Answered step by step

Verified Expert Solution

Question

1 Approved Answer

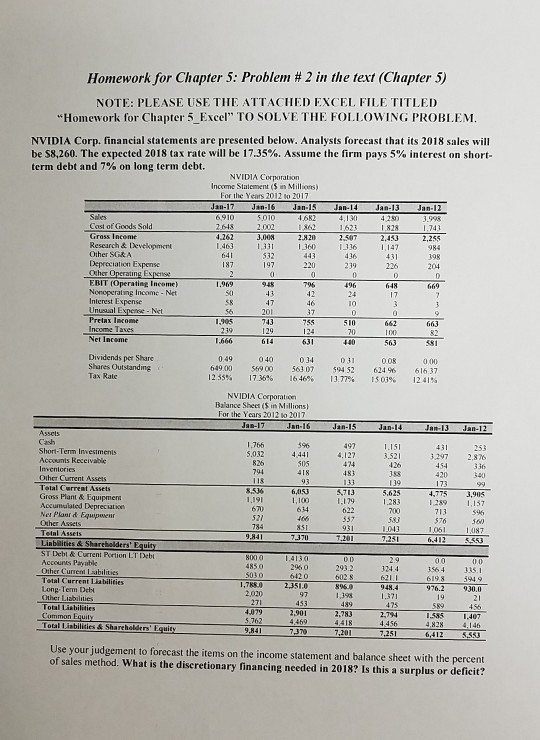

please show all work in excel! Homework for Chapter 5: Problem #2 in the text (Chapter 5) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED

please show all work in excel!

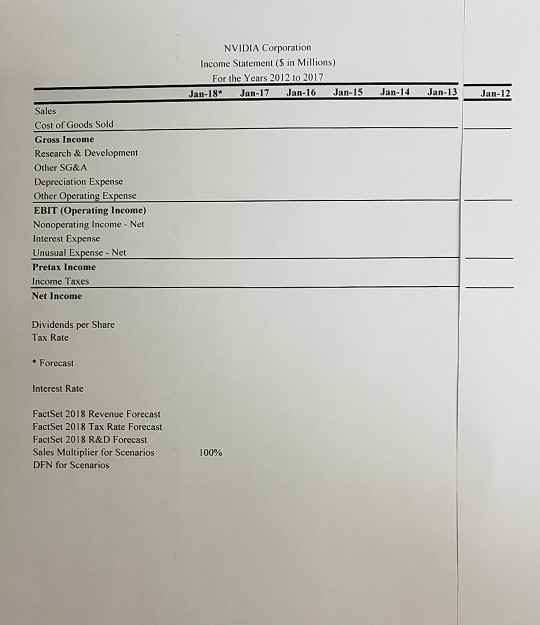

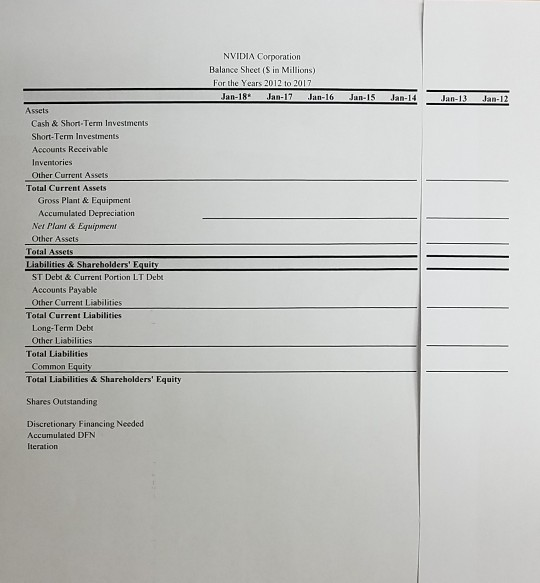

Homework for Chapter 5: Problem #2 in the text (Chapter 5) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED Homework for Chapter 5 Excel" TO SOLVE THE FOLLOWING PROBLEM. NVIDIA Corp. financial statements are presented below. Analysts forecast that its 2018 sales will be 58.260. The expected 2018 tax rate will be 17.35%. Assume the firm pays 5% interest on short term debt and 7% on long term debt. NVIDIA Corporat Income Statement in Millions) For the Years 2012 - 2017 Jan 17 Jan 16 Jan 15 Jan 14 Jan 13 Jan 12 Ses 6,910 S0106 24110 420 1998 Cost of Goods Sold 2000 12 Gross Inc 0262 300 22255 Research & Development 1331 1 116 1.147 Other SGA 532 416 Depreciation Expense 220 219 Other Operating Expertise EBIT (Operating Income Nonoperating Income - Net Interest Expense 47 Unusual Expense - Net 201 Pretax income 755 SIO 662 663 Income Taxes 124 1.666 614 440 563 197 Dividends per Share Shares Outstanding Tax Rate 0.49 649.00 12 35% 040 $69.00 17.36% 014 01 OOR 561 075943262496 16.16% 1729 1501% 000 616.37 12.41% NVIDIA Corporation Balance Sheet(in Millions) For the Years 2012 a 2017 Jan-17 Jan 16 Janis Jan 14 Jan 13 Jan-12 1.766 S012 TISI 3.521 Short-Term Investments 4.127 431153 3297 2825 454 8.536 5703 Other Current Assets Total Current Assets Gross Plant & Equipment s ed Deprecat Net Plant que 6,00 1.100 5.625 123 1359 713 614 851 7 370 931 201 103 .250 1.061 6.412 50 1087 5553 9,841 7 Liane Shareholders' Equity ST Debt Current Porton LTDb Accounts Payable Other Cur a bilities Total Current liabilities Long Term Debt 3244 3564 4850 00 1. TRR) 2060 620 2 SIO 2932 602 31. 5949 90.0 976. 2 1.321 4.9 Total Ladies 4079 5.762 453 2901 4 469 73767 2.733 4,418 ,2017 1.585 4.828 6,412 4456 ,251 Total lisbilities & Shareholders' Equ 1407 145 5.53 Use your judgement to forecast the items on the income statement and balance sheet with the percent of sales method. What is the discretionary financing needed in 2018? Is this a surplus or deficit? NVIDIA Corporation Income Statement (5 in Millions) For the Years 2012 to 2017 Jan-18 Jan-17 Jan-16 Jan-15 Jan-14 Jan-13 Sales Cost of Goods Sold Gross Income Research & Development Other SG&A Depreciation Expense Other Operating Expense EBIT (Operating Income) Nonoperating Income - Net Interest Expense Unusual Expense - Net Pretax Income Income Taxes Net Income Dividends per Share Tax Rate Forecast Interest Rate FactSet 2018 Revenue Forecast FactSet 2018 Tax Rate Forecast FactSet 2018 R&D Forecast Sales Multiplier for Scenarios DFN for Scenarios 100% NVIDIA Corporation Balance Sheet (Sin Millions) For the Years 2012 to 2017 Jan-18 Jan-17 Jan-16 Jan 15 Jan 14 Jan 13 Jan 12 Assets Cash & Short-Term Investments Short-Term Investments Accounts Receivable Inventories Other Current Assets Total Current Assets Gross Plant & Equipment Accumulated Depreciation Nel Plan & Equipmeni Other Assets Total Assets Liabilities & Shareholders' Equity ST Debt & Current Portion LT Debt Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debe Other Liabilities Total Liabilities Common Equity Total Liabilities & Shareholders' Equity Shares Outstanding Discretionary Financing Needed Accumulated DEN Iteration Homework for Chapter 5: Problem #2 in the text (Chapter 5) NOTE: PLEASE USE THE ATTACHED EXCEL FILE TITLED Homework for Chapter 5 Excel" TO SOLVE THE FOLLOWING PROBLEM. NVIDIA Corp. financial statements are presented below. Analysts forecast that its 2018 sales will be 58.260. The expected 2018 tax rate will be 17.35%. Assume the firm pays 5% interest on short term debt and 7% on long term debt. NVIDIA Corporat Income Statement in Millions) For the Years 2012 - 2017 Jan 17 Jan 16 Jan 15 Jan 14 Jan 13 Jan 12 Ses 6,910 S0106 24110 420 1998 Cost of Goods Sold 2000 12 Gross Inc 0262 300 22255 Research & Development 1331 1 116 1.147 Other SGA 532 416 Depreciation Expense 220 219 Other Operating Expertise EBIT (Operating Income Nonoperating Income - Net Interest Expense 47 Unusual Expense - Net 201 Pretax income 755 SIO 662 663 Income Taxes 124 1.666 614 440 563 197 Dividends per Share Shares Outstanding Tax Rate 0.49 649.00 12 35% 040 $69.00 17.36% 014 01 OOR 561 075943262496 16.16% 1729 1501% 000 616.37 12.41% NVIDIA Corporation Balance Sheet(in Millions) For the Years 2012 a 2017 Jan-17 Jan 16 Janis Jan 14 Jan 13 Jan-12 1.766 S012 TISI 3.521 Short-Term Investments 4.127 431153 3297 2825 454 8.536 5703 Other Current Assets Total Current Assets Gross Plant & Equipment s ed Deprecat Net Plant que 6,00 1.100 5.625 123 1359 713 614 851 7 370 931 201 103 .250 1.061 6.412 50 1087 5553 9,841 7 Liane Shareholders' Equity ST Debt Current Porton LTDb Accounts Payable Other Cur a bilities Total Current liabilities Long Term Debt 3244 3564 4850 00 1. TRR) 2060 620 2 SIO 2932 602 31. 5949 90.0 976. 2 1.321 4.9 Total Ladies 4079 5.762 453 2901 4 469 73767 2.733 4,418 ,2017 1.585 4.828 6,412 4456 ,251 Total lisbilities & Shareholders' Equ 1407 145 5.53 Use your judgement to forecast the items on the income statement and balance sheet with the percent of sales method. What is the discretionary financing needed in 2018? Is this a surplus or deficit? NVIDIA Corporation Income Statement (5 in Millions) For the Years 2012 to 2017 Jan-18 Jan-17 Jan-16 Jan-15 Jan-14 Jan-13 Sales Cost of Goods Sold Gross Income Research & Development Other SG&A Depreciation Expense Other Operating Expense EBIT (Operating Income) Nonoperating Income - Net Interest Expense Unusual Expense - Net Pretax Income Income Taxes Net Income Dividends per Share Tax Rate Forecast Interest Rate FactSet 2018 Revenue Forecast FactSet 2018 Tax Rate Forecast FactSet 2018 R&D Forecast Sales Multiplier for Scenarios DFN for Scenarios 100% NVIDIA Corporation Balance Sheet (Sin Millions) For the Years 2012 to 2017 Jan-18 Jan-17 Jan-16 Jan 15 Jan 14 Jan 13 Jan 12 Assets Cash & Short-Term Investments Short-Term Investments Accounts Receivable Inventories Other Current Assets Total Current Assets Gross Plant & Equipment Accumulated Depreciation Nel Plan & Equipmeni Other Assets Total Assets Liabilities & Shareholders' Equity ST Debt & Current Portion LT Debt Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debe Other Liabilities Total Liabilities Common Equity Total Liabilities & Shareholders' Equity Shares Outstanding Discretionary Financing Needed Accumulated DEN IterationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started