please show all work in excel! Thank you:)

please show all work in excel! Thank you:)

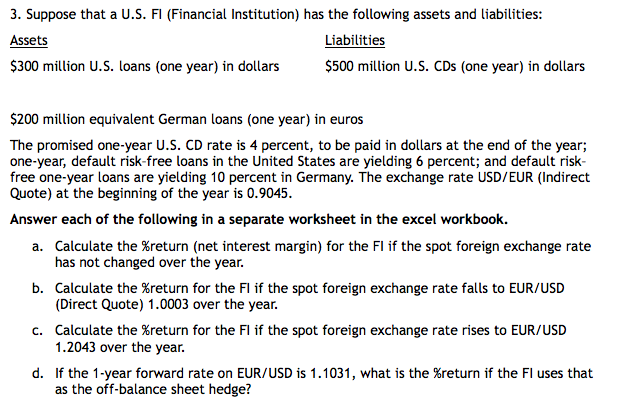

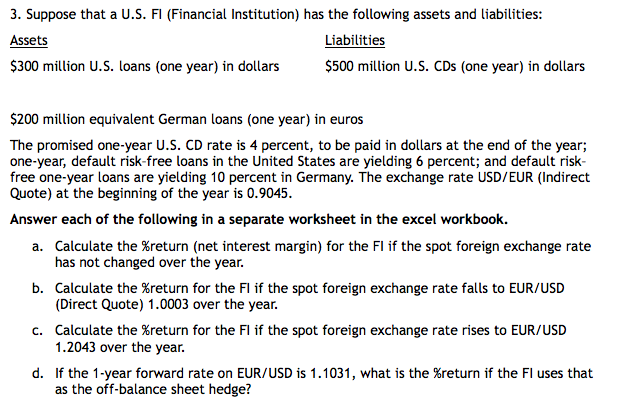

3. Suppose that a U.S. FI (Financial Institution) has the following assets and liabilities: Assets Liabilities $300 million U.S. loans (one year) in dollars $500 million U.S. CDs (one year) in dollars $200 million equivalent German loans (one year) in euros The promised one-year U.S. CD rate is 4 percent, to be paid in dollars at the end of the year; one-year, default risk-free loans in the United States are yielding 6 percent; and default risk- free one-year loans are yielding 10 percent in Germany. The exchange rate USD/EUR (Indirect Quote) at the beginning of the year is 0.9045. Answer each of the following in a separate worksheet in the excel workbook. a. Calculate the %return (net interest margin) for the Fl if the spot foreign exchange rate has not changed over the year. b. Calculate the %return for the Fl if the spot foreign exchange rate falls to EUR/USD (Direct Quote) 1.0003 over the year. C. Calculate the %return for the Fl if the spot foreign exchange rate rises to EUR/USD 1.2043 over the year. d. If the 1-year forward rate on EUR/USD is 1.1031, what is the %return if the Fl uses that as the off-balance sheet hedge? 3. Suppose that a U.S. FI (Financial Institution) has the following assets and liabilities: Assets Liabilities $300 million U.S. loans (one year) in dollars $500 million U.S. CDs (one year) in dollars $200 million equivalent German loans (one year) in euros The promised one-year U.S. CD rate is 4 percent, to be paid in dollars at the end of the year; one-year, default risk-free loans in the United States are yielding 6 percent; and default risk- free one-year loans are yielding 10 percent in Germany. The exchange rate USD/EUR (Indirect Quote) at the beginning of the year is 0.9045. Answer each of the following in a separate worksheet in the excel workbook. a. Calculate the %return (net interest margin) for the Fl if the spot foreign exchange rate has not changed over the year. b. Calculate the %return for the Fl if the spot foreign exchange rate falls to EUR/USD (Direct Quote) 1.0003 over the year. C. Calculate the %return for the Fl if the spot foreign exchange rate rises to EUR/USD 1.2043 over the year. d. If the 1-year forward rate on EUR/USD is 1.1031, what is the %return if the Fl uses that as the off-balance sheet hedge

please show all work in excel! Thank you:)

please show all work in excel! Thank you:)