Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work Capital management. Initially, Irvine Commerce Bank has the following assets: - $200 million in loans $28 million in securities $22 million

Please show all work

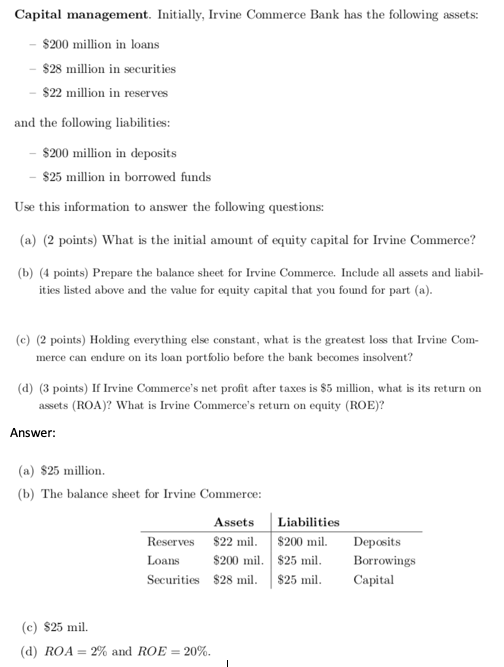

Capital management. Initially, Irvine Commerce Bank has the following assets: - $200 million in loans $28 million in securities $22 million in reserves and the following liabilities: - $200 million in deposits -$25 million in borrowed funds Use this information to answer the following questions: (a) (2 points) What is the initial amount of equity capital for Irvine Commerce? (b) (4 points) Prepare the balance sheet for Irvine Commerce. Include all assets and labil- it ies listed above and the value for equity capital that you found for part (a) (c) (2 points) Holding everything else constant, what is the greatest loss that Irvine Com- merce can endure on its loan portfolio before the bank becomes insolvent? (d) (3 points) If Irvine Commerce's net profit after taxes is $5 million, what is its return on assets (ROA)? What is Irvine Commerce's return on equity (ROE)? Answer: (a) S25 million. (b) The balance sheet for Irvine Commerce: Assets Liabilities Reserves $22 $200 il Deposits Loans $200 mi. $25 mil Borrowings Securities $28 mi $25 mil Capital (c) $25 mil. (d) ROA-2% and ROE=20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started