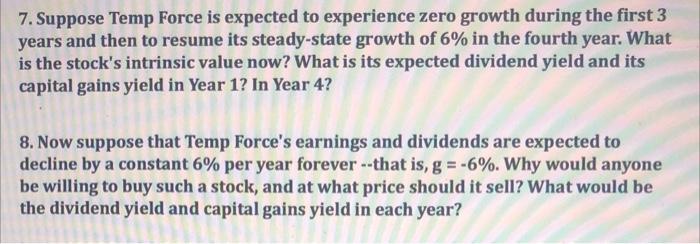

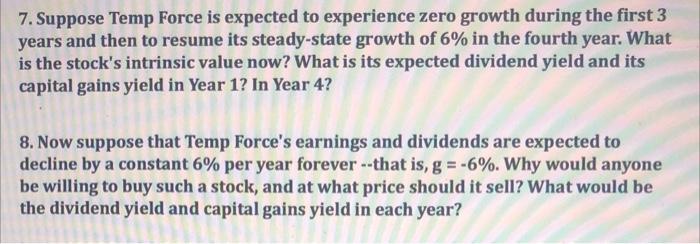

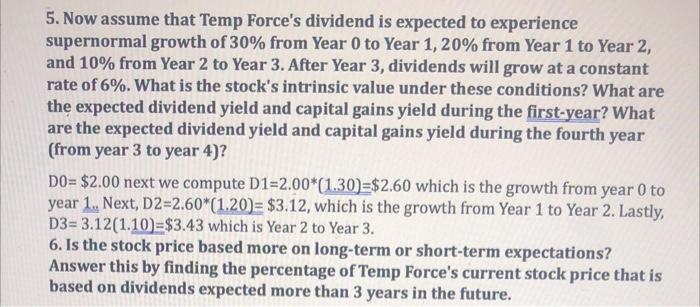

7. Suppose Temp Force is expected to experience zero growth during the first 3 years and then to resume its steady-state growth of 6% in the fourth year. What is the stock's intrinsic value now? What is its expected dividend yield and its capital gains yield in Year 1? In Year 4? 8. Now suppose that Temp Force's earnings and dividends are expected to decline by a constant 6% per year forever --that is, g = -6%. Why would anyone be willing to buy such a stock, and at what price should it sell? What would be the dividend yield and capital gains yield in each year? 5. Now assume that Temp Force's dividend is expected to experience supernormal growth of 30% from Year 0 to Year 1, 20% from Year 1 to Year 2, and 10% from Year 2 to Year 3. After Year 3, dividends will grow at a constant rate of 6%. What is the stock's intrinsic value under these conditions? What are the expected dividend yield and capital gains yield during the first-year? What are the expected dividend yield and capital gains yield during the fourth year (from year 3 to year 4)? DO= $2.00 next we compute D1=2.00*(1.30=$2.60 which is the growth from year 0 to year 1.. Next, D2=2.60*(1.20= $3.12, which is the growth from Year 1 to Year 2. Lastly, D3= 3.12(1.10) =$3.43 which is Year 2 to Year 3. 6. Is the stock price based more on long-term or short-term expectations? Answer this by finding the percentage of Temp Force's current stock price that is based on dividends expected more than 3 years in the future. 7. Suppose Temp Force is expected to experience zero growth during the first 3 years and then to resume its steady-state growth of 6% in the fourth year. What is the stock's intrinsic value now? What is its expected dividend yield and its capital gains yield in Year 1? In Year 4? 8. Now suppose that Temp Force's earnings and dividends are expected to decline by a constant 6% per year forever --that is, g = -6%. Why would anyone be willing to buy such a stock, and at what price should it sell? What would be the dividend yield and capital gains yield in each year? 5. Now assume that Temp Force's dividend is expected to experience supernormal growth of 30% from Year 0 to Year 1, 20% from Year 1 to Year 2, and 10% from Year 2 to Year 3. After Year 3, dividends will grow at a constant rate of 6%. What is the stock's intrinsic value under these conditions? What are the expected dividend yield and capital gains yield during the first-year? What are the expected dividend yield and capital gains yield during the fourth year (from year 3 to year 4)? DO= $2.00 next we compute D1=2.00*(1.30=$2.60 which is the growth from year 0 to year 1.. Next, D2=2.60*(1.20= $3.12, which is the growth from Year 1 to Year 2. Lastly, D3= 3.12(1.10) =$3.43 which is Year 2 to Year 3. 6. Is the stock price based more on long-term or short-term expectations? Answer this by finding the percentage of Temp Force's current stock price that is based on dividends expected more than 3 years in the future