Please show all work and number each problem correctly!

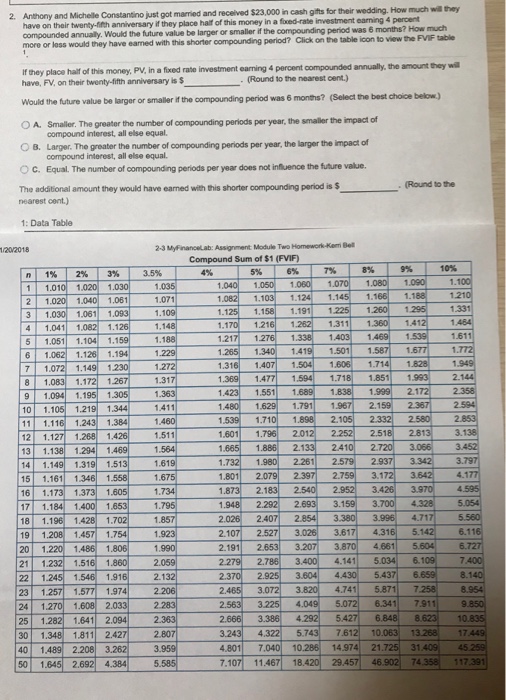

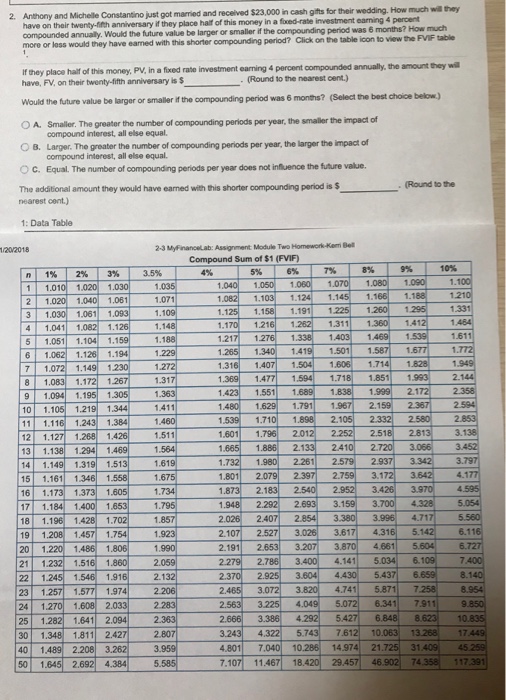

2. Anthony and Michelle Constantino just got married and recelved $23,000 in cash gifts for their wodding. How much wll they have on their twenty-fifth anniversary if they place half of this money in a foxed-rate investment earning 4 percent compounded annually. Would the future value be larger or smaller if the compounding period was 6 months? How much more or loss would they have eamed with this shorter compounding period? Click on the table icon to view the FVIF table they wi If they place haif of this money, PV., in a fixed rate investment earning 4 percent compounded annually, the amount have, FV, on their twenty-fifth anniversary is $ (Round to the nearest cent.) Would the future value be larger or smaller if the compounding period was 6 months? (Select the best choice below.) O A. Smaler. The greater the number of compounding periods per year, the smaller the impact of compound interest, all else equal O 8. Larger. The greater the number of compounding periods per year, the larger the impact of OC. Equal. The number of compounding periods per year does not influence the future value. The additional amount they would have eaned with this shorter compounding period is $ compound interest, all else equal. Round to the . - - nearest cent.) 1: Data Table 2-3 MyFinanceab: Assignment Module Two Homework-Kam Be Compound Sum of $1 (FVIF) 6% 10% 5% n| 1% | 2% | 3% | 3.5%| 11.010 4% 1.04 1.0701 1.030 040 1.061 1.061 1.093 1.126 5 1.0511.1041.159 1210 1071 1.191 1.225 1.260 1295 1.331 3 1030 1.311 1 1.41 1701 1.21 1.217 1.276 1 0411 1.148 1611 419 1.5011.58 1.94 2. 1.71 1.31 1.477 1.5941.718.8511 911.094| 1.195| 1.305] 1.363 1.423 1.551 1.689 1.838-99 2.1721 1.411 1.460 1.511 1629 1.791 1 1.7101 101.105 1.219 11 1.116 1.243 1.384 2 1.127 1.268 1.42 13 1.138 1.2941.469 14 1.1491.319 1.513 15 1.1611 16 1.173 1.3731.605 17 1.1841 18 1.1961 1601 1 1665 1.8 3.1 2.01 2.1 2.518 281 2.41 1.732 1.980 2.261| 2.579 2.957 3342 2.397 2 2. 1.558 1.801 2.079 2.952 3.4 3. 2.183 4.71 1.85 1.923 2.026 2407 2.854 2.107 2.527 3.026 3.617 4.316 5 2.191 2.653 6.11 457 1.754 20 1. .8061.990 3.8 4661 5 7.400 3. 3.604 4 1.516 1.8602.059 2. 4.141 5 5.4376 1.9162.132 1.974 2. 22 1.245 23 1 2.465 3.0 4.7415.8717 2 12701.608 2.033 2283 3.225 4.049-5072-6341 7.9111-9B50 2.563 3.225 4.0495.0 2.666 3.243 4 4.8017 7.107| 11.467| 18.4201 29.457 46.902| 74 10 25 1.282 1641 2.094 2.363 7.612 10.06313.268 1744 301 1.345 1.811| 2.427| 40 1.489 2.208 2.807 10.286 14.974 21.725 31 50 1 1645 2.692 4.384