Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all work!! Decision Making Problem Zippo is considering replacing its executive jet. They purchased the current jet 5 years ago for $1.9 million.

please show all work!!

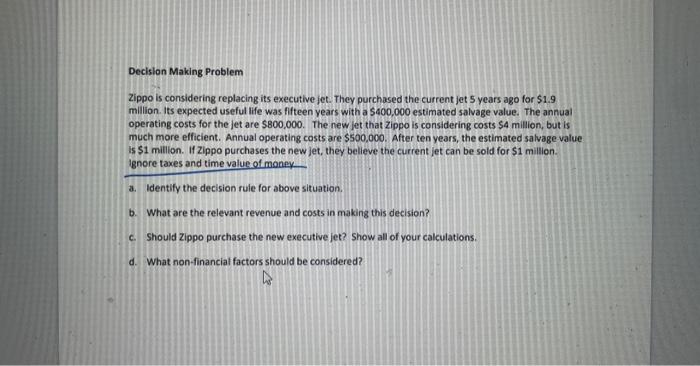

Decision Making Problem

Zippo is considering replacing its executive jet. They purchased the current jet 5 years ago for $1.9

million. Its expected useful life was fifteen years with a $400,000 estimated salvage value. The annual

operating costs for the jet are $800,000. The new jet that Zippo is considering costs $4 million, but is

much more efficient. Annual operating costs are $500,000. After ten years, the estimated salvage value

is $1 million. If Zippo purchases the new jet, they believe the current jet can be sold for $1 million.

Ignore taxes and time value of monev

, Identify the decision rule for above situation.

b.

What are the relevant revenue and costs in making this decision?

C.

Should Zippo purchase the new executive jet? Show all of your calculations.

d

What non-financial factors should be considered?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started