Question

Please Show All Work! Good Will = 60,000 Annual Amortization of Building = 8,666.67 Annual Amortization of Equipment = 34,000 Investment in Allie Co 470,000

Please Show All Work!

Good Will = 60,000

Annual Amortization of Building = 8,666.67

Annual Amortization of Equipment = 34,000

Investment in Allie Co 470,000

Equity in Allie Co = (110,000)

Retained Earnings = (190,000)

- Prepare Entry S, consolidation worksheet entries for December 31, 2018(t+2).

- Prepare Entry A, consolidation worksheet entries for December 31, 2018(t+2).

- Prepare Entry I, consolidation worksheet entries for December 31, 2018(t+2).

- Prepare Entry D, consolidation worksheet entries for December 31, 2018(t+2).

- Prepare Entry E, consolidation worksheet entries for December 31, 2018(t+2).

- In year 2018, Choco and Allie had an intra-entity receivable and payable transaction of $9,000.

Prepare Entry P, consolidation worksheet entries for December 31, 2018(t+2).

- From consolidation entries S, A, I, and D, the balance of Investment in Allie Co. has $724,000 credit at the end of 2018. Prepare Entry *C consolidation worksheet entries for December 31, 2018(t+2).

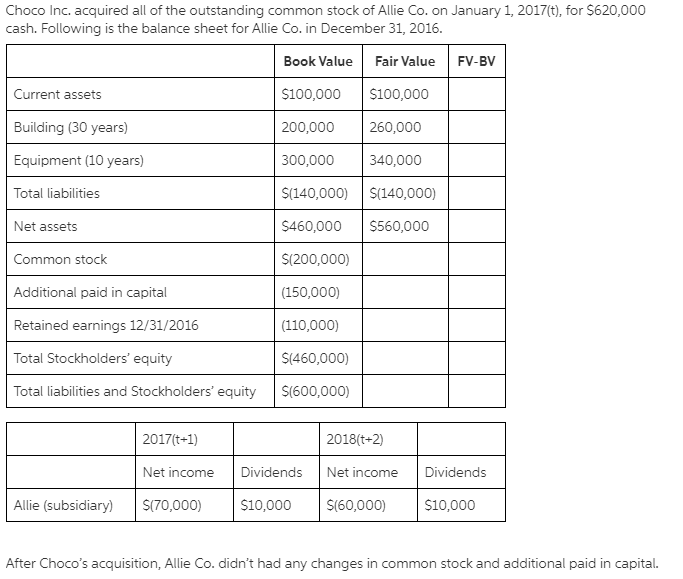

Choco Inc. acquired all of the outstanding common stock of Allie Co. on January 1, 2017(t), for $620,000 cash. Following is the balance sheet for Allie Co. in December 31, 2016. Book Value Fair Value FV-BV Current assets $100,000 $100,000 Building (30 years) 200.000 260,000 Equipment (10 years) Total liabilities 300,000 $(140,000) $460,000 340,000 S(140,000) $560,000 Net assets Common stock $(200,000) Additional paid in capital (150,000) Retained earnings 12/31/2016 (110,000) Total Stockholders' equity $(460,000) Total liabilities and Stockholders' equity $(600,000) 2017(t+1) 2018(t+2) Net income Dividends Net income Dividends Allie (subsidiary) S(70,000) $10,000 $160,000) After Choco's acquisition, Allie Co. didn't had any changes in common stock and additional paid in capital. Choco Inc. acquired all of the outstanding common stock of Allie Co. on January 1, 2017(t), for $620,000 cash. Following is the balance sheet for Allie Co. in December 31, 2016. Book Value Fair Value FV-BV Current assets $100,000 $100,000 Building (30 years) 200.000 260,000 Equipment (10 years) Total liabilities 300,000 $(140,000) $460,000 340,000 S(140,000) $560,000 Net assets Common stock $(200,000) Additional paid in capital (150,000) Retained earnings 12/31/2016 (110,000) Total Stockholders' equity $(460,000) Total liabilities and Stockholders' equity $(600,000) 2017(t+1) 2018(t+2) Net income Dividends Net income Dividends Allie (subsidiary) S(70,000) $10,000 $160,000) After Choco's acquisition, Allie Co. didn't had any changes in common stock and additional paid in capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started