Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all work in excel if possible. (a nue a sund ousiamsu asn)inaudaaanae (Free cash flows) Boiger, Inc, a manufacturing company in Harvey, Illinois

please show all work in excel if possible.

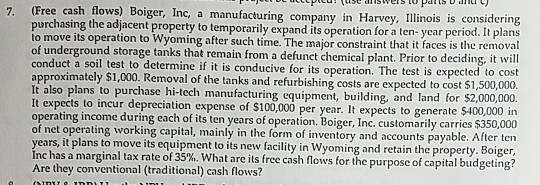

(a nue a sund ousiamsu asn)inaudaaanae (Free cash flows) Boiger, Inc, a manufacturing company in Harvey, Illinois is considering 7. purchasing the adjacent property to temporarily expand its operation for a ten-year period. It plans to move its operation to Wyoming after such time. The major constraint that it faces is the removal of underground storage tanks that remain from a defunct chemical plant. Prior to deciding, it will conduct a soil test to determine if it is conducive for its operation. The test is expected to cost approximately $1,000. Removal of the tanks and refurbishing costs are expected to cost $1,500,000 It also plans to purchase hi-tech manufacturing equipment, building, and land for $2,000,000 It expects to incur depreciation expense of $100,000 per year. It expects to generate $400,000 in operating income during each of its ten years of operation. Boiger, Inc. customarily carries $350,000 of net operating working capital, mainly in the form of inventory and accounts payable. After ten years, it plans to move its equipment to its new facility in Wyoming and retain the property. Boiger, Inc has a marginal tax rate of 35%. What are its free cash flows for the purpose of capital budgeting? Are they conventional (traditional) cash flowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started