Please show all work and formulas!

Answer both questions please!

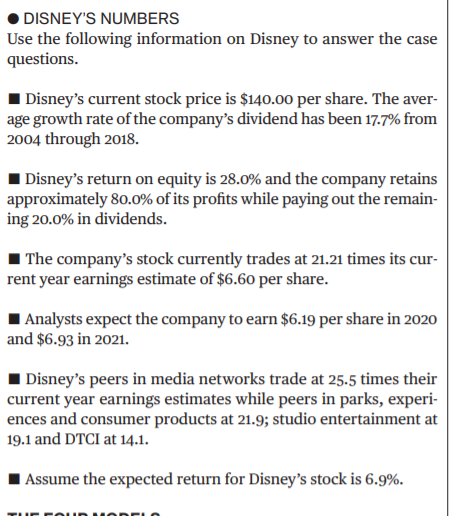

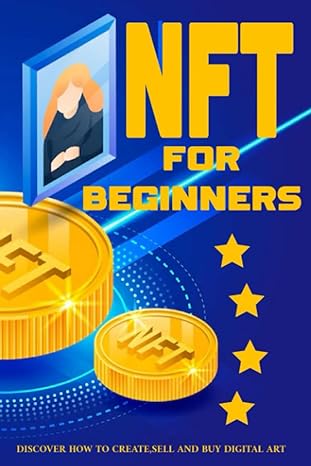

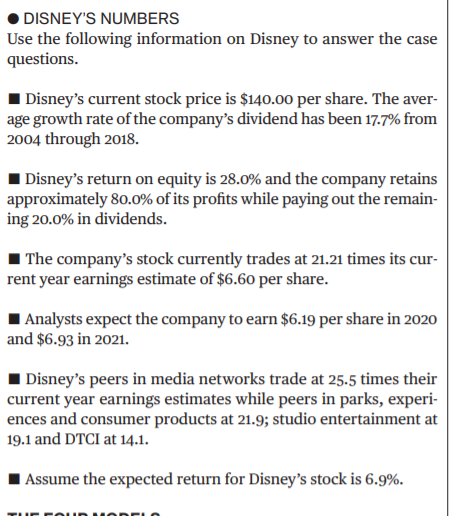

DISNEY'S NUMBERS Use the following information on Disney to answer the case questions. Disney's current stock price is $140.00 per share. The aver- age growth rate of the company's dividend has been 17.7% from 2004 through 2018. Disney's return on equity is 28.0% and the company retains approximately 80.0% of its profits while paying out the remain- ing 20.0% in dividends. The company's stock currently trades at 21.21 times its cur- rent year earnings estimate of $6.60 per share. Analysts expect the company to earn $6.19 per share in 2020 and $6.93 in 2021. Disney's peers in media networks trade at 25.5 times their current year earnings estimates while peers in parks, experi- ences and consumer products at 21.9; studio entertainment at 19.1 and DTCI at 14.1. Assume the expected return for Disney's stock is 6.9%. What is Disney stock's intrinsic value using each of the four models? O Constant Growth Model O O Multi-Stage Growth Model O Discounted Dividend Model O Market Multiples Approach Reconcile Disney stocks intrinsic value, considering the strengths and weaknesses of each valuation approach. DISNEY'S NUMBERS Use the following information on Disney to answer the case questions. Disney's current stock price is $140.00 per share. The aver- age growth rate of the company's dividend has been 17.7% from 2004 through 2018. Disney's return on equity is 28.0% and the company retains approximately 80.0% of its profits while paying out the remain- ing 20.0% in dividends. The company's stock currently trades at 21.21 times its cur- rent year earnings estimate of $6.60 per share. Analysts expect the company to earn $6.19 per share in 2020 and $6.93 in 2021. Disney's peers in media networks trade at 25.5 times their current year earnings estimates while peers in parks, experi- ences and consumer products at 21.9; studio entertainment at 19.1 and DTCI at 14.1. Assume the expected return for Disney's stock is 6.9%. What is Disney stock's intrinsic value using each of the four models? O Constant Growth Model O O Multi-Stage Growth Model O Discounted Dividend Model O Market Multiples Approach Reconcile Disney stocks intrinsic value, considering the strengths and weaknesses of each valuation approach