Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work I just want to double check my work! 1. If you invested $1,000 for 3 months and earned 2%, what is

Please show all work I just want to double check my work!

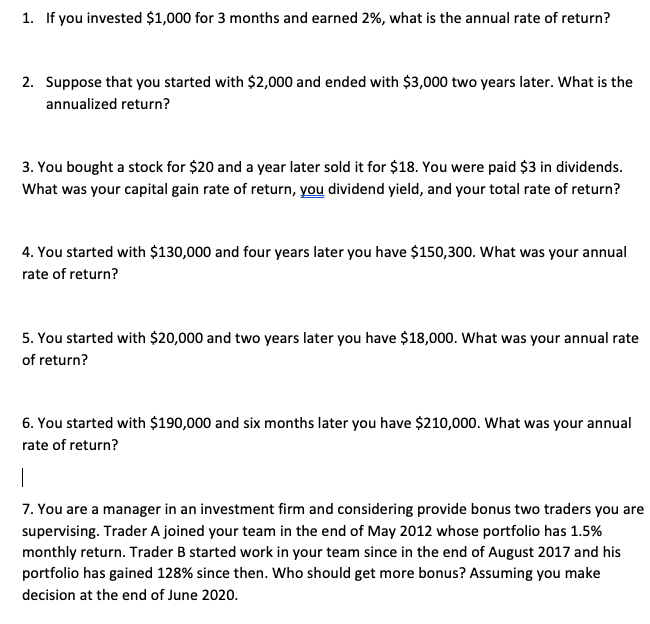

1. If you invested $1,000 for 3 months and earned 2%, what is the annual rate of return? 2. Suppose that you started with $2,000 and ended with $3,000 two years later. What is the annualized return? 3. You bought a stock for $20 and a year later sold it for $18. You were paid $3 in dividends. What was your capital gain rate of return, you dividend yield, and your total rate of return? 4. You started with $130,000 and four years later you have $150,300. What was your annual rate of return? 5. You started with $20,000 and two years later you have $18,000. What was your annual rate of return? 6. You started with $190,000 and six months later you have $210,000. What was your annual rate of return? | 7. You are a manager in an investment firm and considering provide bonus two traders you are supervising. Trader A joined your team in the end of May 2012 whose portfolio has 1.5% monthly return. Trader B started work in your team since in the end of August 2017 and his portfolio has gained 128% since then. Who should get more bonus? Assuming you make decision at the end of June 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started