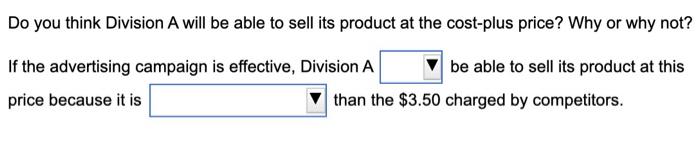

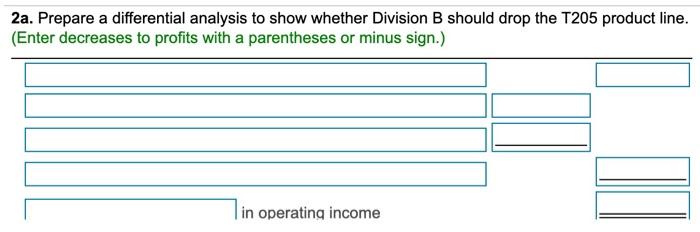

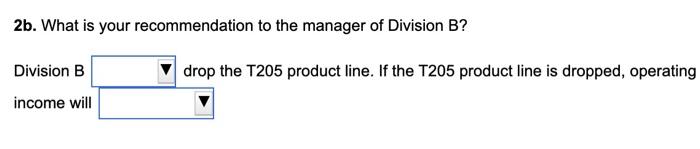

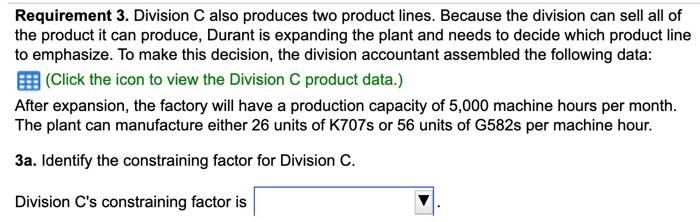

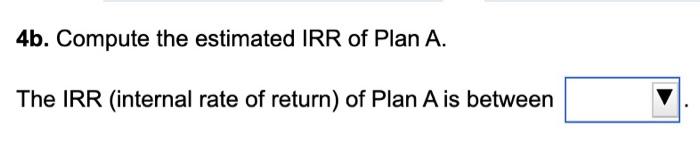

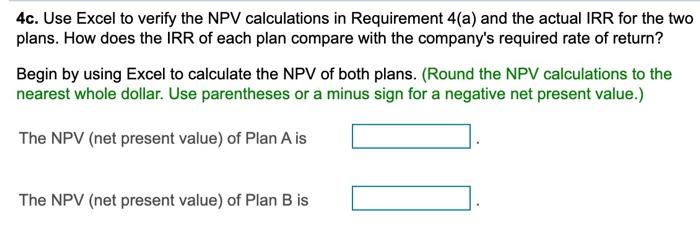

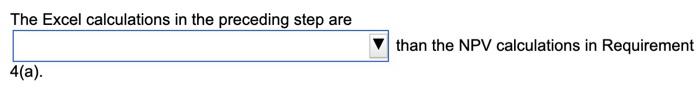

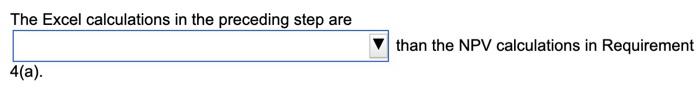

PLEASE SHOW ALL WORK AND MARK ANSWERS CLEARLY THANK YOU

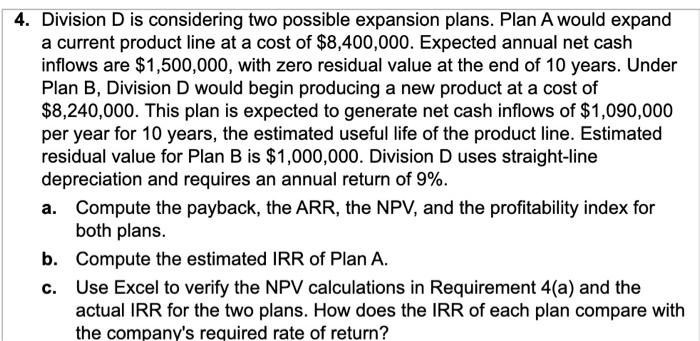

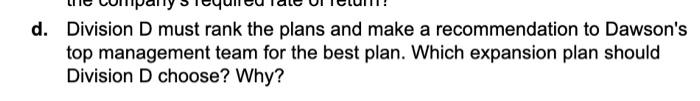

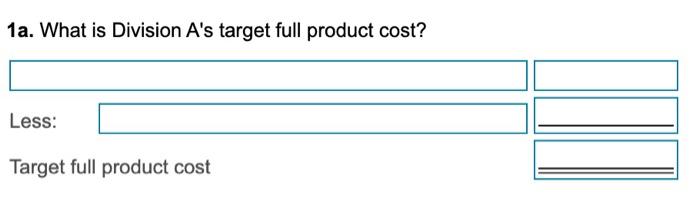

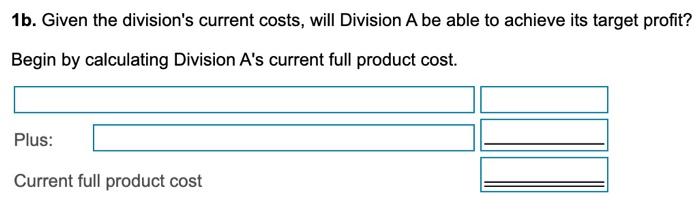

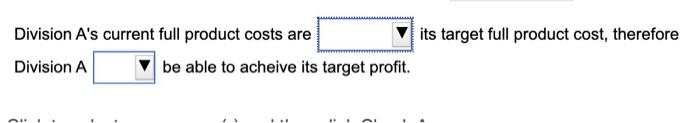

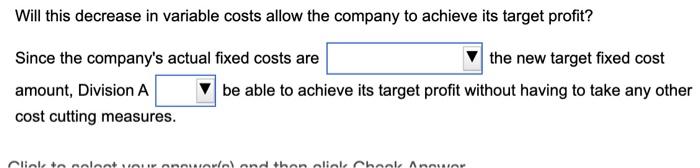

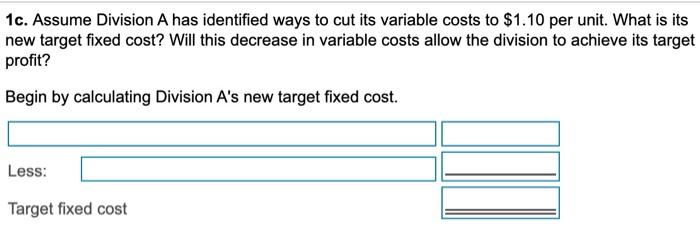

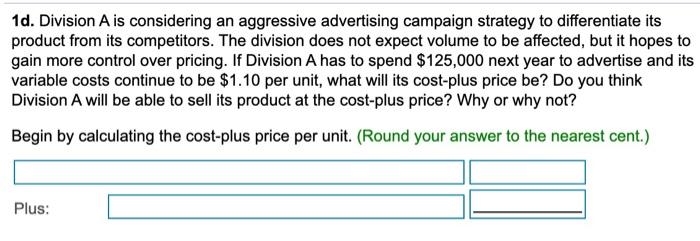

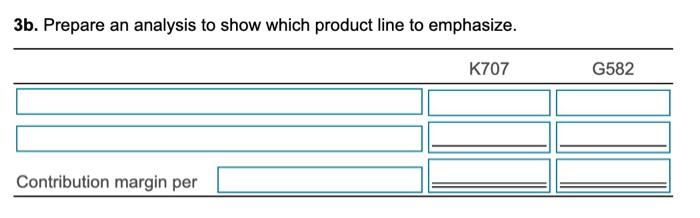

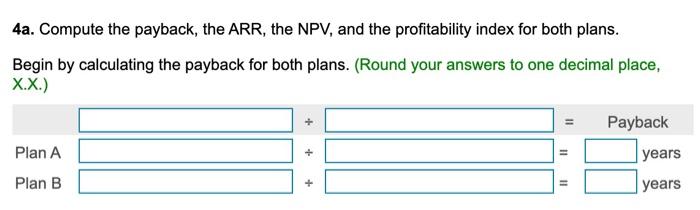

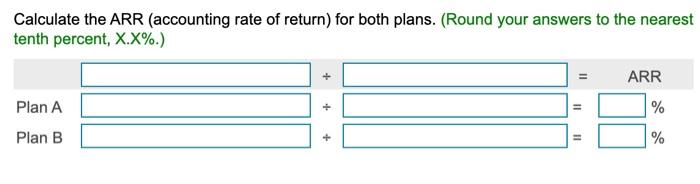

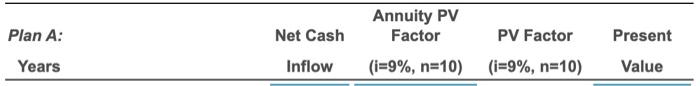

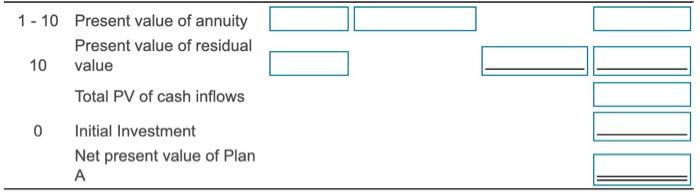

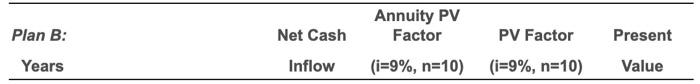

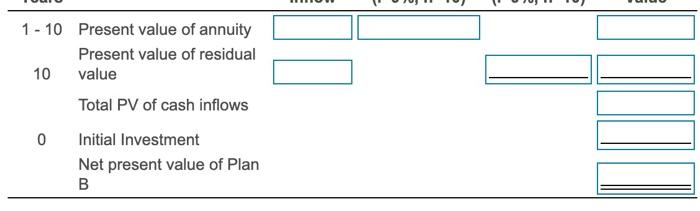

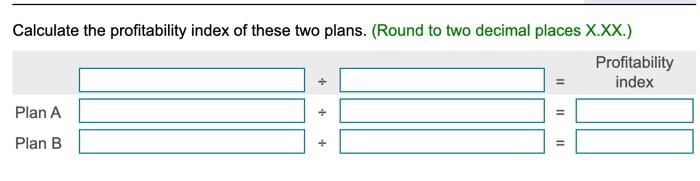

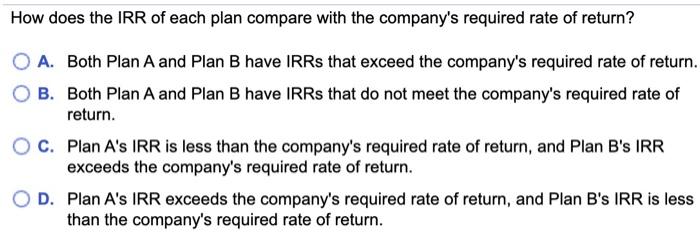

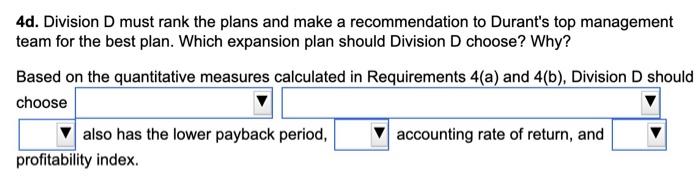

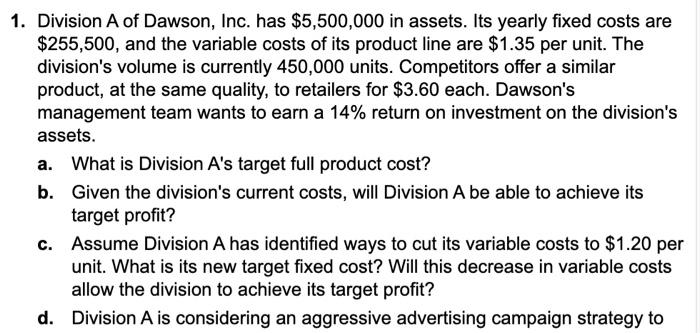

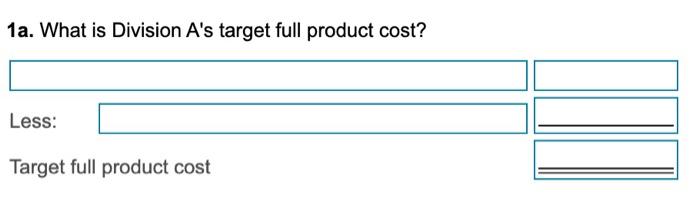

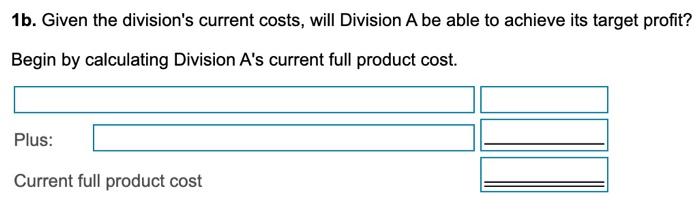

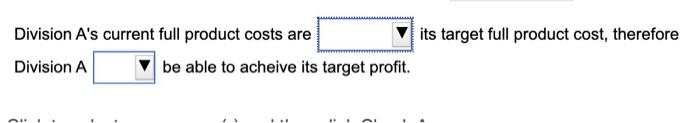

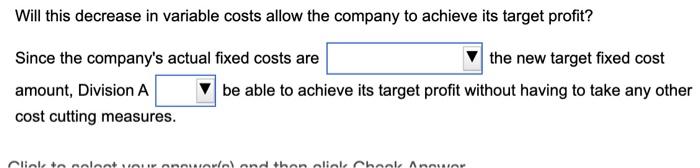

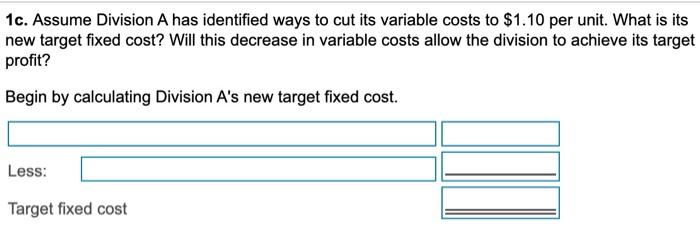

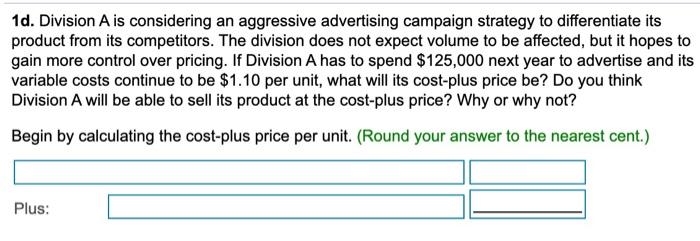

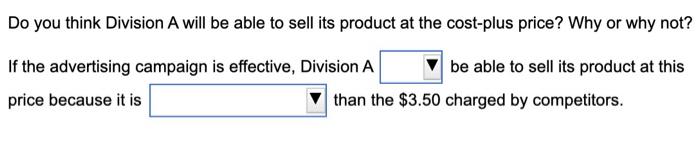

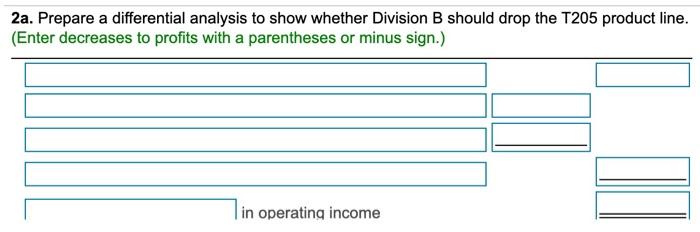

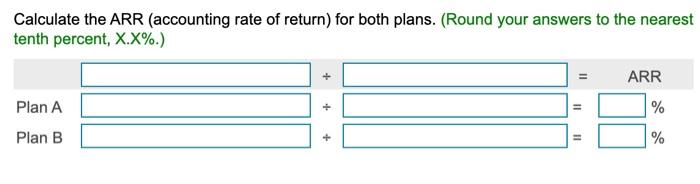

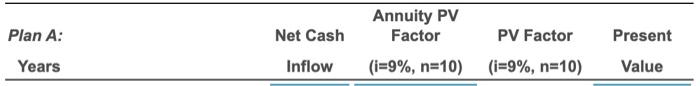

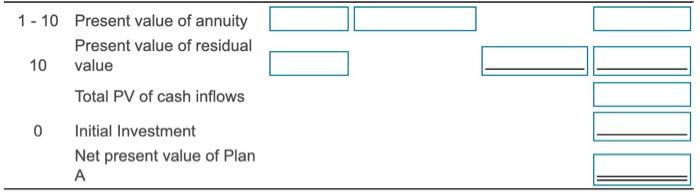

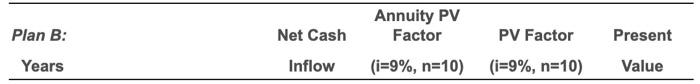

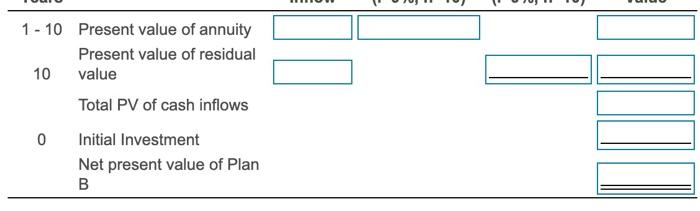

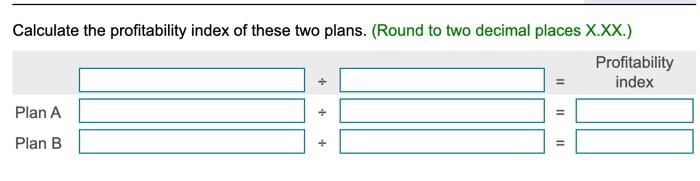

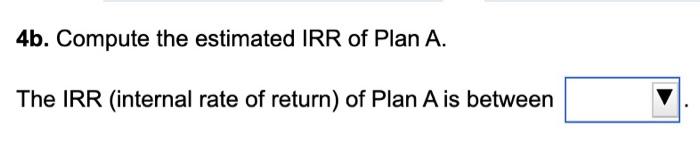

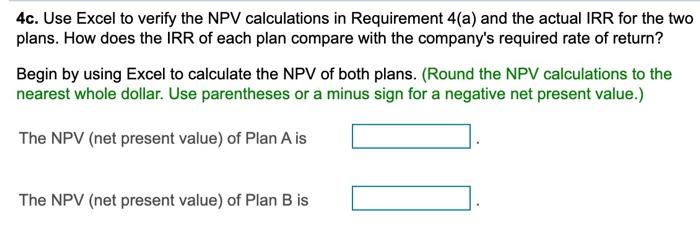

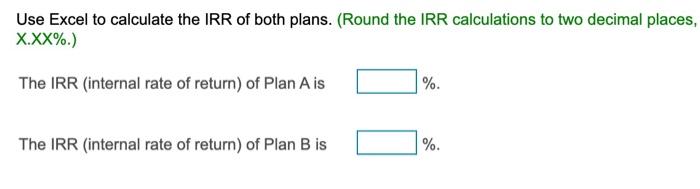

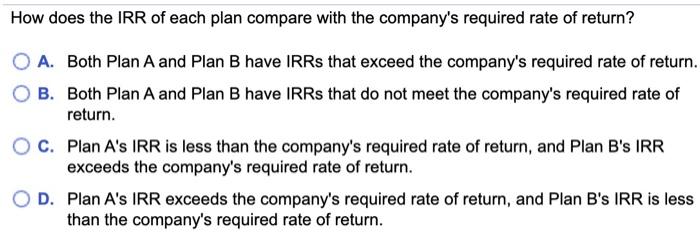

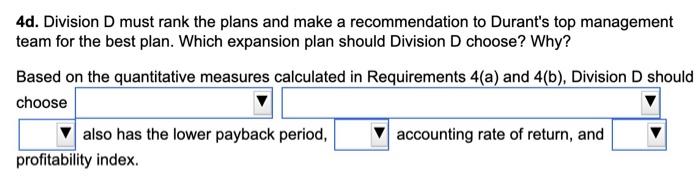

Duncan Dawson, majority stockholder and president of Dawson, Inc., is working with his top managers on future plans for the company. As the company's managerial accountant, you've been asked to analyze the following situations and make recommendations to the management team. 1. Division A of Dawson, Inc. has $5,500,000 in assets. Its yearly fixed costs are $255,500, and the variable costs of its product line are $1.35 per unit. The division's volume is currently 450,000 units. Competitors offer a similar product, at the same quality, to retailers for $3.60 each. Dawson's management team wants to earn a 14% return on investment on the division's assets. a. What is Division A's target full product cost? b. Given the division's current costs, will Division A be able to achieve its target profit? C. Assume Division A has identified ways to cut its variable costs to $1.20 per unit. What is its new target fixed cost? Will this decrease in variable costs allow the division to achieve its target profit? d. Division A is considering an aggressive advertising campaign strategy to differentiate its product from its competitors. The division does not expect volume to be affected, but it hopes to gain more control over pricing. If Division A has to spend $125,000 next year to advertise and its variable costs continue to be $1.20 per unit, what will its cost-plus price be? Do you think Division A will be able to sell its product at the cost-plus price? Why or why not? 2. The division manager of Division B received the following operating income data for the past year: (Click the icon to view the Division B operating income data.) The manager of the division is surprised that the T205 product line is not profitable. The division accountant estimates that dropping the T205 product line will decrease fixed cost of goods sold by $81,000 and decrease fixed selling and administrative expenses by $16,000. a. Prepare a differential analysis to show whether Division B should drop the T205 product line. b. What is your recommendation to the manager of Division B? 3. Division C also produces two product lines. Because the division can sell all of the product it can produce, Dawson is expanding the plant and needs to decide which product line to emphasize. To make this decision, the division accountant assembled the following data: (Click the icon to view the Division C product data.) After expansion, the factory will have a production capacity of 4,100 machine hours per month. The plant can manufacture either 35 units of K707s or 58 units of G582s per machine hour. a. Identify the constraining factor for Division C. b. Prepare an analysis to show which product line to emphasize. 4. Division D is considering two possible expansion plans. Plan A would expand a current product line at a cost of $8,400,000. Expected annual net cash inflows are $1,500,000, with zero residual value at the end of 10 years. Under Plan B, Division D would begin producing a new product at a cost of $8,240,000. This plan is expected to generate net cash inflows of $1,090,000 per year for 10 years, the estimated useful life of the product line. Estimated residual value for Plan B is $1,000,000. Division D uses straight-line depreciation and requires an annual return of 9%. a. Compute the payback, the ARR, the NPV, and the profitability index for both plans. b. Compute the estimated IRR of Plan A. Use Excel to verify the NPV calculations in Requirement 4(a) and the actual IRR for the two plans. How does the IRR of each plan compare with the company's required rate of return? d. Division D must rank the plans and make a recommendation to Dawson's top management team for the best plan. Which expansion plan should Division D choose? Why? 1a. What is Division A's target full product cost? Less: Target full product cost 1b. Given the division's current costs, will Division A be able to achieve its target profit? Begin by calculating Division A's current full product cost. Plus: Current full product cost Division A's current full product costs are its target full product cost, therefore Division A be able to acheive its target profit. Will this decrease in variable costs allow the company to achieve its target profit? Since the company's actual fixed costs are the new target fixed cost amount, Division A be able to achieve its target profit without having to take any other cost cutting measures. lil talentovanileland then click on ADATA 1c. Assume Division A has identified ways to cut its variable costs to $1.10 per unit. What is its new target fixed cost? Will this decrease in variable costs allow the division to achieve its target profit? Begin by calculating Division A's new target fixed cost. Less: MI Target fixed cost 1d. Division A is considering an aggressive advertising campaign strategy to differentiate its product from its competitors. The division does not expect volume to be affected, but it hopes to gain more control over pricing. If Division A has to spend $125,000 next year to advertise and its variable costs continue to be $1.10 per unit, what will its cost-plus price be? Do you think Division A will be able to sell its product at the cost-plus price? Why or why not? Begin by calculating the cost-plus price per unit. (Round your answer to the nearest cent.) Plus: Do you think Division A will be able to sell its product at the cost-plus price? Why or why not? If the advertising campaign is effective, Division A be able to sell its product at this price because it is than the $3.50 charged by competitors. 2a. Prepare a differential analysis to show whether Division B should drop the T205 product line. (Enter decreases to profits with a parentheses or minus sign.) in operating income 2b. What is your recommendation to the manager of Division B? drop the T205 product line. If the T205 product line is dropped, operating Division B income will Requirement 3. Division C also produces two product lines. Because the division can sell all of the product it can produce, Durant is expanding the plant and needs to decide which product line to emphasize. To make this decision, the division accountant assembled the following data: (Click the icon to view the Division C product data.) After expansion, the factory will have a production capacity of 5,000 machine hours per month. The plant can manufacture either 26 units of K707s or 56 units of G582s per machine hour. 3a. Identify the constraining factor for Division C. Division C's constraining factor is 3b. Prepare an analysis to show which product line to emphasize. K707 G582 Contribution margin per 4a. Compute the payback, the ARR, the NPV, and the profitability index for both plans. Begin by calculating the payback for both plans. (Round your answers to one decimal place, X.X.) + 11 Payback Plan A years Plan B + 11 years Calculate the ARR (accounting rate of return) for both plans. (Round your answers to the nearest tenth percent, X.X%.) - II ARR Plan A % Plan B + % Plan A: Net Cash Annuity PV Factor (i=9%, n=10) PV Factor Present Years Inflow (i=9%, n=10) Value 1 - 10 Present value of annuity Present value of residual 10 value Total PV of cash inflows 0 Initial Investment Net present value of Plan A Plan B: Net Cash Annuity PV Factor (i=9%, n=10) PV Factor Present Years Inflow (i=9%, n=10) Value 1 - 10 Present value of annuity Present value of residual 10 value Total PV of cash inflows 0 Initial Investment Net present value of Plan B Calculate the profitability index of these two plans. (Round to two decimal places X.XX.) Profitability index = Plan A 11 Plan B + 11 4b. Compute the estimated IRR of Plan A. The IRR (internal rate of return) of Plan A is between 4c. Use Excel to verify the NPV calculations in Requirement 4(a) and the actual IRR for the two plans. How does the IRR of each plan compare with the company's required rate of return? Begin by using Excel to calculate the NPV of both plans. (Round the NPV calculations to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) The NPV (net present value) of Plan A is The NPV (net present value) of Plan B is The Excel calculations in the preceding step are than the NPV calculations in Requirement 4(a). Use Excel to calculate the IRR of both plans. (Round the IRR calculations to two decimal places, X.XX%.) The IRR (internal rate of return) of Plan A is %. The IRR (internal rate of return) of Plan B is %. How does the IRR of each plan compare with the company's required rate of return? O A. Both Plan A and Plan B have IRRs that exceed the company's required rate of return. B. Both Plan A and Plan B have IRRs that do not meet the company's required rate of return. C. Plan A's IRR is less than the company's required rate of return, and Plan B's IRR exceeds the company's required rate of return. OD. Plan A's IRR exceeds the company's required rate of return, and Plan B's IRR is less than the company's required rate of return. 4d. Division D must rank the plans and make a recommendation to Durant's top management team for the best plan. Which expansion plan should Division D choose? Why? Based on the quantitative measures calculated in Requirements 4(a) and 4(b), Division D should choose also has the lower payback period, accounting rate of return, and profitability index