please show all work and formulas used

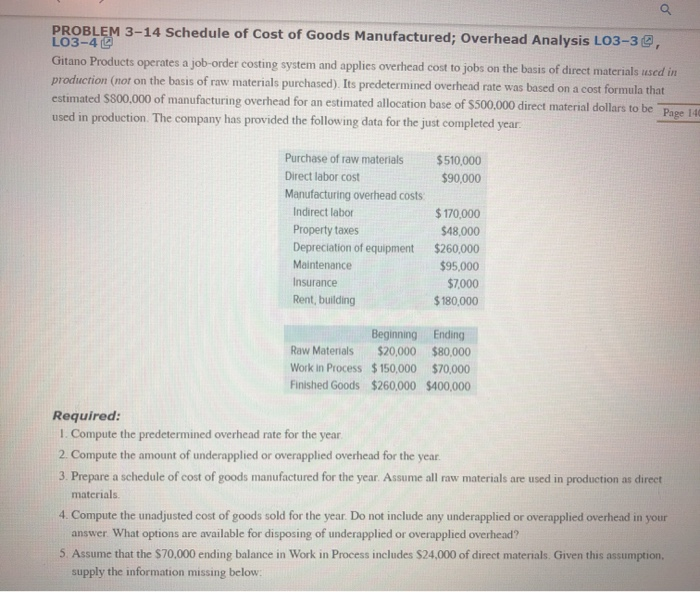

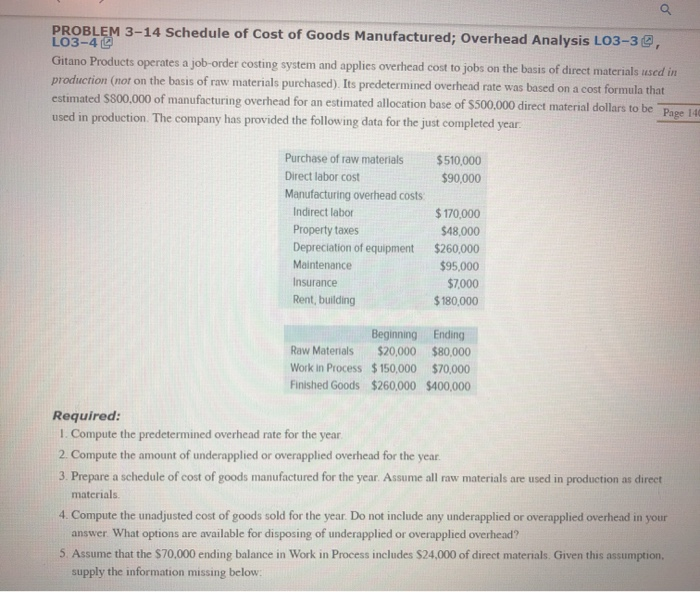

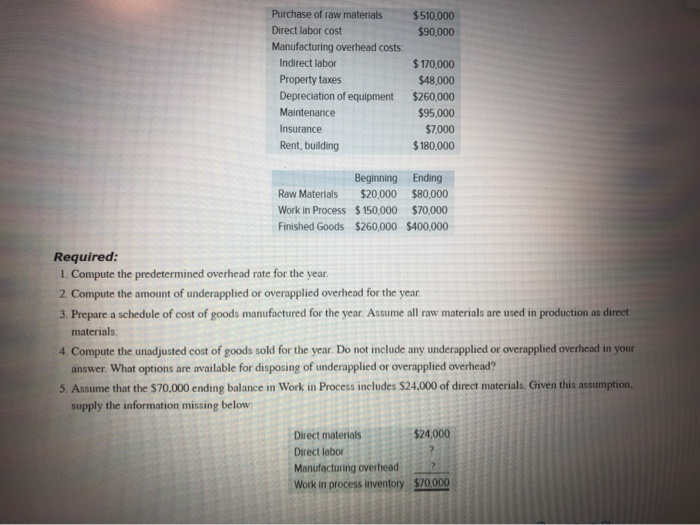

PROBLEM 3-14 Schedule of Cost of Goods Manufactured; Overhead Analysis LO3-3, LO3-4 Gitano Products operates a job-order costing system and applies overhead cost to jobs on the basis of direct materials used in production (not on the basis of raw materials purchased). Its predetermined overhead rate was based on a cost formula that estimated $800,000 of manufacturing overhead for an estimated allocation base of $500,000 direct material dollars to be Page 14 used in production. The company has provided the following data for the just completed year. $510,000 $90,000 Purchase of raw materials Direct labor cost Manufacturing overhead costs: Indirect labor Property taxes Depreciation of equipment Maintenance Insurance Rent, building $ 170,000 $48,000 $260,000 $95,000 $7,000 $ 180,000 Beginning Ending Raw Materials $20,000 $80,000 Work in Process $ 150,000 $70,000 Finished Goods $260,000 $400,000 Required: 1. Compute the predetermined overhead rate for the year 2. Compute the amount of underapplied or overapplied overhead for the year. 3. Prepare a schedule of cost of goods manufactured for the year. Assume all raw materials are used in production as direct materials 4. Compute the unadjusted cost of goods sold for the year. Do not include any underapplied or overapplied overhead in your answer. What options are available for disposing of underapplied or overapplied overhead? 5. Assume that the $70,000 ending balance in Work in Process includes $24,000 of direct materials. Given this assumption. supply the information missing below: $510,000 $90,000 Purchase of raw materials Direct labor cost Manufacturing overhead costs Indirect labor Property taxes Depreciation of equipment Maintenance Insurance Rent, building $ 170,000 $48,000 $260,000 $95,000 $7,000 $180,000 Beginning Ending Raw Materials $20,000 $80,000 Work in Process $ 150,000 $70,000 Finished Goods $260,000 $400,000 Required: 1. Compute the predetermined overhead rate for the year. 2. Compute the amount of underapplied or overapplied overhead for the year 3. Prepare a schedule of cost of goods manufactured for the year. Assume all raw materials are used in production as direct materials 4. Compute the unadjusted cost of goods sold for the year. Do not include any underapplied or overapplied overhead in your answer. What options are available for disposing of underapplied or overapplied overhead? 5. Assume that the 570.000 ending balance in Work in Process includes $24,000 of direct materials. Given this assumption supply the information missing below $24,000 Direct materials Direct labor Manufacturing overhead Work in process inventory $70,000