Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work for the incorrect answers marked with a red X. I'll upvote the correct answer. Thank you! Remeasurement of financial statements Assume

Please show all work for the incorrect answers marked with a red X. I'll upvote the correct answer. Thank you!

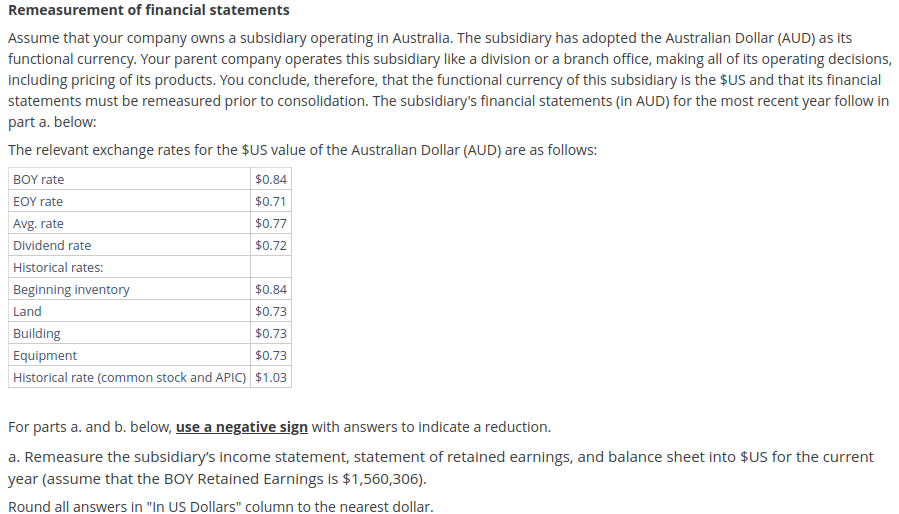

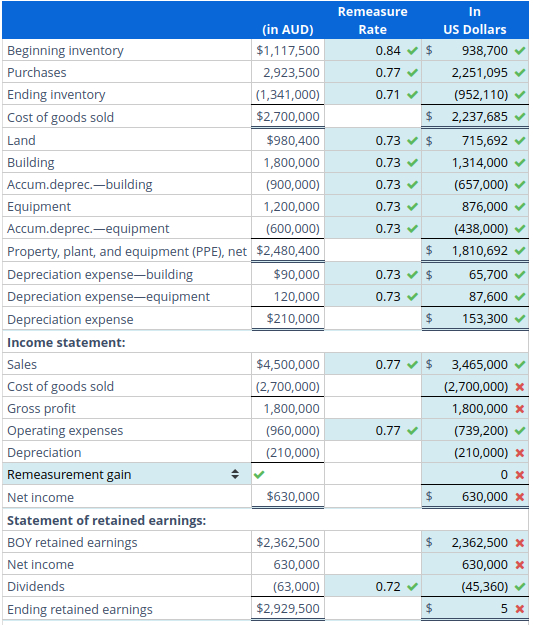

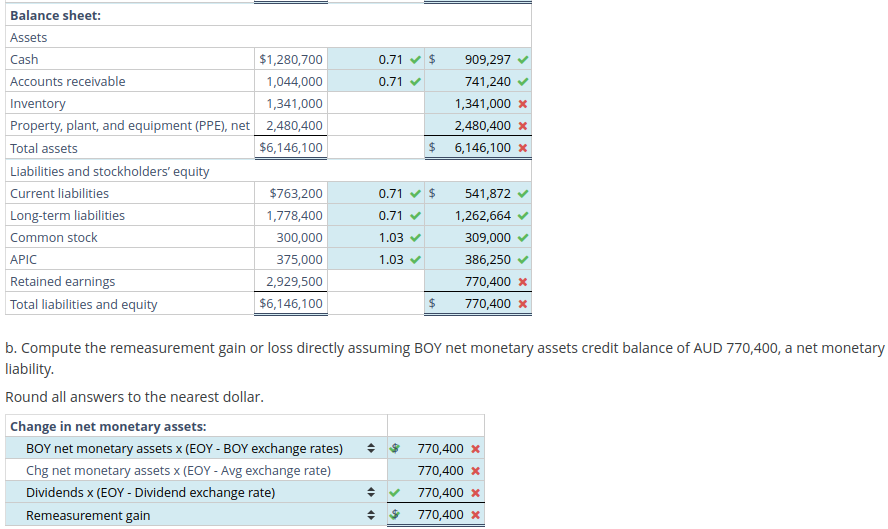

Remeasurement of financial statements Assume that your company owns a subsidiary operating in Australia. The subsidiary has adopted the Australian Dollar (AUD) as its functional currency. Your parent company operates this subsidiary like a division or a branch office, making all of its operating decisions, including pricing of its products. You conclude, therefore, that the functional currency of this subsidiary is the \$US and that its financial statements must be remeasured prior to consolidation. The subsidiary's financial statements (in AUD) for the most recent year follow in part a. below: The relevant exchange rates for the \$US value of the Australian Dollar (AUD) are as follows: For parts a. and b. below, use a negative sign with answers to indicate a reduction. a. Remeasure the subsidiary's income statement, statement of retained earnings, and balance sheet into $US for the current year (assume that the BOY Retained Earnings is $1,560,306 ). Round all answers in "In US Dollars" column to the nearest dollar. \begin{tabular}{|c|c|c|c|} \hline & & Remeasure & In \\ \hline & (in AUD) & Rate & US Dollars \\ \hline Beginning inventory & $1,117,500 & 0.84 & 938,700 \\ \hline Purchases & 2,923,500 & 0.77 & 2,251,095 \\ \hline Ending inventory & (1,341,000) & 0.71 & (952,110) \\ \hline Cost of goods sold & $2,700,000 & & 2,237,685 \\ \hline Land & $980,400 & 0.73 & 715,692 \\ \hline Building & 1,800,000 & 0.73 & 1,314,000 \\ \hline Accum.deprec.-building & (900,000) & 0.73 & (657,000) \\ \hline Equipment & 1,200,000 & 0.73 & 876,000 \\ \hline Accum.deprec.-equipment & (600,000) & 0.73 & (438,000) \\ \hline Property, plant, and equipment (PPE), net & $2,480,400 & & 1,810,692 \\ \hline Depreciation expense-building & $90,000 & 0.73 & 65,700 \\ \hline Depreciation expense-equipment & 120,000 & 0.73 & 87,600 \\ \hline Depreciation expense & $210,000 & & 153,300 \\ \hline Income statement: & & & \\ \hline Sales & $4,500,000 & 0.77 & $3,465,000 \\ \hline Cost of goods sold & (2,700,000) & & (2,700,000) \\ \hline Gross profit & 1,800,000 & & 1,800,000 \\ \hline Operating expenses & (960,000) & 0.77 & (739,200) \\ \hline Depreciation & (210,000) & & (210,000) \\ \hline Remeasurement gain & & & 0 \\ \hline Net income & $630,000 & & 630,000 \\ \hline Statement of retained earnings: & & & \\ \hline BOY retained earnings & $2,362,500 & & 2,362,500 \\ \hline Net income & 630,000 & & 630,000 \\ \hline Dividends & (63,000) & 0.72 & (45,360) \\ \hline Ending retained earnings & $2,929,500 & & 5 \\ \hline \end{tabular} b. Compute the remeasurement gain or loss directly assuming BOY net monetary assets credit balance of AUD 770,400, a net monetary liability. Round all answers to the nearest dollarStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started