Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work Harron Productions manufactures industrial electric motors used by appliance companies. In the past year, the company has experienced severe excess capacity

Please show all work

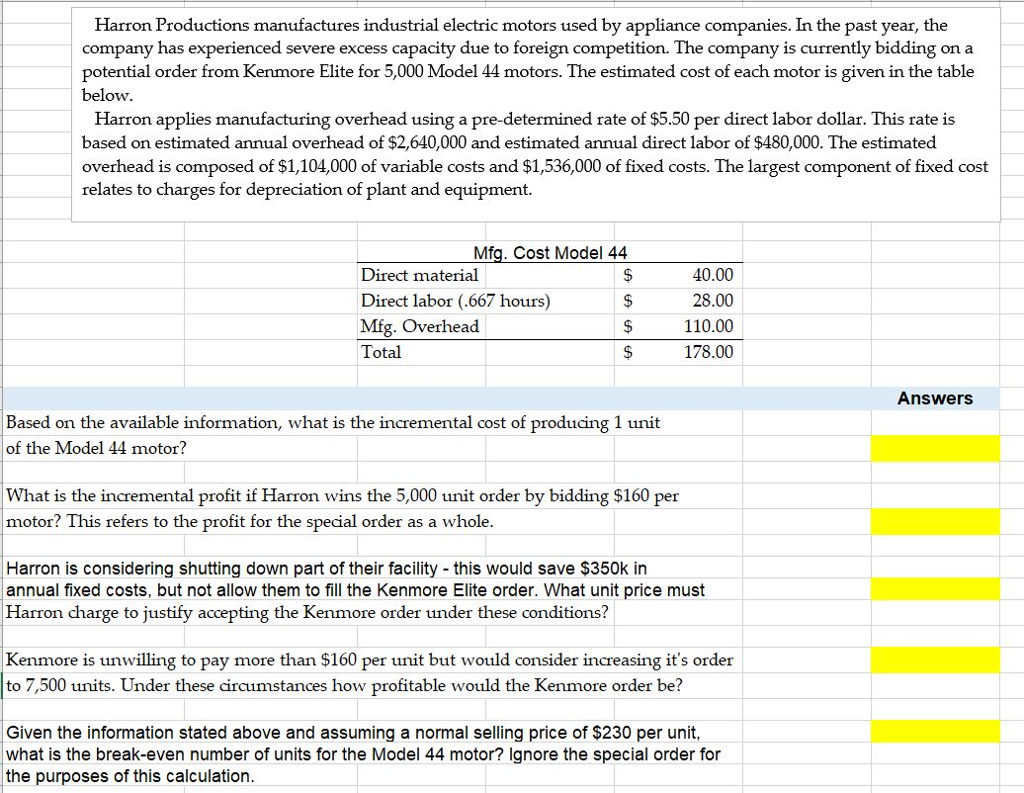

Harron Productions manufactures industrial electric motors used by appliance companies. In the past year, the company has experienced severe excess capacity due to foreign competition. The company is currently bidding on a potential order from Kenmore Elite for 5,000 Model 44 motors. The estimated cost of each motor is given in the table below. Harron applies manufacturing overhead using a pre-determined rate of $5.50 per direct labor dollar. This rate is based on estimated annual overhead of $2,640,000 and estimated annual direct labor of $480,000. The estimated overhead is composed of $1,104,000 of variable costs and $1,536,000 of fixed costs. The largest component of fixed cost relates to charges for depreciation of plant and equipment. Mfg. Cost Model 44 Direct material $ Direct labor (.667 hours) Mfg. Overhead Total | 40.00 40.00 28.00 110.00 178.00 Answers Based on the available information, what is the incremental cost of producing 1 unit of the Model 44 motor? What is the incremental profit if Harron wins the 5,000 unit order by bidding $160 per motor? This refers to the profit for the special order as a whole. Harron is considering shutting down part of their facility - this would save $350k in annual fixed costs, but not allow them to fill the Kenmore Elite order. What unit price must Harron charge to justify accepting the Kenmore order under these conditions? Kenmore is unwilling to pay more than $160 per unit but would consider increasing it's order to 7,500 units. Under these circumstances how profitable would the Kenmore order be? Given the information stated above and assuming a normal selling price of $230 per unit, what is the break-even number of units for the Model 44 motor? Ignore the special order for the purposes of this calculation. Harron Productions manufactures industrial electric motors used by appliance companies. In the past year, the company has experienced severe excess capacity due to foreign competition. The company is currently bidding on a potential order from Kenmore Elite for 5,000 Model 44 motors. The estimated cost of each motor is given in the table below. Harron applies manufacturing overhead using a pre-determined rate of $5.50 per direct labor dollar. This rate is based on estimated annual overhead of $2,640,000 and estimated annual direct labor of $480,000. The estimated overhead is composed of $1,104,000 of variable costs and $1,536,000 of fixed costs. The largest component of fixed cost relates to charges for depreciation of plant and equipment. Mfg. Cost Model 44 Direct material $ Direct labor (.667 hours) Mfg. Overhead Total | 40.00 40.00 28.00 110.00 178.00 Answers Based on the available information, what is the incremental cost of producing 1 unit of the Model 44 motor? What is the incremental profit if Harron wins the 5,000 unit order by bidding $160 per motor? This refers to the profit for the special order as a whole. Harron is considering shutting down part of their facility - this would save $350k in annual fixed costs, but not allow them to fill the Kenmore Elite order. What unit price must Harron charge to justify accepting the Kenmore order under these conditions? Kenmore is unwilling to pay more than $160 per unit but would consider increasing it's order to 7,500 units. Under these circumstances how profitable would the Kenmore order be? Given the information stated above and assuming a normal selling price of $230 per unit, what is the break-even number of units for the Model 44 motor? Ignore the special order for the purposes of this calculationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started