Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all work Expected value of perfect information - Joe has inherited an option on a plot of land and must decide whether to

please show all work

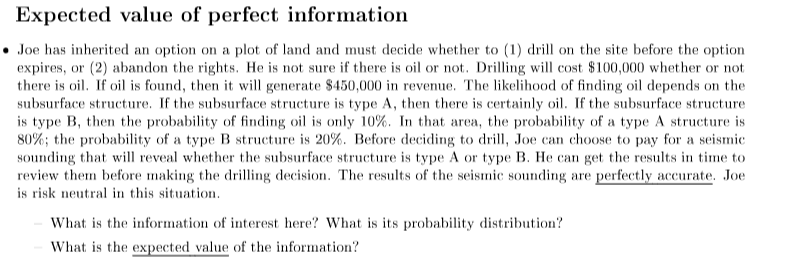

Expected value of perfect information - Joe has inherited an option on a plot of land and must decide whether to (1) drill on the site before the option expires, or (2) abandon the rights. He is not sure if there is oil or not. Drilling will cost $100,000 whether or not there is oil. If oil is found, then it will generate $450,000 in revenue. The likelihood of finding oil depends on the subsurface structure. If the subsurface structure is type A, then there is certainly oil. If the subsurface structure is type B, then the probability of finding oil is only 10%. In that area, the probability of a type A structure is 80%; the probability of a type B structure is 20%. Before deciding to drill, Joe can choose to pay for a seismic sounding that will reveal whether the subsurface structure is type A or type B. He can get the results in time to review them before making the drilling decision. The results of the seismic sounding are perfectly accurate. Joe is risk neutral in this situation. - What is the information of interest here? What is its probability distribution? What is the expected value of the informationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started