Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work and solve by hand. A company has $1 million available for investing in four bonds. Not all of the money must

Please show all work and solve by hand.

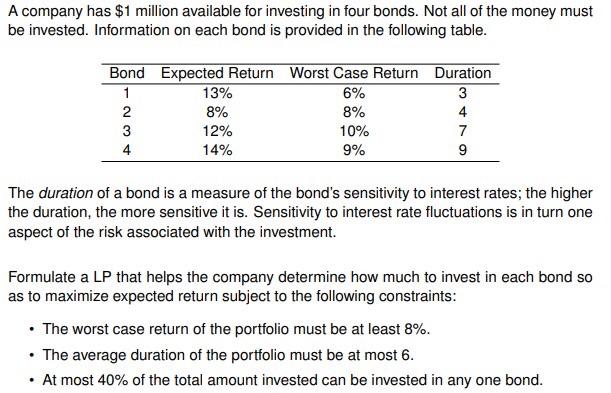

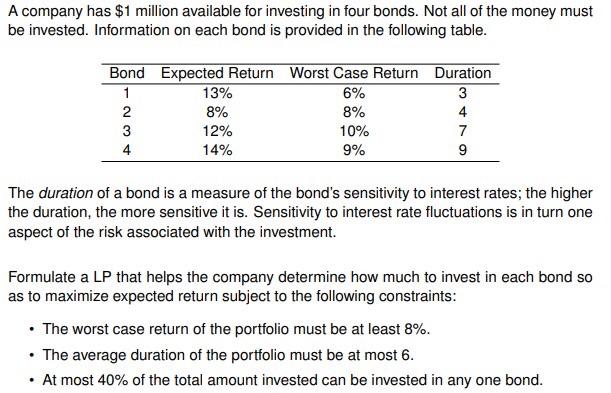

A company has $1 million available for investing in four bonds. Not all of the money must be invested. Information on each bond is provided in the following table. Bond Expected Return Worst Case Return Duration 1 13% 6% 3 2 8% 8% 4 3 12% 10% 7 4 14% 9% 9 AWN The duration of a bond is a measure of the bond's sensitivity to interest rates; the higher the duration, the more sensitive it is. Sensitivity to interest rate fluctuations is in turn one aspect of the risk associated with the investment. Formulate a LP that helps the company determine how much to invest in each bond so as to maximize expected return subject to the following constraints: The worst case return of the portfolio must be at least 8%. The average duration of the portfolio must be at most 6. At most 40% of the total amount invested can be invested in any one bond

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started