Answered step by step

Verified Expert Solution

Question

1 Approved Answer

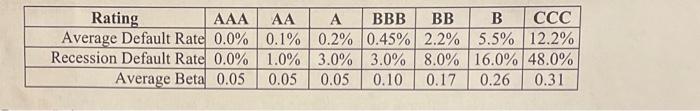

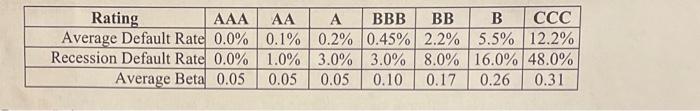

please show all work and formulas Rating A B Average Default Rate 0.0% 0.1% 0.2% 0.45%) 2.2% | 5.5% | 12.2% Recession Default Rate 0.0%

please show all work and formulas

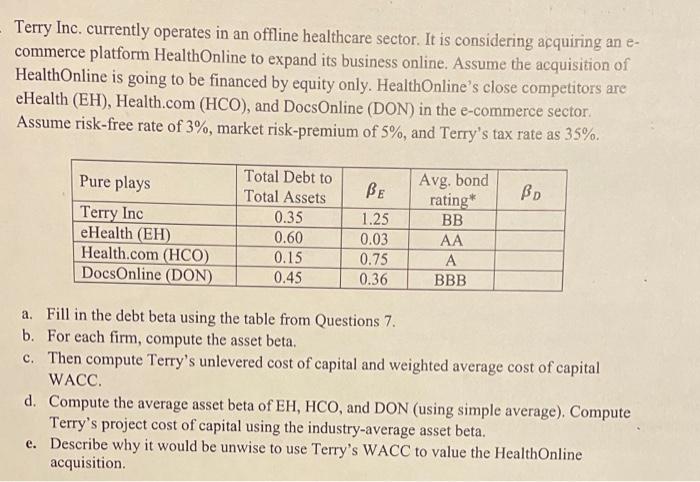

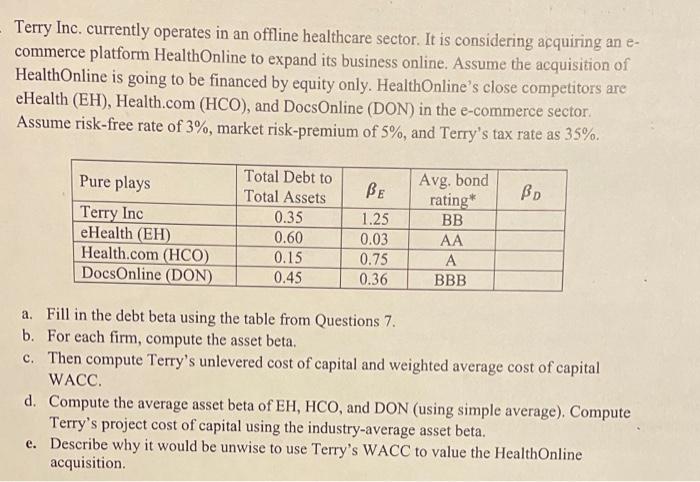

Rating A B Average Default Rate 0.0% 0.1% 0.2% 0.45%) 2.2% | 5.5% | 12.2% Recession Default Rate 0.0% 1.0% | 3.0% | 3.0% 80% | 16.0% | 48.0% Average Beta 0.05 0.05 0.05 0.10 0.17 0.26 0.31 - Terry Inc. currently operates in an offline healthcare sector. It is considering acquiring an e- commerce platform HealthOnline to expand its business online. Assume the acquisition of HealthOnline is going to be financed by equity only. HealthOnline's close competitors are eHealth (EH), Health.com (HCO), and DocsOnline (DON) in the e-commerce sector. Assume risk-free rate of 3%, market risk-premium of 5%, and Terry's tax rate as 35%. Pure plays BD Terry Inc eHealth (EH) Health.com (HCO) DocsOnline (DON) Total Debt to Total Assets 0.35 0.60 0.15 0.45 BE 1.25 0.03 0.75 0.36 Avg. bond rating* BB A BBB a. Fill in the debt beta using the table from Questions 7. b. For each firm, compute the asset beta. c. Then compute Terry's unlevered cost of capital and weighted average cost of capital WACC. d. Compute the average asset beta of EH, HCO, and DON (using simple average). Compute Terry's project cost of capital using the industry-average asset beta. e. Describe why it would be unwise to use Terry's WACC to value the HealthOnline acquisition Rating A B Average Default Rate 0.0% 0.1% 0.2% 0.45%) 2.2% | 5.5% | 12.2% Recession Default Rate 0.0% 1.0% | 3.0% | 3.0% 80% | 16.0% | 48.0% Average Beta 0.05 0.05 0.05 0.10 0.17 0.26 0.31 - Terry Inc. currently operates in an offline healthcare sector. It is considering acquiring an e- commerce platform HealthOnline to expand its business online. Assume the acquisition of HealthOnline is going to be financed by equity only. HealthOnline's close competitors are eHealth (EH), Health.com (HCO), and DocsOnline (DON) in the e-commerce sector. Assume risk-free rate of 3%, market risk-premium of 5%, and Terry's tax rate as 35%. Pure plays BD Terry Inc eHealth (EH) Health.com (HCO) DocsOnline (DON) Total Debt to Total Assets 0.35 0.60 0.15 0.45 BE 1.25 0.03 0.75 0.36 Avg. bond rating* BB A BBB a. Fill in the debt beta using the table from Questions 7. b. For each firm, compute the asset beta. c. Then compute Terry's unlevered cost of capital and weighted average cost of capital WACC. d. Compute the average asset beta of EH, HCO, and DON (using simple average). Compute Terry's project cost of capital using the industry-average asset beta. e. Describe why it would be unwise to use Terry's WACC to value the HealthOnline acquisition

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started